Article written by:

John Meine

Financial Analyst

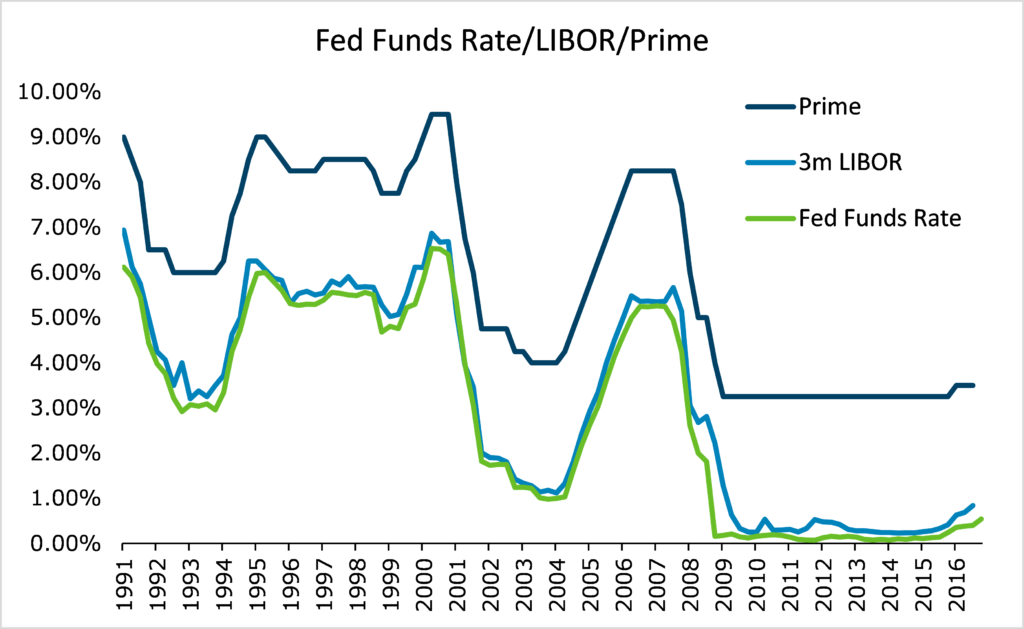

In March 2017, the Federal Reserve Bank elected to increase its key interest rate from a range of 0.50 percent to 0.75 percent to the range of 0.75 percent to 1.00 percent. This increase, which represents the Fed’s third increase in interest rates in nearly a decade, represents a new era of monetary policy, meant to lift the economy from its current low (and in some countries, zero or negative) interest rate environment. In general, this should have no effect on valuation, as the Fed typically increases rates to cool an overheating economy (i.e., when cash flows are abnormally high) and decreases rates to stimulate a depressed economy (i.e., when cash flows are abnormally low). However, this rate is highly correlated with other interest rates that are key inputs into a company’s cost of capital.

A company can finance its operations through three main avenues: 1. raising debt capital; 2. raising equity capital; and 3. using internally-generated funds. While there are no explicit costs attributed to internally generated funds (other than the return of capital to investors), both the former options inherently contain costs to provide investors a return on their investment.

