Paying your individual income taxes likely represents one of the largest outlays of the year, but it also offers an opportunity for significant savings. Whether you have paid individual income taxes through employer withholding or quarterly estimates, thoughtful planning before the calendar turns to 2020 can reduce your total tax liability and help retain more of your earnings. If you devote substantial research and forethought to how you invest your money, then you should take a similar approach to how that income will be taxed.

With numerous changes to the federal tax code, this 2019 Year-End Tax Planning for Individuals Letter can help identify specific opportunities to reduce or defer your annual tax obligation. And the sooner you start the conversation around tax planning, the more time you’ll have to carefully consider all applicable factors. This process requires a projection of your estimated income, deductions and tax liability for both 2019 and 2020 to determine your anticipated marginal tax rate. Reviewing the actual amounts from 2018 will help with those projections.

You should determine the extent to which you can control the timing of income and deductions, and then optimize your planning for the lowest overall tax in both 2019 and 2020. Important considerations include charitable gifts, capital losses, retirement contributions, potential gifts to children or grandchildren, and using trusts. If you can’t reduce your overall tax liability, then it’s generally best to defer as much tax liability as possible to 2020.

Individuals should also consider the tax implications for any businesses conducted directly or indirectly by the individual owners. To understand the important details that apply to those areas, you can review our 2019 Year-End Tax Planning for Businesses Letter. Because some guidance and regulations are still pending, we also suggest you consult our website regularly for additional updates and insights while you continue the planning process.

This letter was written prior to the release of the inflation-adjusted tax rate schedules and other key tax figures for 2020. See IRS Revenue Procedure 2019-44 and Notice 2019-59 for updates on the figures discussed in this letter for 2020.

This tax letter discusses planning for federal income taxes, but state income taxes must be considered as well, so you should consult your client service professional regarding applicable factors for state taxes.

2019 Versus 2020 Marginal Tax Rates

Whether you should defer or accelerate income and deductions between 2019 and 2020 depends to a great extent on your projected marginal tax rate for each year. You should analyze your anticipated marginal tax rates for 2019 and 2020 and determine which of the two years is projected to have a higher marginal tax rate.

The highest marginal tax rate for 2019 is 37 percent, with an additional 3.8 percent tax on the net investment income of high-income taxpayers. The tax rates for 2019 are included in this Tax Letter. Projections of your 2019 and 2020 income and deductions are necessary to estimate your marginal tax rate for each year.

Recognizing Income and Deductions into the Most Advantageous Year

You can recognize taxable income between 2019 and 2020 by controlling the receipt of income and the payment of deductions. Generally, income should be received in the year with the lower marginal tax rate, while deductible expenses should be paid in the year with the higher marginal rate. If your top tax rate is the same in 2019 and 2020, deferring income into 2020 and accelerating deductions into 2019 will generally produce a tax deferral of up to one year. On the other hand, if you expect your tax rate to be higher in 2020, you may want to accelerate income into 2019 and defer deductions to 2020.

Planning Suggestion: The time value of money should be considered when deciding to defer income or accelerate deductions. Comparative computations should be made to determine and evaluate the net after-tax result of these financial actions. Moreover, you should consider whether you expect to be subject to the AMT for either or both years.

Controlling Income

Income can be accelerated into 2019, or deferred to 2020, by controlling the receipt of various types of income depending on your situation, such as:

For Business Owners

- Year-end interest or dividend payments from closely-held corporations

- Rents and fees for services (delay December billings to defer income)

- Commissions (close sales in January to defer income)

Caution: Income cannot be deferred to 2020 if you constructively receive it in 2019. Constructive receipt occurs when you have the right to receive payment or have received a check for payment, even though it has not been deposited. Income also cannot be deferred if you effectively receive the benefit of the income, for example, if you pledge a deferred compensation account balance to obtain a loan.

Bonuses that are determined based on work performed in 2019 can be paid during 2019 or in 2020. Payment in 2019 secures the 2019 deduction for the business using either the cash or accrual basis of accounting. Payment in 2020 will delay the deduction for a cash basis business, therefore allowing some flexibility in the year of deduction.

For Investors

- Interest on short-term investments, such as Treasury bills (T-bills) and certain certificates of deposit that do not permit early withdrawal of the interest without a substantial penalty, is not taxable until maturity.

Example: In November 2019, an investor buys a six-month T-bill. The interest is not taxable until 2020, assuming the T-bill is held to maturity.

Interest on U.S. Series EE Savings Bonds

Other than not being taxable until the proceeds are received, interest on issued Series EE savings bonds may be exempt from tax if the proceeds of the bond are used to pay certain educational expenses for yourself or your dependents, and the requirements of “qualified United States savings bonds” are met.

Planning Suggestion: Consider investments that generate interest exempt from the regular income tax. You must, however, compare the tax-exempt yield with the after-tax yield on taxable securities to determine the most advantageous investment. In addition, some tax-exempt interest may be subject to AMT which could lower the after-tax yield.

Other ways to defer income include installment sales and tax-free exchanges of “like-kind” real property used for investment or business.

Planning Suggestion: If you made a 2019 sale that is eligible for installment reporting, you have until the due date of your 2019 return, including extensions, to decide if you do not want to use the installment method and, instead, report the entire gain in 2019.

