The monthly reports from the Bureau of Labor Statistics in January and February revealed that price inflation, which had been limited to a handful of major items in 2021, had become more widespread at the beginning of 2022.

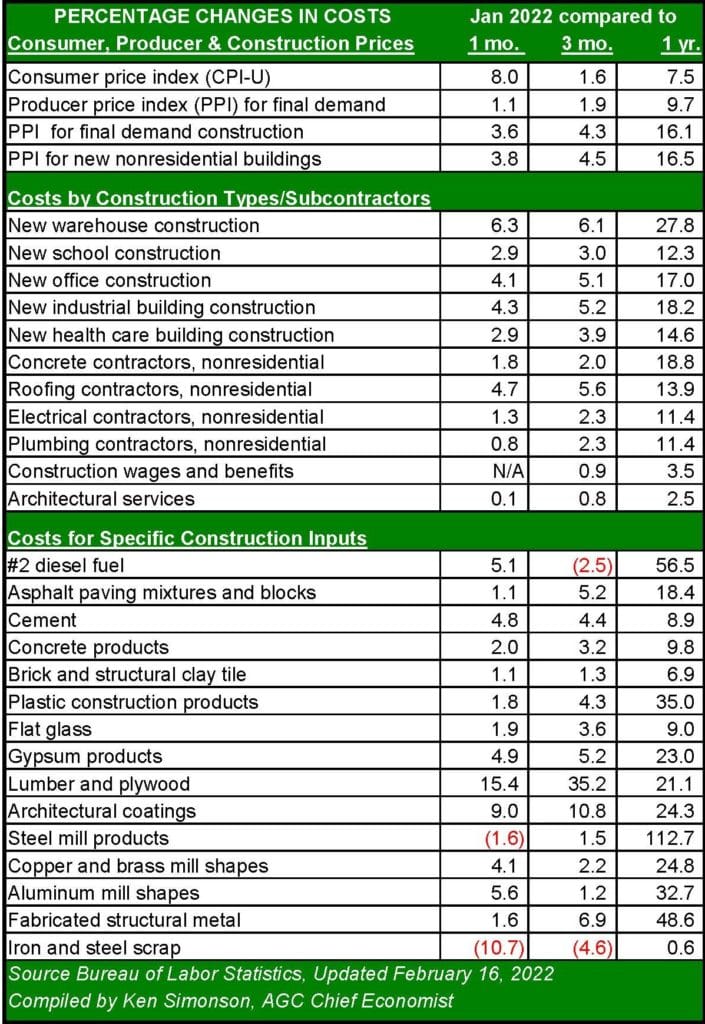

Data from the January producer price index release showed that inflation for new construction has leveled off since the spike from September to October 2021, when the year-over-year variance for new nonresidential buildings jumped from five percent to more than 12 percent. Ongoing inflation of 12 percent is going to dampen demand for construction in 2022, especially since price increases in a number of materials are significantly higher than the overall rate. The current levels may seem all the more shocking because the year-over-year rate of inflation at the end of 2020 had fallen to just over one percent, after reaching almost three percent in February 2020.

While the trend for most materials and building types was for lower month-to-month increases as 2021 ended, January saw jumps of between 2.5 and 3.5 percent in producer price indexes (PPI) from December across all inputs to construction. In many cases, the change in PPI from December to January was the same as from October to January, suggesting that prices were heating up again after stabilizing in the fourth quarter.

Among the outliers from the overall trend, only steel mill products, iron and steel scrap, and asphalt (at the refinery) were lower in January. Steel, which has increased 1.5 percent since October, is still more than double the price of January 2020. Lumber and plywood were again spiking, jumping 15.4 percent in January and 21.1 percent year-over-year. The trajectory of lumber prices will largely follow the lead of residential construction in 2022. Most materials saw double-digit year-over-year increases, and most of those exceeded 20 percent.

Wages also climbed in January and the pace of wage growth continued to increase. Excluding benefits, wages rose 3.8 percent year-over-year. Wage growth was only 3.2 percent year-over-year in October.

The root cause of the higher levels of inflation – white-hot demand meeting a supply chain still disrupted by pandemic conditions – has not changed. As the Federal Reserve Bank withdraws monetary support and hikes its Fed Funds rate, beginning in March, there will be downward pressure on inflation for the first time since the outbreak of COVID-19 in 2020. Strong demand will also motivate improvements to the supply chain, the fruits of which have begun to be felt on the consumer side. And, beginning in April, year-over-year comparisons will be made to economic conditions that reflect the rollout of vaccines and the normalization of many businesses in 2021.

Bond markets continue to reflect expectations of a return to inflation of two-to-three percent inflation next year. Aggressive Fed actions are likely to cool the economy off slightly. But geopolitical issues are likely to keep steel, energy, and fuel prices high, which will reflect throughout the construction supply chain.