Article written by:

Eric Dollin

Manager, Valuation Services

On December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act of 2017 (the “Act”). While this first major overhaul of the tax code in over 30 years will have implications for individuals and businesses alike, for privately-held companies with a pending need for a valuation of their business (for estate and gift tax planning purposes, employee stock ownership plans, share-based compensation, financial reporting, or other purposes), there are several factors that should be considered by the valuation advisor when evaluating the potential valuation impact of the changes stemming from the Act.

There are several valuation methodologies that utilize a company’s cash flows in the determination of value: the discounted/capitalized cash flow methods (variations of the income approach), the guideline public company method and the guideline transaction method (each a variation of the market approach). Each of these methodologies presents unique elements that should be considered by the valuator in their analysis when evaluating the impact of the Act on company value, as follows:

Discounted/Capitalized Cash Flow Methods

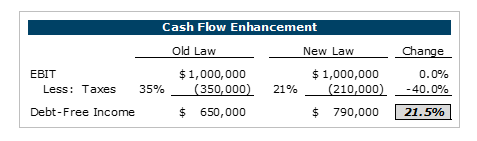

The single-period capitalized cash flow and multi-period discounted cash flow methods determine the value of a company through the projection and discounting of future expected business cash flows at an appropriate rate of return. A significant component of a company’s projected future cash flows is the applicable tax rate. Following the implementation of the Act, tax rates have generally decreased for most companies (e.g., C-corporations are now taxed at a flat rate of 21% compared to a top marginal rate of 35% under previous tax law). All else equal, higher available levels of distributable cash flow would yield higher values. For example, as outlined in the accompanying chart, a reduction in the applicable tax rate from 35% to 21% would, all else equal, yield a 21.5% increase in debt-free income.

However, while reduced tax rates suggest enhanced cash flows and subsequently higher valuations, there are several provisions of the Act (e.g., limits on the tax deductibility of interest) and valuation variables (e.g., re-leveraging of betas in the calculated cost of capital, tax implications on the cost of debt) that could partially offset these potential gains.

Given the complexity of the Act and the number of variables used in the development of a Discounted/Capitalized Cash flow analysis, it will be important for management and the valuation advisor to understand the impact of the Act on a company’s projected cash flows and how any enhanced future cash flows will be utilized to drive additional value for the company going forward.

Guideline Public Company Method

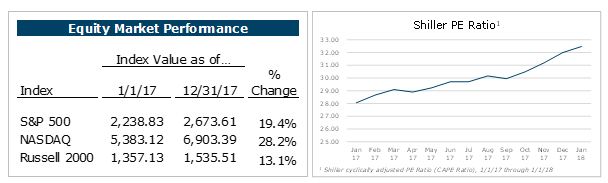

The guideline public company method, which utilizes pricing multiples exhibited by similar publicly-traded companies in the determination of value, provides an interesting case study in evaluating the impact of the Act on company valuations. As evidenced in the accompanying charts, broad-based public company returns in 2017 (in which it was assumed by many that some sort of favorable tax legislation would be introduced), suggest that investors were anticipating higher future cash flows, as equity market returns and pricing multiples increased substantially during the year (although it’s certainly debatable the amount of these increases that are attributable to the anticipation of tax reform).

Guideline Transaction Method

In utilizing the guideline transaction method, which relies on actual transactions involving similar companies in the determination of applicable pricing multiples, it will be important for the valuator to understand how multiples of historical transactions (a large portion of which will have occurred prior to the change in tax law) would be impacted by the Act and make adjustments to the indicated multiples accordingly.

As time passes, the valuation impact of the Act on public markets should become clear, and it will be important for valuators to continue to analyze both public company multiples and the multiples implied by merger and acquisition transactions over time to identify shifts in pricing multiples. The valuator should also consider the implications on the Act on businesses in the company’s specific industry and in determining how apparent changes in market multiples may be applicable to the company.

No “Magic Bullet” in Valuation

In addition to the considerations outlined above, other factors, including the company’s tax status (c-corporation vs. pass-through entity), industry, nature of the investor, minority vs. controlling interest, etc., are all items that should be taken into consideration in the context of a comprehensive business valuation. It is important to note that there will not be a one-size-fits-all solution that will be applicable in the valuation of every company in the wake of these significant changes to the tax code. It will also be important to work with your valuation advisor to understand the factors specific to your company and how those factors impact your company’s value under the framework of the Act.

For further questions on how the Act may impact the valuation of your business, please contact one of GBQ’s business valuation professionals.