Net Investment Income Tax

The Health Care and Education Reconciliation Act imposes an additional 3.8 percent tax (net investment income tax) on net investment income in excess of certain thresholds for taxable years beginning after December 31, 2012. Examples of net investment income include non-business interest, dividends, and capital gains. Net investment income also includes business income from an activity in which the taxpayer does not materially participate, including from partnerships and S corporations. Income excluded from net investment income includes wages, unemployment compensation, self-employment income, Social Security benefits, tax-exempt interest, distributions from certain qualified retirement plans, and non-investment income from businesses in which the taxpayer is a material participant. The 3.8 percent tax is applicable to taxpayers with modified adjusted gross income for 2019 exceeding $250,000 for married couples and surviving spouses, $125,000 for married individuals filing separate returns, and $200,000 for single individuals and head of household filers. You should be aware that these statutory threshold amounts are not indexed for inflation. The tax is 3.8 percent of the lesser of your net investment income or the excess of your modified adjusted gross income over the applicable threshold amount stated above. This tax is also likely to apply to a significant portion of the net investment income of an estate or trust that is otherwise subject to income tax on such income. The suspension of miscellaneous itemized deductions and limitations on other itemized deductions under tax reform will also limit the use of such itemized deductions against net investment income for taxable years beginning in 2018 and ending before 2026.

Planning Suggestion: We strongly encourage you to consult your investment and tax advisors to maximize the after-tax returns if you believe your portfolio may not be currently aligned to account for increased tax exposure.

For Employees

Year-End Bonuses and Deferred Compensation

Caution: The IRS will scrutinize deferrals of income between owner-employees and their closely-held corporations. Additionally, if you own more than 50 percent of a C corporation or any stock of an S corporation that reports its income on an accrual method of accounting, the corporation can deduct a year-end bonus to you only when it is paid. Also, any deferred compensation arrangements must comply with the Section 409A rules discussed later in this letter. These rules may prevent a reduction of 2019 taxable income by deferral, but elections can be made before December 31, 2019, that affect your 2020 taxable income.

Planning Suggestion: Determine if you would like to avoid 2020 taxation of your 2020 compensation and make the appropriate deferral election before the end of 2019.

Additional Planning: Evaluate existing deferred compensation arrangements and the stated distribution schedule. If distributions are not scheduled to begin within the next 12 months, consider a second deferral of five additional years.

The tax rates for the Medicare (hospital insurance) portion of the social security tax are:

- 45 percent for employees for 2020

- 45 percent for employers for 2020

- 9 percent for self-employed individuals for 2020

There is an additional 0.9 percent tax on all wages and self-employment income in excess of $200,000 for single, head of household and surviving spouse taxpayers, $250,000 for married taxpayers filing jointly, and $125,000 for married taxpayers filing a separate return.

This tax is imposed on all employee compensation and self-employment income, including vested deferred compensation, without any limitation or cap. The income thresholds for the additional 0.9 percent tax apply first to total wages, and then to self-employment income.

Planning Suggestion: If you are a shareholder in an S corporation, you might be able to reduce the tax by reducing your salary. However, reasonable compensation must be paid to S corporation shareholders for services rendered to the S corporation.

The tax rate for the old age, survivors, and disability insurance portion of the social security tax is:

- 2 percent for employees for 2020

- 2 percent for employers for 2020

- 4 percent for self-employed individuals for 2020

Similar to the Medicare withholding tax, this tax is imposed on employee compensation and self-employment income, except that this tax is imposed only to the extent of the maximum wage base set by the Social Security Administration ($132,900 for 2019).

Distributions From Retirement Plans

Distributions from qualified retirement plans can be delayed.

Caution: Penalties may be imposed on early, late, or insufficient distributions.

IRA Distributions

All distributions from a regular individual retirement account (IRA) are subject to ordinary income taxes. This tax liability can be delayed until age 70½, at which time you are required to begin taking annual distributions from your IRA. The 10 percent early withdrawal penalty discourages distributions before age 59½ in most cases. However, if you are over 59½ you can take a penalty-free voluntary distribution if accelerating ordinary taxable income is desirable. Penalty-free access to the funds is available prior to age 59½ to the extent the distribution is used (1) to pay unreimbursed medical expenses in excess of 10 percent of your adjusted gross income (AGI) (if you are under age 65), (2) to pay any health insurance premiums (provided you have received unemployment compensation for at least 12 weeks), or (3) for a limited number of other exceptions.

If you are planning to purchase a new home, you may withdraw up to $10,000 from your IRA to pay certain qualified acquisition expenses without having to pay the 10 percent early withdrawal penalty. The distribution is still subject to regular income tax. The $10,000 withdrawal is a lifetime cap. If a taxpayer or spouse has owned a principal residence in the previous two years, this penalty-free provision is not available. An eligible homebuyer for this purpose can be the owner of the IRA, his or her spouse, child, grandchild, or any ancestor. Also, penalty-free distributions can be made from IRAs for certain higher education expenses of a taxpayer, spouse, child, or grandchild.

If you are planning to make a charitable gift, individuals aged 70½ or older can donate money from their IRA account directly to a charitable organization without the gift counting as income. Qualified charitable distributions can also satisfy all or part of your required minimum distribution from your IRA.

