ASC 842: ROU Asset Impairment

The adoption of Accounting Standards Codification (ASC) 842 Leases introduces new considerations that must be made regarding right of use (ROU) asset valuation and impairment. When evaluating ROU assets for impairment, the evaluation must be performed at the lowest level that cash flows can be identified. As cash flows for restaurants would be tied to the individual operating store, ROU assets, and property and equipment at the individual store should be included in the same asset group for evaluation. Asset impairment will be triggered when the estimated fair value of the ROU asset and property and equipment is less than its carrying amount, and the estimated future cash flows associated with the location will not be sufficient to fully recover its net book value. Some common impairment indicators are as follows:

- Significant changes in the operation (e.g. store closure) or expected future cash flows of the asset

- Legal proceedings that could potentially impact an asset’s future use or value

- Adverse changes to the economy or business climate

Under Generally Accepted Accounting Principles (GAAP), if any impairment indicators are present, a recoverability test must be performed as specified by ASC 360-10-35-17 to determine whether further impairment analysis is required. There is a two-step approach whereby first, a recoverability test is performed, and if the fair value of the asset group is less than its carrying amount, then a step two impairment test is performed. There are three approaches to this (as listed below), and Approach A is expected to be the most common. The end result of the impairment calculation (i.e. fair value of the associated right-of-use assets and impairment loss to be recorded) is not expected to significantly differ between methods. Impairment calculations have historically not been impacted by an organization’s financing decisions and this is the intent of ASC 842 as well given that ASC 842 looks at operating leases as operating liabilities. However, given the financing characteristics associated with these right-of-use assets and corresponding lease liabilities, the FASB has elected to allow each of these approaches.

| Approach A | Approach B |

Approach C | |

| Step 1 – Carrying amount of asset group |

|

|

|

| Step 1 – Undiscounted cash flows |

|

|

|

| Step 2 – Fair value (Discounted Cash Flow approach) |

|

|

|

Impairment Analysis

Determining the recoverability of a right-of-use asset requires an evaluation of the undiscounted future cash flows generated from the use of an asset (or asset group) is equal to or less than the current book value of the asset (or asset group). As mentioned previously, the analysis must be performed at the lowest level cash flows are identifiable (e.g. at the individual store level vs. company-wide level) and overhead costs that cannot be tied to individual locations, such as executive salaries, interest expense, etc. are not included.

- If the expected undiscounted future cash flows are greater than the net book value of the asset, the asset is “recoverable” and impairment indicators are not deemed to be present. The cash flows utilized should typically be forward-looking and factor in all known information included in your sales or operational forecast.

- If the net book value of the asset is greater than its estimated undiscounted future cash flows, the asset (or asset group) does not pass the recoverability test, and further evaluation is required to quantify the potential impairment loss.

One additional item to note is that for private companies, the Financial Accounting Standards Board (FASB) allows the utilization of a risk-free rate in the calculation of right-of-use assets and the associated lease liability. While this is much easier in practice than utilizing an incremental borrowing rate and we expect many organizations to utilize this approach, it will result in larger right-of-use assets on the books. This increases the risk of valuation and potential future impairment which may result in a larger number of recoverability tests and potential impairment calculations for those organizations with a large lease portfolio.

Impairment Example

In the example below, the following fact pattern is considered (using Approach A as listed previously):

- ABC Company has an underperforming store with 5 years remaining in the lease term. Based on the underperformance of the store and low operating cash flows, a recoverability test was triggered.

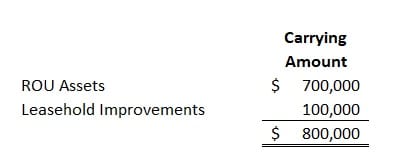

- Total right-of-use assets and total leasehold improvements are as follows:

- Total associated lease liabilities were $750,000

- No variable lease payments are expected. Total fixed lease costs are $173,000 per year and are excluded from the recoverability test as Approach A is being utilized. Expected cash inflows and outflows are as follows over the remainder of the lease term:

- As the total undiscounted cash flows of $500,000 are less than the total net book value of the ROU assets and leasehold improvements of $800,000, further evaluation is required to estimate the impairment loss.

Impairment Calculation

While the recoverability test is calculated using undiscounted cash flows, cash flows would be discounted in calculating the true fair value of the ROU and associated assets to determine the impairment loss. The discount rate utilized would be the rate that a market participant would utilize in calculating fair value.

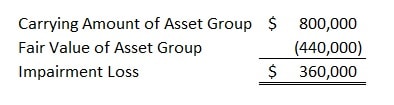

If it was determined that a market participant would use a discount rate of 5%, then 5% would be used in the discounted cash flow method to calculate the fair value of the asset group and associated impairment loss. Discounting the cash flows above at a rate of 5% would result in an estimated fair value of the ROU assets and leasehold improvements of $440,000 (refer to the table above). A total impairment loss of $360,000 would then be recorded based on the difference between the fair value of $440,000 and the net book value of $800,000.

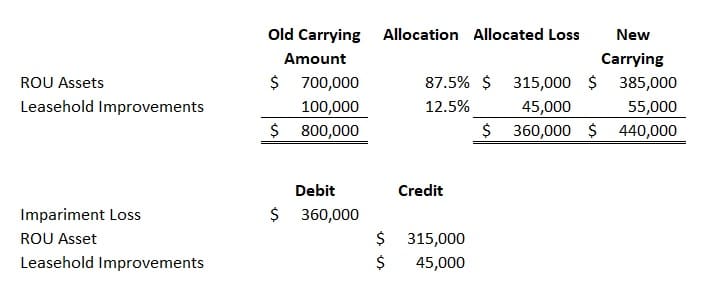

As there are both ROU assets and leasehold improvements at the store level, the impairment loss would be allocated between the two asset groups based on their respective percentage of the total book value pre-impairment. See below for the calculation of the impairment loss allocation and the journal entry to be recorded.

Future Accounting

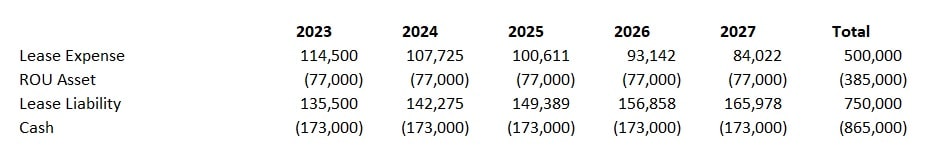

After an ROU asset is impaired, the remaining ROU asset is amortized into expense on a straight-line basis over the remaining lease term. The associated lease liability is accreted using the interest method over the remainder of the lease term. The interest rate utilized in this calculation would be the same interest rate utilized in the initial lease liability calculation at either lease commencement or adoption of ASC 842 regardless of whether the incremental borrowing rate or risk-free rate as allowed by the private company exception was utilized. As such, although the lease remains an operating lease, it is accounted for similarly to a finance lease post-impairment. Considering the above example and assuming an interest rate of 5% was used at lease commencement, the following future journal entries would be recorded (a positive number indicates a debit entry and a negative number indicates a credit entry).

Summary

There are many complexities to consider when evaluating individual store locations for impairment as well as performing recoverability tests and impairment calculations. As mentioned previously, associated lease payments can either be included or excluded in the recoverability test and impairment calculation based on the approach elected by management. However, whether or not lease payments are included or excluded would not typically impact the total impairment loss to be recorded. To the extent you encounter any circumstances where a recoverability test may be triggered, we encourage you to reach out and talk through your approach as we are always here to help.

By: Tobin Perrill, CPA, Director, Assurance & Business Advisory Services