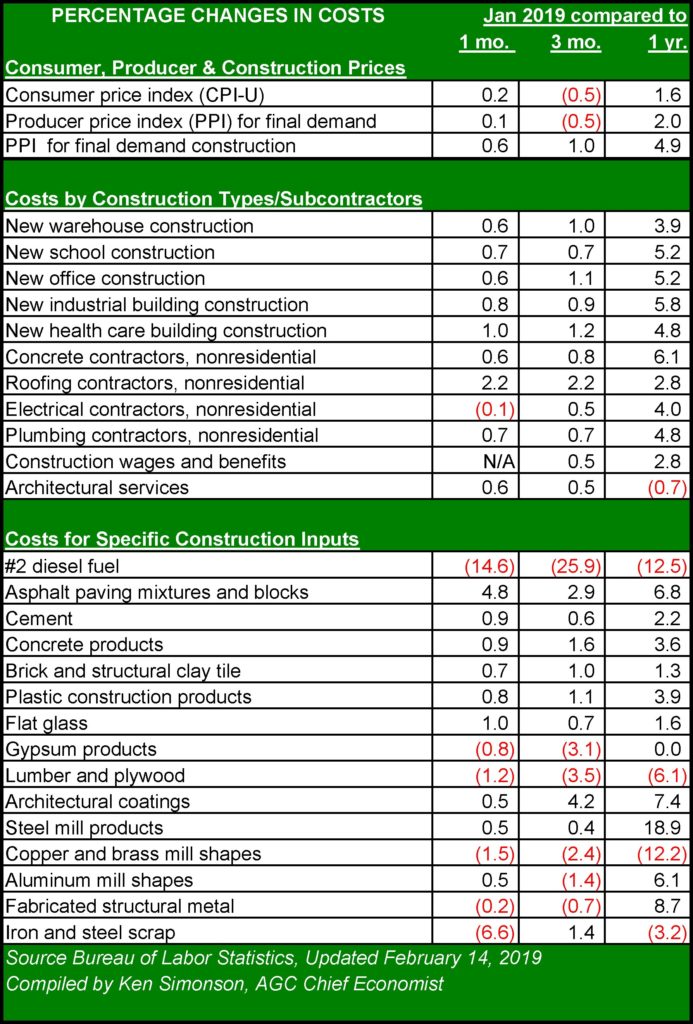

The Bureau of Labor Statistics (BLS) reported on February 14, 2019, that the producer price index (PPI) for final demand in January increased 0.6 percent from December and 4.9 percent year-over-year from January 2018. Final demand includes goods, services and five types of nonresidential buildings that BLS says make up 31 percent of total nonresidential construction. The PPI for new nonresidential building construction – the price that contractors say they would charge to build a fixed set of buildings – increased 0.7 percent for the month and 5.2 percent year-over-year.

All in all, this data was good news for the construction industry, and it mirrored good news on inflation for the overall economy. Prices leveled out during the last four months of 2018 and, for construction, balanced out the near double-digit spike in prices mid-year, when the tariffs were announced by the Trump Administration. January’s report, which also showed that inflation was staying close to the Federal Reserve Bank’s target, showed that there were fewer outliers (except to the downside) among the basic materials used in buildings and roads. The negative to that trend is that it means construction inflation is steadily registering at or above four percent.

Two factors in the calmer report bear further observation. First is that a dramatic decline in the price of oil and energy-related products was the primary reason for the lower inflation reading. Falling more than 40 percent since October 1, the price of crude oil has since rebounded more than 30 percent. Oil-derived products, like #2 diesel fuel and asphalt, saw prices fall by more than 25 percent over the same period. Those prices lag the crude oil price, so an increase in oil-related products is likely to follow in the coming months. The long-term outlook for oil is lower.

The second factor worth watching is construction wages. During December and January, wage inflation for construction was lower than wage growth overall. This bucks the trend that developed when wages began moving higher in 2017. Wage growth for construction was still ahead of inflation overall at 2.8 percent, compared to January 2018, but there are indicators that could put upward pressure on construction wages again. Construction job openings are at a cyclical high, suggesting that workers have more opportunity to push for higher wages. And the BLS’s Job Openings and Labor Turnover Survey (JOLTS) showed the highest quit rate for construction since 2005 at 2.2 percent. That more workers are leaving jobs without an offer is a warning sign that wage demands will rise faster.

The most promising news from January’s inflation report was that the PPI for inputs to construction stabilized further, remaining at 4.8 percent year-over-year. After jumping to 9.6 percent in April 2018, this PPI measure has moderated each month, staying more closely in the range of four to five percent.

Materials that saw extreme swings from December to January, and January 2018 to January 2019, were steel mill products (18.9 percent year-over-year), aluminum mill shapes (6.1 percent), fabricated structural metal (8.7 percent), architectural coatings (7.4 percent), asphalt paving mixtures (8.9 percent), #2 diesel fuel (-12.5 percent year-over-year and -14.6 percent since December), copper and brass mill shapes (-12.2 percent), and lumber/plywood (-6.1 percent).