Accelerated Insurance Benefits

Subject to certain requirements, payments received under a life insurance policy of an individual who is terminally or chronically ill are excluded from gross income. If you sell a life insurance policy to a viatical settlement provider (regularly engaged in the business of purchasing or taking assignments of life insurance policies), these payments also are excluded from gross income.

Educational Expense Exclusion

An exclusion for employer-provided education benefits for non-graduate and graduate courses up to $5,250 per year is available.

Damages Received For Non-physical Injuries and Punitive Damages

All amounts received as punitive damages and damages attributable to non-physical injuries are gross income in the year received. Legal fees attributable to employment-related unlawful discrimination lawsuits are a deduction in arriving at adjusted gross income, instead of a miscellaneous itemized deduction. Damages received by a spouse, which are attributable to loss of consortium due to physical injuries of the other spouse, are excluded from income.

Controlling Deductions

The phase-out of itemized deductions for high income individual taxpayers, called the “Pease” limitation, was suspended for tax years 2018 through 2025. Under the Pease limitation, itemized deductions that would otherwise be allowable were reduced by the lesser of:

- 3 percent of the amount of the taxpayer’s AGI in excess of a threshold amount, or

- 80 percent of the itemized deductions otherwise allowable for the taxable year.

High-earning taxpayers will once again be able to take itemized deductions that were limited under Pease, however with the increased standard deduction, a taxpayer’s amount of total deductions in 2020 must generally be greater than $12,400 ($12,200 for 2019) for single individuals and $24,800 ($24,400 in 2019) for married couples filing jointly before they incur the benefit of itemizing deductions.

The following discusses deductions that may be accelerated into 2019 or deferred to 2020.

Charitable Contributions (Cash or Property)

You must obtain written substantiation from the charitable organization, in addition to a canceled check, for all charitable donations in excess of $250. Charities are required to inform you of the amount of your net contribution, where you receive goods or services in excess of $75 in exchange for your contribution.

If the value of contributed property exceeds $5,000, you must obtain a qualified written appraisal (prior to the due date of your tax return, including extensions), except for publicly traded securities and non-publicly-traded stock of $10,000 or less.

Planning Suggestion: If you are considering contributing marketable securities to a charity and the securities have declined in value, sell the securities first and then donate the sales proceeds. You will obtain both a capital loss and a charitable contribution deduction.

Caution: If you are contemplating the repurchase of the security in the future, you need to consider the wash sale rules discussed.

On the other hand, if the marketable securities or other long-term capital gain property have appreciated in value, you should contribute the property in kind to the charity. By contributing the property in kind, you will avoid taxes on the appreciation and receive a charitable contribution deduction for the property’s full fair market value.

If you wish to make a significant gift of property to a charitable organization yet retain current income for yourself, a charitable remainder trust may fulfill your needs. A charitable remainder trust is a trust that generates a current charitable deduction for a future contribution to a charity. The trust pays you (or another person) income annually on the principal in the trust for a specified term or for life. When the term of the trust ends, the trust’s assets are distributed to the designated charity. You obtain a current income tax deduction when the trust is funded based on the present value of the assets that will pass to the charity when the trust terminates (at least 10 percent of the initial FMV). This accelerates your deduction into the year the trust is funded, while you retain the income from the assets. This method of making a charitable contribution can work very well with appreciated property.

If you volunteer time to a charity, you cannot deduct the value of your time, but you can deduct your out-of-pocket expenses. If you use your automobile in connection with performing charitable work, including driving to and from the organization, you can deduct 14 cents per mile for 2019. You must keep a record of the miles.

The allowable deduction for donating an automobile (or a boat or an airplane) is significantly reduced. The deduction for a contribution made to a charity, in which the claimed value exceeds $500, will be dependent on the charity’s use of the vehicle. If the charity sells the donated property without having significantly used the vehicle in regularly conducted activities, the taxpayer’s deduction will be limited to the amount of the proceeds from the charity’s sale. In addition, greater substantiation requirements are also imposed on property contributions. For example, a deduction will be disallowed unless the taxpayer receives written acknowledgement from the charity containing detailed information regarding the vehicle donated, as well as specific information regarding a subsequent sale of the property.

Tax reform increased the adjusted gross income limitation for cash contributions to a public charity beginning in 2018 from 50 percent of adjusted gross income to 60 percent of adjusted gross income.

Medical Expenses

In addition to medical expenses for doctors, hospitals, prescription medications, and medical insurance premiums, you may be entitled to deduct certain related out-of-pocket expenses such as transportation, lodging (but not meals), and home healthcare expenses. If you use your car for trips to the doctor during 2019, you can deduct 20 cents per mile for travel that year. Payments for programs to help you stop smoking and prescription medications to alleviate nicotine withdrawal problems are deductible medical expenses. Uncompensated costs of weight-loss programs to treat diseases diagnosed by a physician, including obesity, are also deductible medical expenses.

In 2019, the deduction is limited to the extent your medical expenses exceed 10 percent of your adjusted gross income.

Planning Suggestion: If you pay your medical expenses by credit card, the expense is deductible in the year the expense is charged, not when you pay the credit card company. It is important to remember that prepayments for medical services generally are not deductible until the year when the services are actually rendered. Because medical expenses are deductible in 2019 only to the extent they exceed 10 percent of AGI as discussed above, they should, where possible, be bunched in a year in which they would exceed this AGI limit.

