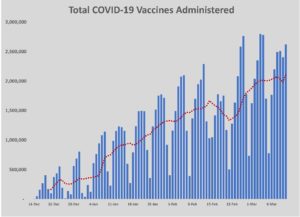

As metrics of economic activity continue to improve at the end of winter 2021, the most important trend for the U.S. economy is the steeply downward bending of the daily hospitalization rate and the upward trend of daily vaccinations. By March, more than two million vaccinations were occurring daily and the U.S. vaccine manufacturers were taking measures to increase production and distribution capacity. Additionally, the federal COVID-19 response accelerated, with the government purchasing sufficient doses of the three app roved vaccines so that 330 million people could be immunized by mid-year.

roved vaccines so that 330 million people could be immunized by mid-year.

Businesses have begun looking towards the latter half of 2021 for steadily improving conditions. Owners and developers have indicated a return to pre-pandemic levels of investment by the end of 2021, and projects with completions at the end of 2021 or later have been given green lights with increasing frequency. Most economists have upped their forecasts for 2021 growth in gross domestic product (GDP) because of the vaccination rollout, year-end COVID-19 relief package passed by Congress, and the commitment to maintain supportive policies by the Biden administration. The passage of the $1.9 trillion supplemental relief package has been hailed by economists and corporate leaders as a stopgap measure to prevent falling back into recession.

Early data on consumer spending suggests that the $600 payments to individuals that were included in the December relief bill contributed to an increase in spending by middle- and lower-income consumers. The Commerce Department reported on February 17th that retail sales jumped 5.3 percent in January, more than five times what was expected.

Financial institutions that have raised their outlook for 2021 see the COVID-19 relief and declining infections as keys to demand returning. The expectation for fiscal policy assumes that interest rates will remain untouched through 2021, with market responses impacting neither short-term nor long-term debt more than 50 basis points. The late February run-up in the 10-year Treasury bond yield has rattled investors slightly, although that yield has proven to be volatile within a wider range in recent years. Low rates will decrease the borrowing costs for private development and public bond issuance, both good for the construction industry. Among the notable GDP forecast changes were Wells Fargo Securities revision from 5.1 percent to 5.3 percent, Goldman Sachs’ prediction of 6.3 percent growth, and PNC’s prediction of 3.4 percent GDP growth in 2021. The latter’s forecast was in line with the consensus forecast of the National Association of Business Economists.

Concerns about inflation because of the accommodative fiscal policy seem largely overblown, according to the data available. Severe winter weather in much of the nation’s energy-producing regions drove a temporary spike in prices for oil and gas. No permanent changes to the supply and demand dynamics have followed but it is worth noting that inflationary cycles have begun with similar events in the past.

