Qualified Opportunity Zones were established as part of the 2017 federal tax overhaul bill to provide tax incentives to spur long-term investment in distressed communities. As businesses and/or investors invest in these zones to stimulate private investment in exchange for capital gain tax incentives, now is the time to determine the optimal fund structure. We are pleased to provide an overview of significant pieces of the opportunity zone program as they relate to qualifying operating businesses for this tax incentive.

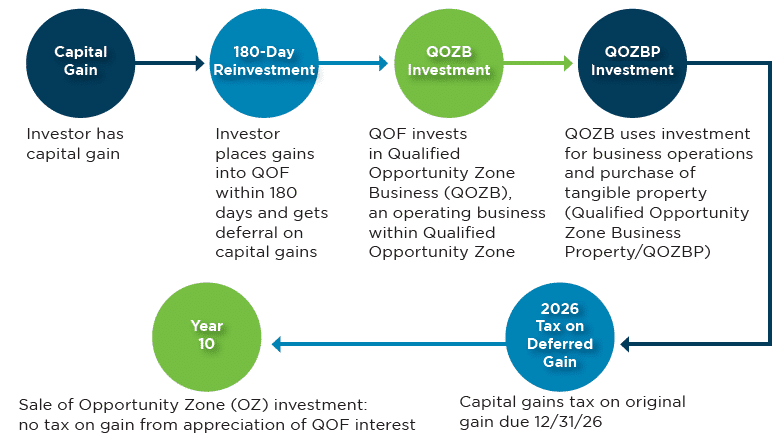

Investor Benefits:

- Tax Deferral – Capital gains rolled into Qualified Opportunity Fund (QOF) deferred until 2026

- Permanent Tax Exclusion – If QOF investment is held for 10 years or more, no gains are taxed on appreciation upon a sale (except for inventory)

- Ohio Tax Credit – Investors may be eligible for a 10% tax credit on their investment in Ohio QOFs

Qualified Opportunity Zone Process:

Recommended Structure:

We recommend the use of a two-tier structure – investors invest into a QOF, and the QOF acquires an interest in a lower-tier partnership that would operate the business in the OZ. This lower-tier operating business is referred to as Qualified Opportunity Zone Business (QOZB). 90% of QOF assets have to be QOZ assets, as measured twice a year. QOF ownership interest in the QOZB will count as a qualifying asset for the purposes of 90% testing, as long as the operating business meets its own set of requirements.

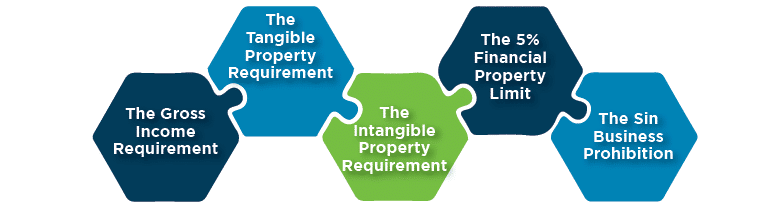

QOZB Requirements:

In order for the operating business to be a good asset in the hands of a QOF, it has to be trade or business that qualifies as a QOZB:

Gross Income Requirement

Under the Gross Income Requirement, a QOZB has to generate at least 50% of its gross income from the active conduct of its trade or business in an OZ. There are four safe harbors businesses can use to satisfy this requirement:

- Hours Safe Harbor will be met if at least 50% of the services, based on hours performed for the QOZB by its employees and contractors, are within an OZ

- Compensation Safe Harbor will be met if at least 50% of the compensation for services performed for the QOZB by its employees and contractors is paid for services performed within an OZ

- Property and Management Safe Harbor will be met if the tangible property of the QOZB in an opportunity zone and the management or operational functions performed for the QOZB in an OZ are each necessary to generate 50% of the gross income of the QOZB

- Facts and Circumstances Safe Harbor

Tangible Property Requirement

70% of the tangible property owned or leased by the QOZB must be Qualified Opportunity Zone Business Property (QOZBP). To qualify as QOZBP, tangible assets have to either be assets that are newly placed in services by the QOZB (original use test) or substantially improved (doubling the basis); acquired by purchase after 12/31/2017; and during substantially all of the QOZB’s holding period of QOZBP, substantially all of the use of the property has to be in an opportunity zone (substantially all test); Leases can also qualify as QOZBP, provided that the lease is a ‘market rate lease’ and meets 70% requirement.

The Intangible Property Requirement

To the extent a QOZB has intangible property, at least 40% of the intangible property must be used in the active conduct of its trade or business in an OZ.

The 5% Financial Property Limit

The OZ program does not permit investors to claim the OZ tax benefits for investments in financial products. Less than 5% of the average aggregate unadjusted bases of the QOZBP can be attributable to nonqualified financial property (debt, stock, partnership interests, options, futures, forwards, warrants and other similar property). Reasonable amounts of working capital held in cash do not constitute as nonqualified financial property.

The Sin Business Prohibition

QOZB cannot be a specified sin business – massage parlors, hot tub facilities, suntan facilities, racetracks or other gambling facilities, golf courses, country clubs, and liquor stores.

(Click ‘Download PDF’ below to access a copy of the document.)

« Back