Under certain conditions, if you provide more than half of an individual’s support, such as a dependent parent, you can deduct the unreimbursed medical expenses you pay for that individual to the extent all medical expenses exceed the applicable AGI limit. Even if you cannot claim that individual as your dependent because his or her 2019 gross income is $4,200 or more, you are still entitled to the medical deduction. Please consult your client service professional for details.

Long-term Care Insurance and Services

Premiums you pay on a qualified long-term care insurance policy are deductible as a medical expense. The maximum amount of your deduction is determined by your age. The following table sets forth the deductible limits for 2019:

Age Deduction Limitation

40 or less $420

41-50 $790

51-60 $1,580

61-70 $4,220

Over 70 $5,270

These limitations are per person, not per return. Thus, a married couple over 70 years old has a combined maximum deduction of $10,540, subject to the applicable AGI limit.

Generally, if your employer pays these premiums, they are not taxable income to you. However, if this benefit is provided as part of a flexible spending account or cafeteria plan arrangement, the premiums are taxable to you. The deduction for health and long-term care insurance premiums paid by a self-employed individual is covered in the chart at the end of this letter titled “Tax Tips for the Self-Employed.”

Medical payments for qualified long-term care services prescribed by a licensed healthcare professional for a chronically ill individual are also deductible as medical expenses.

Coverage for Adult Children

The Patient Protection and Affordable Care Act (ACA) provides that any health insurance plan that covers dependents must be extended to provide coverage of adult children until the day the child reaches age 26. The general exclusion from gross income also includes premiums from employer-provided health benefits to any employee’s child who has not attained age 27 as of the end of the taxable year, and is also extended under the ACA. Republican congressional leaders and President Trump attempted to repeal or curtail the ACA several times and continue to express that dialing back or eliminating the ACA remains a possibility.

Mortgage Interest and Points

Interest and points paid on a loan to purchase or improve a principal residence are generally deductible in the year paid. The mortgage loan must be secured by your principal residence. Points paid in connection with refinancing an existing mortgage are not deductible currently, but rather must be amortized over the life of the new mortgage unless the loan proceeds are used to substantially improve the residence. However, if the mortgage is refinanced again, the unamortized points on the old mortgage can be deducted in full.

Interest Paid on Qualified Education Loans

An “above-the-line” deduction (a deduction to arrive at AGI) is allowed for interest paid on qualified education loans. All student loan interest up to the $2,500 annual limit is deductible. However, in 2019 this deduction begins to phase out for single individuals with modified AGI of $70,000 and is completely phased out if AGI is $85,000 or more ($140,000to $170,000 for joint returns).

Caution: Interest paid to a relative or to an entity (such as a corporation or trust) controlled by you or a relative does not qualify for the deduction.

Non-business Bad Debts

Non-business bad debts are treated as short-term capital losses when they become totally worthless. To establish worthlessness, you must demonstrate there is no reasonable prospect of recovering the debt. This might include documenting the efforts you made to collect the debt, including correspondence to the debtor to demand payment.

Retirement Plan Contributions

If your employer (including a tax-exempt organization) has a 401(k) plan or 403(b) plan, consider making elective contributions up to the maximum amount of $19,000 ($25,000 if age 50 or over) in 2019, especially if you are unable to make contributions to an IRA. You should also consider making after-tax, nondeductible contributions to a 401(k) plan if the plan allows, as future earnings on those contributions will grow tax-deferred. A nondeductible contribution to a Roth IRA can also be considered.

Planning Suggestion: If you are a participant in an employer’s qualified plan that allows employee contributions such as a 401(k) plan and are at least 50 years old, you can elect to make a deductible “catch-up” contribution of $6,000 to the plan (for a $25,000 maximum contribution). To make a “catchup” contribution, your employer’s plan must allow such contributions.

IRA Deductions

The total allowable annual deduction for IRAs in 2019 is $6,000, subject to certain AGI limitations if you are an “active participant” in a qualified retirement plan. A non-working spouse may also make an IRA contribution based upon the earned income of his or her spouse. A catch-up provision for individuals age 50 or older applies, increasing the deductible limit by $1,000 for IRAs, to a total deductible amount of $7,000.

Planning Suggestion: Consider making your full IRA contribution early in the year so that income earned on the contribution can accumulate tax-free for the entire year.

Planning Suggestion: If cash flow is a concern, consider using credit cards to make tax deductible year-end payments. Note, however, interest paid to a credit card company is not deductible because it is personal interest.

Caution: If you choose to accelerate income into 2019 or defer deductions to 2020, make sure your estimated tax payments and withheld taxes are sufficient to avoid 2019 estimated tax penalties.

Deferred Compensation

Section 409A restricts the timing of distributions from and contributions to deferred compensation plans requiring most individuals to:

- Make an election to defer compensation in the calendar year prior to the year in which the services related to the compensation are performed.

- Limit the timing of distributions based on one (or more) of six prescribed times or events as follows:

- separation from service

- disability

- death

- a specified time (or pursuant to a fixed schedule)

- change in ownership of the company

- an unforeseeable emergency

Plans that may be affected by these rules include salary deferral plans, incentive bonus plans, severance plans, discounted stock options, stock appreciation rights, phantom stock plans, restricted stock unit plans, and salary continuation agreements included in employment contracts.