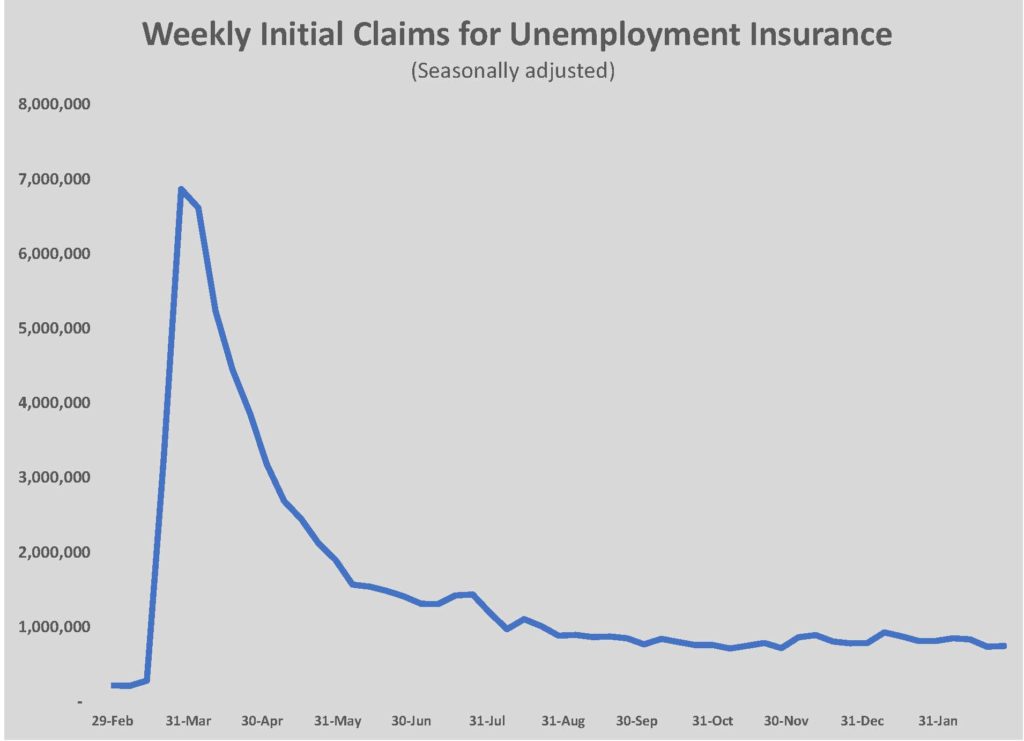

Inflation should not present any sort of problem to the economy until the labor market moves much closer to full employment. The increase in infections following the holiday season stopped the hiring momentum built through the fall. December saw the labor market shrink by 227,000 jobs. First-time claims for unemployment remain elevated, averaging more than 800,000 since the start of 2021. Continuing claims for unemployment compensation have fallen considerably since the late spring but remain stubbornly high, at 4.5 million at the end of February.

As the potential for a robust recovery grows, economists have been looking more closely at various measures of unemployment to gauge the strength of the labor market. The most commonly reported measure of unemployment, the U3 rate, gauges unemployment among those seeking a job. That excludes those discouraged or not currently seeking work, which are counted in the U6 unemployment rate. The U3 rate is currently 6.3 percent but the Bureau of Labor Statistics also knows that the workforce participation rate has plummeted by more than two points since COVID-19 hit. Most observers do not peg real unemployment as high as the 12.2 percent U6 rate but are clear that the number of workers unemployed is likely at 10 percent.

February’s jobs report was better than expected and underscored how crucial the vaccination effort is to restarting the economy. Employers added 379,000 jobs in February, boosted by a gain of 355,000 jobs in leisure and hospitality hiring and the decline in infections. That bodes well for a strong recovery mid-year if recent loosening of mitigation measures does not trigger another surge in infections in spring. Among the nuggets of information below the headline: the number of people working from home due to the virus outbreak declined by 0.6 points; labor force participation remained weak at 61.4 percent; and the number of people reported not working because their employer closed due to the pandemic fell by 1.5 million to 13.3 million. Hiring in skilled labor positions has improved markedly, another of the bright spots in the employment situation.

The pace of re-hiring will lag the pace of businesses re-starting, which will depend largely on the sector of the economy those businesses serve and the time it takes to resume normal activities. For office-using employment, it’s expected that full recovery to February 2020 levels will occur by the fourth quarter of 2021 or first quarter 2022. For non-office-using employment, the outlook is more pessimistic. According to JLL’s chief economist, Ryan Severino, the problems for non-office-using employment stem from conditions that preexisted the pandemic.

“For the non-office using segment of the labor market, we foresee a longer, more tenuous recovery. Although many of those jobs will return as the economy accelerates, many have been lost permanently due to business failures or downsizing of businesses,” Severino explains. “Although some businesses could return or replace those lost, many services businesses, such as restaurants and hotels, suffered from excess capacity in many markets in the U.S. before the downturn. Entrepreneurs seem unlikely to rush back to such an oversupply situation, intimating slower growth ahead for jobs in these industries.”

Slower growth is likely to be reflected in construction as the year unfolds, but the impact on nonresidential construction is apparent in the early data for 2021. Construction starts for January were $1.52 trillion, 5.8 percent higher than a year earlier. Strength in the residential construction spending, which was 21 percent higher than in January 2020, offset the $41.8 billion, or five percent, decline in nonresidential spending. Investment in private nonresidential construction was off 10.1 percent year-over-year.

A leading indicator for nonresidential construction, the American Institute of Architects’ (AIA) Architectural Billings Index, is pointing towards more durable improvement in the market in late 2021. The January reading on billings was still in the negative territory; however, the upward trend of inquiries and steady billings share closer to 50 are indicators that decline has stopped. AIA firms responding to the January survey overwhelmingly reported that more than one project that stalled in 2020 was still on hold, rather than canceled. That backlog offers potential for a shorter lag time between increased billings and construction.