Cost of Debt

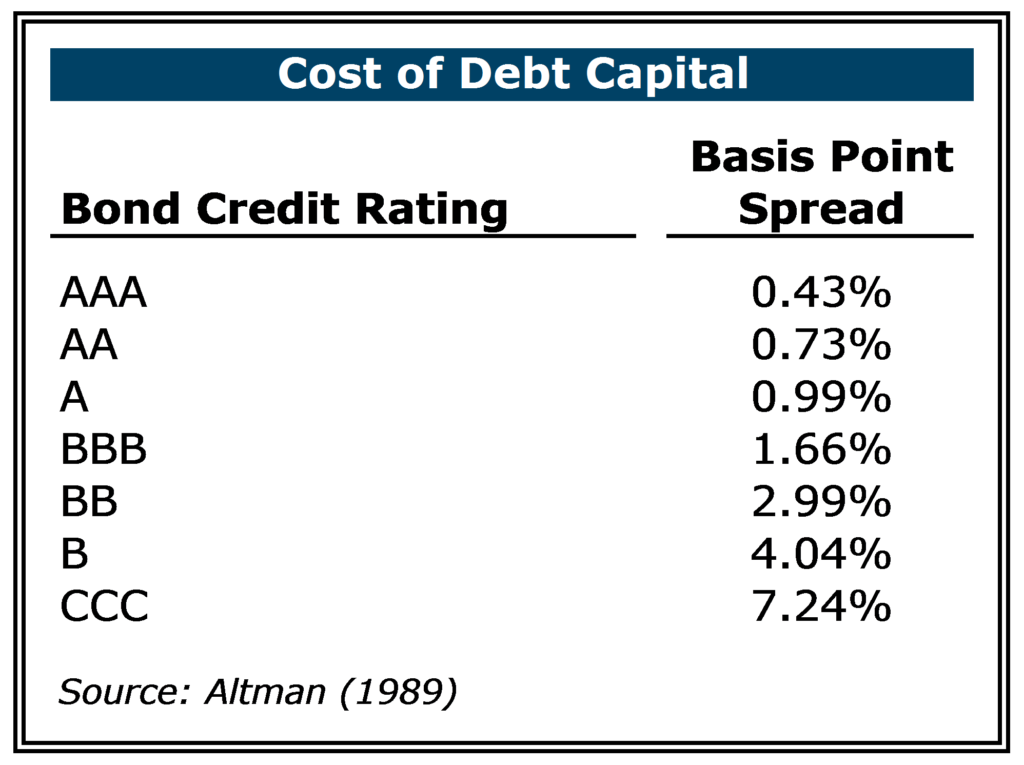

The cost of debt represents the cost to satisfy debt holders who are providers of short-term capital (e.g., lines of credit) and long-term capital (e.g., mortgages or other term debt). LIBOR and Prime, interest rates that are reported by the Intercontinental Exchange (ICE) and Wall Street Journal, respectively, are highly correlated with the Fed’s key rate and represent the foundation of the cost of debt. These variable interest rates serve as a starting point in determining a company’s cost of debt, as most debt is pegged off one of these two rates. When determining a company’s cost of debt, one of two methods can be used: 1. start with LIBOR or Prime and layer in additional company-specific credit risk; 2. use publicly traded corporate debt as a proxy. The cost of debt can range from near 0.50% (for high quality credit borrowers) to near 10% (for low quality credit borrowers, sometimes referred to as junk bonds in public markets, or subordinated capital provided by mezzanine lenders).

Cost of Equity

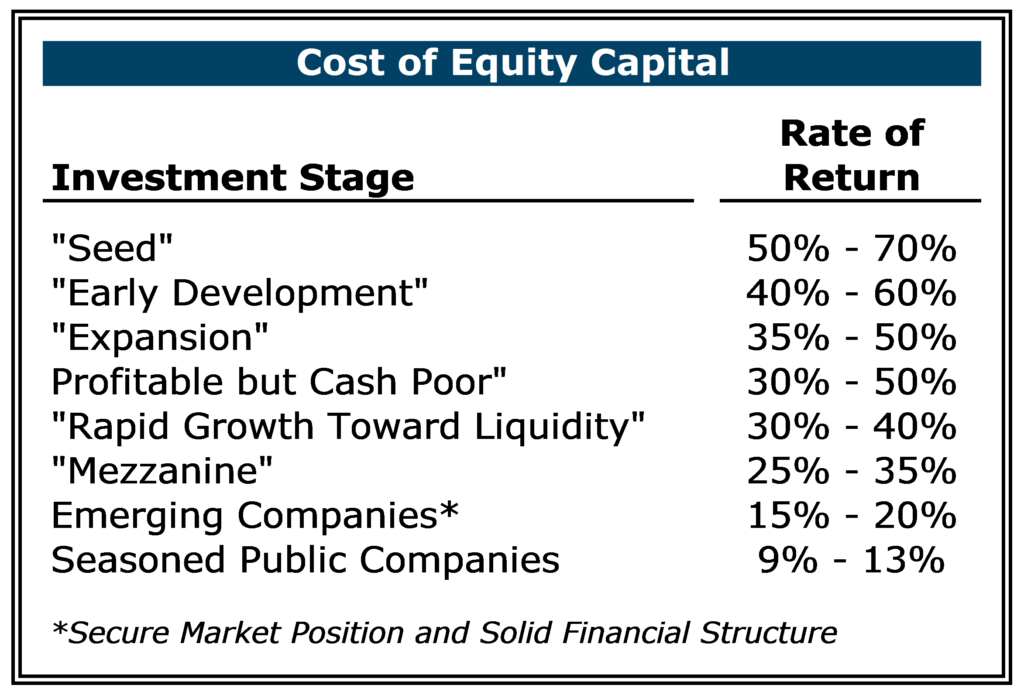

The cost of equity is an investor’s required rate of return expected for an investment in a company’s equity. There are many methods to calculate the cost of equity (i.e., Capital Asset Pricing Model, bond yield plus risk premium, etc.); however, the return on equity is much more subjective than the return on debt. An estimate for the cost of equity can be determined based on the maturity of the business. For example, early stage companies can demand returns from 30% to as high as 70%, compared to seasoned public companies which can range from 9% to 13%.

By increasing the riskiness of an investment (e.g., caused by diminishing credit quality or a firm in a very early stage), an investor’s required return on capital increases. This creates an inverse relationship between the required return on capital and the valuation of the investment instrument. While equity can command a higher return than debt (i.e., through dividends and/or capital gains), the additional risk associated will have a directly negative effect on valuation. While the Federal Reserve’s decision to increase interest rates should have no effect on valuation (as discussed earlier), increasing the return on an investment does have an inverse relationship with the valuation of an investment.