A violation of these rules requires not only a payment of normal income taxes on all amounts deferred up to the time of the violation (or vesting if later), but payment of an additional 20 percent tax as well. This punitive tax makes it challenging to accelerate properly deferred compensation into a current taxable year. However, if you wish to delay income taxes on compensation that you will earn in 2020 to a later taxable year, the agreement to defer generally must be executed before December 31, 2019.

Additionally, under Section 457A, certain taxpayers who have previously deferred compensation may be required to include deferred amounts in their income by December 31, 2019, if not previously included, if a substantial risk of forfeiture no longer exists.

Capital Gains and Losses

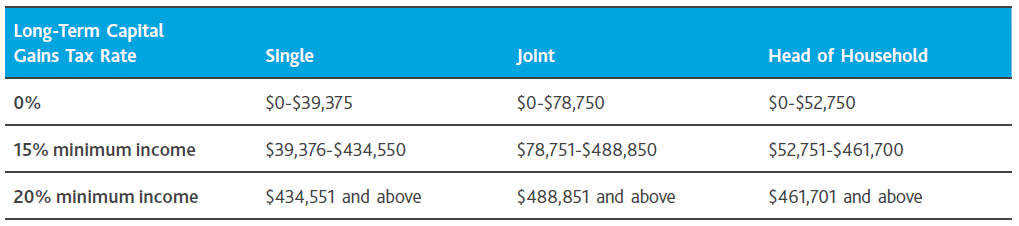

The brackets for long-term capital gains for 2019 are shown below. Long-term capital gains have a lower tax rate, so investors may consider holding on to assets for over a year to qualify for those taxable rates.

Note: Capital gains may also be subject to the 3.8 percent net investment income tax.

Caution: The tax law contains rules to prevent converting ordinary income into long-term capital gains. For instance, net long-term capital gains on investment property are excluded in computing the amount of investment interest expense that can be deducted unless the taxpayer elects to subject those gains to ordinary income tax rates. Additionally, if long-term real property is sold at a gain, the portion of the gain represented by prior depreciation is taxed at a maximum 25 percent rate. Capital losses are offset against capital gains. For joint filers, net capital losses of up to $3,000 ($1,500 for married taxpayers filing separate returns) can be deducted against ordinary income. Unused capital losses may be carried forward indefinitely and offset against capital gains and up to $3,000 ($1,500 for married taxpayers filing separate returns) of ordinary income annually, in future years.

Planning Suggestion: Add up all capital gains and losses you have realized so far this year, plus anticipated year-end capital gain distributions from mutual funds (this amount should be presently available by calling your mutual fund’s customer service number). Then review the unrealized gains and losses in your portfolio. Consider selling additional securities to generate gains or losses to maximize tax benefits.

Caution: Do not sell a security simply to generate a gain or loss to offset other realized gains or losses. The investment merits of selling any security must also be considered.

Note: Capital gains and losses on publicly-traded securities are recognized on the trade date, not the settlement date. For instance, gains and losses on trades executed on December 31, 2019, are taken into account in computing your 2019 taxable income.

If a security is sold at a loss and substantially the same security is acquired within 30 days before or after the sale, the loss is considered a “wash sale” and is not currently deductible. However, this nondeductible loss is added to the cost of the purchased security that caused the “wash sale.” This basis adjustment will reduce gain, or increase loss, later when that security is sold.

Although present tax law significantly limits a taxpayer’s ability to lock in capital gains without realizing the gains for tax purposes, there are still methods by which this can be accomplished. Please consult your client service professional for further guidance.

Qualified Small Business Stock

A non-corporate taxpayer can exclude specified percentages (50 percent, 75 percent or 100 percent depending on date of issuance) of any gain realized from the sale of “qualified small business stock” (QSBS). QSBS applies only to a sale or exchange of stock in a C corporation and it is not available to exclude gain on the sale or disposition of S corporation stock or partnership interest. To be eligible, the stock must be issued after August 10, 1993, and must have been held for more than five years. The gain eligible for this exclusion cannot exceed the greater of (i) ten times the taxpayer’s basis in the stock disposed of during the year or (ii) $10 million less the taxpayer’s aggregate prior-year gains from the sale of the same corporation’s stock. The includible portion of the gain is subject to a maximum tax rate of 28 percent, and a portion of the excluded gain is included as a tax preference in determining the taxpayer’s liability (if any) for the AMT.

However, the 100 percent exclusion is available only for qualified stock issued after September 27, 2010. If a 100 percent exclusion is available, no portion of the gain is subject to the AMT.

A non-corporate taxpayer may also elect to rollover the entire gain from the sale of “qualified small business stock” held for more than six months if, within the 60-day period beginning on the date of sale, the taxpayer purchases QSBS having a cost at least equal to the amount realized from the sale. Your client service professional can be consulted for more information.

Dividend Income

Qualified dividend income from domestic corporations and qualified foreign corporations is taxed at the same reduced rates as long-term capital gains for regular tax and AMT purposes.

Planning Suggestion: For taxpayers who are owners of closely-held corporations or a corporation that was converted to an S corporation, there may be some planning opportunities available. Your client service professional can be consulted for further guidance.