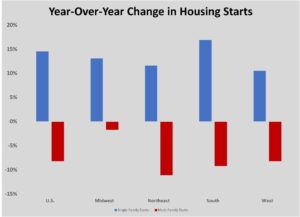

The strongest part of the constructi on market, if not the entire economy, remains residential construction. New residential starts for the full year of 2020 came in at 1.38 million units, an increase of 7 percent over 2019. Single-family construction was particularly robust, rising 14.5 percent year-over-year to 977,863 new homes. A variety of pressures related to COVID-19, ranging from unpaid rents to investor/lender uncertainty, slowed the construction of new multi-family projects. Developers nonetheless started 473,716 units as of December 2020, a decrease of 8.2 percent.

on market, if not the entire economy, remains residential construction. New residential starts for the full year of 2020 came in at 1.38 million units, an increase of 7 percent over 2019. Single-family construction was particularly robust, rising 14.5 percent year-over-year to 977,863 new homes. A variety of pressures related to COVID-19, ranging from unpaid rents to investor/lender uncertainty, slowed the construction of new multi-family projects. Developers nonetheless started 473,716 units as of December 2020, a decrease of 8.2 percent.

Data from the Census Bureau on January 2021 starts suggests that the growth in housing construction will continue into 2021. New home starts fell in January by six percent, with single-family starts falling 12.2 percent. Permits for new homes soared in January, jumping to a 1.881-million-unit pace. That marks the highest level since May 2006. Permits for multi-family units rose to 612,000 units. Building permits are a leading indicator for housing starts, as measured by the government. Usually lagged 30-to-60 days behind permits, new home starts can be delayed by severe weather or factors like a shortage of materials. There was some feedback from homebuilders in February that starts were being delayed by the renewed spike in lumber prices, which reached 52-week highs several times during February. New construction projects under sales contracts will be obligated to start regardless of material prices; however, a sustained spike in the price of lumber or other material crucial to home building could result in delays or cancellations, particularly in the multi-family sector.

The multi-family sector has seen the smallest increase in vacancy rate among the commercial real estate category. According to CoStar, 6.9 percent of apartment units were vacant in February across the U.S. That is only slightly higher than one year ago and about one point lower than in 2010. The commercial sector with the lowest vacancy rate is retail, which has 5.1 percent of space empty. Industrial property was 5.6 percent vacant (and higher than one year ago). Vacancy increased the most year-over-year in offices, although the 10.1 percent rate is 200 basis points lower than at the low point of the last recession.

real estate category. According to CoStar, 6.9 percent of apartment units were vacant in February across the U.S. That is only slightly higher than one year ago and about one point lower than in 2010. The commercial sector with the lowest vacancy rate is retail, which has 5.1 percent of space empty. Industrial property was 5.6 percent vacant (and higher than one year ago). Vacancy increased the most year-over-year in offices, although the 10.1 percent rate is 200 basis points lower than at the low point of the last recession.

Relatively mild vacancy increases and low interest rates provided support for property values. Although transactions fell only 4.4 percent from 2019 to 2020, boosted by an all-time record December that accounted for more than 17 percent of the year’s total. Real Capital Analytics’ Commercial Property Price Index rose 7.2 percent for commercial properties as a whole in 2020.

Commercial properties in the hospitality and office sectors will face challenges beyond the recovery to normal later in 2021 or 2022, but the commercial real estate market should not be a source of stress for the economy or financial system in 2021.

For those looking for a “glass half empty” interpretation of where the economy is heading, there is a reasonable case to be made for optimism overshooting the market. One supportive factor for the economy has been the performance of stocks and private equity. Unlike previous recessions, investors, retirees, long-term savers, and financial companies saw their balances hold steady or grow at solid rates during 2020. The downside of that strength is that it suggests little room for any bumps in the road, which are a solid possibility when dealing with a public health crisis. Most, if not all, measures of investor sentiment and volatility are at levels seen before the pandemic. The VIX Index, a measure of stock volatility, fell below 20 in February. That signaled higher-risk investors, like hedge funds, to increase leverage. That kind of investment shift has led to much higher returns in the past. It has also led to steep corrections.

Even a significant correction in the stock market is not likely to make a dramatic dent in the dry powder waiting to be deployed in business investment and real estate. As vaccination builds momentum globally, the greater risk to the economy remains an unexpected reversal in the fight to stop COVID-19 from spreading. If, as predicted, vaccines are available to the general public in May and most Americans can be vaccinated by the end of August, recovery for the industries that were hurt most by the outbreak can begin before fall of 2021. That would set the stage for the more optimistic forecast for 2021-2022 growth to come to pass.