As the policy of the Federal Reserve Bank shifted from neutral to restrictive during the winter of 2021-2022, two possible scenarios have emerged for the impact of inflation on construction. One is specific to the supply chain and the other to the overall economy. Both scenarios lead to more balance in supply and demand by the end of 2022; however, one of the scenarios will be easier to bear than the other.

The easier path to follow will be one where the recovery from the pandemic gradually restores the supply chain and prices moderate, reducing the number of rate hikes from the Fed in 2022. Some softening of demand is inevitable in this scenario; in fact, the reduced construction volume will expedite normalization of the supply chain. That should help nudge producers, like energy and steel companies that have been remarkably disciplined in their restraint to date, to expand production.

The easier path to follow will be one where the recovery from the pandemic gradually restores the supply chain and prices moderate, reducing the number of rate hikes from the Fed in 2022. Some softening of demand is inevitable in this scenario; in fact, the reduced construction volume will expedite normalization of the supply chain. That should help nudge producers, like energy and steel companies that have been remarkably disciplined in their restraint to date, to expand production.

The harder path is that of a cooling economy, which dials back demand for goods and facilities. There is evidence that this path is already being forged. In response to the Fed’s first small hike in rates in March, long-term mortgage rates went significantly higher. As subsequent hikes in the Fed Funds rate are taken throughout the balance of the year, mortgage rates will increase more slowly but will settle in higher, probably above five percent. That will cool off construction of houses. Likewise, higher long-term rates will dampen or defer business investment, including physical plant expansion and nonresidential construction. This scenario is likelier to bring inflation back under three percent, but it is also likelier to result in recession.

Because the path that is harder for the economy is more palatable politically, expect the emphasis to be on cooling demand through rate hikes, especially since the unemployment rate is so close to that of full employment. This more likely scenario is also one that will cool off construction in 2022 and 2023.

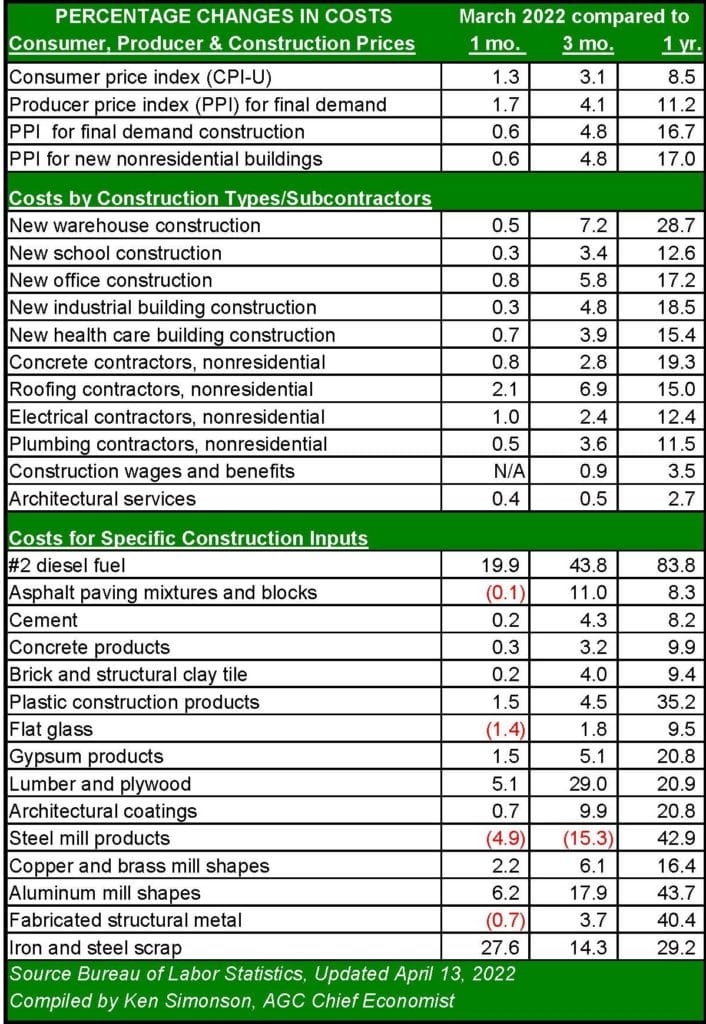

Data from the Bureau of Labor Statistics indicates that neither scenario had much impact on construction inflation in March. The price of inputs overall was flatter compared to the past 90 days but remained nearly 17 percent higher than a year ago. A 20 percent jump in diesel fuel prices from February to March – the result of the Russian invasion of Ukraine – drove producer prices higher; however, a 4.9 percent drop in steel mill products led declines in 10 categories, a sign that input inflation is leveling. More upward pressure is now coming from contractor bids, which are reflecting the risk of ongoing inflation on materials and installation that will occur three-to-nine months after bids are prepared.

Throughout most of 2021, bid prices reflected escalation rates of less than five percent, even as material prices were escalating at rates that were 10 or 15 points higher. That changed dramatically in the fourth quarter. The producer price index (PPI) for bids jumped 17 percent year-over-year in February, suggesting that bids will catch up to material prices by the end of the second quarter. Based upon the last three business cycles, material prices should begin to decline steadily from that point.