Sale of Principal Residence

For sales of a principal residence, up to $500,000 of gain on a joint return ($250,000 on a single or separate return) can be excluded. To be eligible for the exclusion, the residence must have been owned and occupied as your principal residence for at least two of the five years preceding the sale. The exclusion is available each time a principal residence is sold, but only once every two years. Special rules apply in the case of sales of a principal residence after a divorce and sales due to certain unforeseen circumstances. If a taxpayer satisfies only a portion of the two-year ownership and use requirement, the exclusion amount is reduced on a pro-rata basis.

Example: A husband and wife file a joint return. They own and use a principal residence for 15 months and then move because of a job transfer. They can exclude up to $312,500 of gain on the sale of the residence (5/8 of the $500,000 exclusion).

A portion of the gain attributable to a period when the residence is not used as a principal residence will not be eligible for the exclusion.

Planning Suggestion: If you want to sell your principal residence but are unable to do so because of unfavorable market conditions, you can rent it for up to three years after the date you move out and still qualify for the exclusion. However, any gain attributable to prior depreciation claimed during the rental period will be taxed at a maximum 25 percent rate.

If you own appreciated rental property that you wish to sell in the future, you should consider moving into the property to convert it to your principal residence. You will need to live in the property for at least two of the five years preceding the sale of the property. As long as you haven’t sold another principal residence for the two years prior to the sale, a portion of the gain is excluded. Any gain attributable to prior depreciation claimed will be taxed at a maximum 25 percent rate.

The sale of a principal residence does not qualify for the exclusion if during the five-year period prior to the sale, the property was acquired in a tax-free like-kind exchange.

Installment Sales of Depreciable Property by Non-Dealers

A sale of depreciable personal property at a gain generates ordinary income to the extent of any depreciation recapture. This ordinary income is fully taxable in the year of sale even if no sales proceeds are received in that year.

Example: Taxpayer T, in the 37 percent bracket (assuming there is no Section 199A deduction available), sells machinery in 2019 for a $1 million note payable in 2020. T’s gain is $900,000 ($1 million less $100,000 basis). $800,000 of this gain is due to depreciation recapture. T must report gain as follows:

2019 ordinary gain: $800,000

2020 Section 1231/capital gain: $100,000

Total gain: $900,000

Taxpayer T must pay tax of $296,000 (37 percent of $800,000) for 2019, even though the note proceeds will not be received until 2020.

Planning Suggestion: If possible, an installment seller of depreciable personal property should structure the transaction to receive enough cash by the due date of the tax return to meet the first year’s tax on the installment sale. In the above example, T should negotiate to receive an installment payment of at least $296,000 by April 15, 2019. Please consult your client service professional for further guidance.

Moving Expenses

Before 2018, individuals could deduct qualified moving expenses paid or incurred in connection with

starting work in a new location if specific distance and length of service requirements were met that were not reimbursed by an employer. For taxable years 2018 through 2025, tax reform generally eliminates employees’ deductions on their personal income tax returns for unreimbursed moving expenses. Moreover, during this period, employers are required to report any moving expenses they pay to moving vendors or to employees as taxable wages to the employee. Thus, moving expense reimbursements are no longer tax-free to employees, even though employers can still deduct such reimbursements as ordinary and necessary business expenses. An exception applies to military members on active duty who move pursuant to a military order related to a permanent change of station that continues to allow tax-free moving expenses.

Interest Expense

Personal Interest

Interest is not deductible on tax deficiencies, car loans, personal credit card balances, student loans (except for taxpayers eligible for the above-the-line deduction for interest paid on qualified education loans), or other personal debts.

Home Mortgage Interest

A full regular tax deduction is allowed for interest on home acquisition debt used to acquire, construct, or improve a principal or secondary residence to the extent this debt does not exceed $750,000 for joint filers ($375,000 for single filers or married taxpayers filing separate returns). Home acquisition debt incurred on or before December 15, 2017, is grandfathered under the previous $1,000,000 limitation for joint filers ($500,000 for single filers or married taxpayers filing separate returns).

Caution: These debts must be secured by the principal or secondary residence such that your home is at risk if the loan is not repaid.

A residence includes a house, condominium, mobile home, house trailer, or boat containing sleeping space, commode, and cooking facilities. If you own more than two residences, you can annually elect which one will be your secondary residence.

Investment Interest Expense

If you want to add to your investment portfolio through borrowing, consider borrowing from your stockbroker through a margin loan. The interest paid is investment interest expense and will be deductible to the extent of your net investment income (dividends, interest, etc.). Investment interest expense in excess of investment income may be carried forward indefinitely.

Planning Suggestion: Net long-term capital gain (long-term gains over short-term losses) and any qualified dividend income are not included as investment income for purposes of determining how much investment interest expense is deductible, unless you elect to subject the capital gain and dividend income to ordinary income rates.

You should consider switching your investments to those types of investments generating taxable investment income to absorb any excess investment interest expense.

Interest expense, to the extent that it is related to tax-exempt income, is not deductible. Interest expense relating to a passive activity, such as a limited partnership investment, is subject to the passive loss limitations on deductibility.

Allocation Rules

Interest payments are generally allocated among the various categories –personal interest, home mortgage interest, investment interest, etc.) based on the ultimate use of the loan proceeds.

Example: An individual borrows $25,000 on margin and uses the proceeds to purchase an automobile for personal use. The interest expense is treated as personal interest.

The IRS has issued complex regulations for determining how these allocations are made, which may require maintaining separate bank accounts or other records. Your client service professional can help you maximize tax deductions for your interest payments.

Foreign Earned Income Exclusion and Housing Allowance

United States citizens must calculate their foreign earned income exclusion and housing allowance each year. The base housing amount used in calculating the foreign housing cost exclusion is 16 percent of the amount of the foreign earned income exclusion limitation. Reasonable foreign housing expenses in excess of the base housing amount remain excluded from gross income, but the amount of the exclusion is limited to 30 percent of the taxpayer’s foreign earned income exclusion. Income excluded as either foreign earned income or as a housing allowance is included for purposes of determining the marginal tax rates applicable to non-excluded income.

The foreign earned income exclusion for 2018 was $103,900. The IRS has announced that the foreign earned income exclusion for 2019 will be $105,900.

State and Local Deduction

In 2017, tax reform introduced the state and local deduction cap, which places a limitation on the deductibility of state and local property and income taxes from federal taxable income of $10,000, starting with taxable years beginning in 2018 and before 2026. While the limitation impacts all individual taxpayers, it will especially impact taxpayers who will file returns in states with high income and property taxes, including New York, New Jersey, Connecticut, California, Maryland, and Oregon, and on married couples (regardless of whether they file jointly or separately). The cap limits taxpayers’ state and local tax (SALT) deductions to $10,000 per return, and married taxpayers who file separately can only deduct up to $5,000 each, for itemized deductions. The cap does not apply to deductions resulting from a trade or business.

Passive Activities, Rental and Vacation Homes

Losses from passive activities (which, as discussed below, generally include the rental of real estate) are deductible only against passive income. Passive losses cannot be used to reduce non-passive income, such as compensation, dividends, or interest. Similarly, credits from passive activities can be used only to offset the regular tax liability allocable to passive activities. Unused passive losses are carried over to future years and can be used to offset future passive income. Any remaining loss is deductible when the activity, which gave rise to the passive loss, is disposed of in a transaction in which gain or loss is recognized.

A passive activity is one in which the taxpayer does not materially participate. Material participation is involvement in operations on a regular, continuous, and substantial basis. You are considered to materially participate in an activity if, for example:

- You participate in the activity for more than 500 hours in the taxable year.

- Your participation for the taxable year was substantially all of the participation in the activity.

- You participated for more than 100 hours during the taxable year, and you participated at least as much as any other individual for that year.

In determining material participation, a spouse’s participation can be taken into account. Limited partners are conclusively presumed not to materially participate in the partnership’s activity. Rental activities are generally considered passive. However, there are two significant exceptions to this rule.

A working interest in an oil or gas property is not treated as a passive activity, regardless of whether the owner materially participates, unless liability is limited (such as in the case of a limited partner or S corporation shareholder).

Planning Suggestion: Avoid investments producing passive losses unless there is an overriding economic reason to make the investment. If you already have such investments, consider acquiring an investment that generates passive income. If you own a corporation other than an S corporation or personal service corporation, consider transferring investments that generate passive losses to the corporation. The corporation can deduct passive losses against its active business income, but not against its dividends, interest, or other portfolio income.

Additionally, some partnerships receive a special tax treatment under the current law that allow the income/expenses of the investment to be treated by a taxpayer as neither passive income nor portfolio income, meaning that the taxpayer may be able to offset ordinary income with any nonpassive losses. If the partnership receives this special treatment, it will be disclosed as a footnote in the investment. Please consult your tax advisor regarding your entity’s classification.

Rental Real Estate

For real estate professionals, rental real estate activities are not subject to the passive loss rules if, during a taxable year:

- More than 50 percent of the taxpayer’s personal services are performed in real property businesses, and

- More than 750 hours are spent in real property businesses. For both of these tests, the taxpayer must materially participate in the real property businesses. If a joint return is filed, these two tests must be satisfied by the same spouse.

Services performed as an employee are ignored unless the employee owns more than 5 percent of the employer.

A closely-held C corporation that is generally subject to the passive loss rules will satisfy these tests if more than 50 percent of its gross receipts are derived from real property businesses in which the corporation materially participates. Real property businesses are those involving real property development, redevelopment, construction, reconstruction, acquisition, conversion, rental, operation, management, leasing, or brokerage.

For non-real estate professionals, another exception to the passive loss limitations exists for rental real estate activities in which the taxpayer “actively” participates. This requires the taxpayer to own at least a 10 percent interest in the activity. If the taxpayer actively participates in the activity, the taxpayer can offset up to $25,000 of losses and credits from the activity against non-passive income, subject to an AGI phaseout.

Active participation does not require regular, continuous, and substantial involvement in operations as long as the taxpayer participates in a significant and bona fide way by, for example:

- Arranging for others to provide services such as cleaning; or

- Making management decisions, which include approving new tenants, deciding rental terms, and approving repairs and capital expenditures.

The $25,000 allowance begins to phase out when the taxpayer’s AGI exceeds $100,000 and is completely eliminated when AGI reaches $150,000. In that event, the regular passive loss rules determine the amount of any deductible loss. The $25,000 allowance and AGI thresholds are cut in half for a married taxpayer who files separately and does not live with his or her spouse. However, there is no $25,000 allowance if a married individual files separately and lives with his or her spouse at any time during the taxable year.

Planning Suggestion: If your AGI is approaching $100,000, consider recognizing income to 2020 to obtain a full $25,000 rental real estate loss for 2019.

If you think you may be affected by the passive loss rules, you should speak with your client service professional. In certain cases, and with proper planning, the adverse effect of these rules may be minimized.

Vacation Homes

Expenses of a rental property are deductible, even if they exceed gross rents and produce a loss. However, the current deduction of such a loss may be restricted due to the passive activity rules discussed above. A vacation home is treated as rental property if personal use during the year does not exceed the greater of:

- 14 days, or

- 10 percent of the number of days the home is rented at a fair rental value.

If personal use exceeds these limits, the property is considered to be a residence. In that event, the deductibility of expenses is limited.

Planning Suggestion: If you rent your home for less than 15 days during the year, the total rental income you receive is not subject to income tax.

Disposition of Leasehold Improvements

When a lessor disposes of leasehold improvements upon termination of a lease, the lessor can generally write off the adjusted basis of those improvements.

Planning Suggestion: If you have leases terminating early in 2020 where there is substantial remaining basis in the leasehold improvements, it may make sense to provide the lessees with an incentive to leave before the end of 2019 so that you can write off the remaining basis in the applicable leasehold improvements.

Excess Business Loss Limitation

Under Section 461(l), a taxpayer will only be able to deduct net business losses of up to $250,000 ($500,000 in the case of a joint return) for taxable years beginning after December 31, 2017, and before January 1, 2026. Excess business losses are disallowed and added to the taxpayer’s NOL carryforward.

Additionally, non-corporate NOL rules now limit deductible NOL carryforwards to the lesser of the carryforward amount or 80 percent of taxable income. Taxpayers are no longer permitted to carry back their NOLs to the previous two taxable years, but they may carry forward their NOLs indefinitely.

Section 199A

Tax reform lowered the corporate tax rate to a flat rate of 21 percent. In turn, under the new law (under Section 199A), for taxable years beginning after December 31, 2017, taxpayers other than C corporations with taxable income (before computing the QBI Deduction) at or below the threshold amount, are entitled to a deduction equal to the lesser of:

- The combined QBI amount of the taxpayer, or

- An amount equal to 20 percent of the excess, if any, of the taxable income of the taxpayer for the taxable year over the net capital gain of the taxpayer for such taxable year.

The combined QBI amount is generally equal to the sum of (A) 20 percent of the taxpayer’s QBI with respect to each qualified trade or business plus (B) 20 percent of the aggregate amount of the qualified REIT dividends and qualified publicly traded partnership (PTP) income of the taxpayer for the taxable year. The Section 199A deduction may reduce a pass-through owner’s maximum individual effective tax rate from 37 percent to 29.6 percent. It is critical to begin evaluating the extent the pass-through owner will be eligible for this deduction. For further information regarding the Section 199A deduction, please see our 2019 Year-End Tax Planning for Businesses.

An additional limitation applies to taxpayers with taxable income (calculated before the QBI Deduction) in excess of the threshold amount. For these taxpayers, their QBI Deduction is subject to a limitation based on the amount of (a) W-2 wages or (b) W-2 wages and the unadjusted basis immediately after acquisition of qualified property attributable to the QBI generated from each qualified trade or business.

Alternative Minimum Tax

A taxpayer must pay either the regular income tax or the AMT, whichever is higher. The AMT tax system is parallel to the regular tax, but it treats some items of income and deduction differently.

The established exemption amounts for 2019 are $71,700 for unmarried individuals and individuals claiming the head of household status, $111,700 for married individuals filing jointly and surviving spouses, and $55,850 for married individuals filing separately. With the introduction of the SALT deduction cap and end of miscellaneous itemized deductions for 2018 through 2025, the likelihood that an individual taxpayer will be subject to AMT is low compared to that of pre-2017 tax reform filing years.

With increased AMT exemptions for individuals, such taxpayers are likely to use more of the R&D credits passing through to them from their businesses.

The exemption for estates and trusts was increased to $25,000.

AMT paid on “timing” preferences and adjustments (such as accelerated depreciation) for prior years is allowed as a credit against a later year’s regular income tax to the extent it exceeds the later year’s tentative minimum tax. Therefore, this AMT credit cannot reduce the regular income tax below the AMT for that later year.

Example: T’s 2019 AMT attributable to timing preferences was $80,000. T’s 2020 regular tax is $100,000, and T’s tentative minimum tax is $70,000. T may reduce the regular tax by $30,000. Generally, T’s remaining AMT credit of $50,000 ($80,000 less $30,000) may be carried forward indefinitely. No carryback is permitted.

A full discussion of the AMT is beyond the scope of this letter. AMT considerations are exceedingly complex and require careful planning. Please consult your client service professional prior to year-end to discuss how the AMT might affect you.

Stock Options

Incentive Stock Options

An incentive stock option (ISO) is an option issued to an employee that allows all increases in value to be subject to long-term capital gain treatment if the taxpayer disposes of the option shares more than two years after the date the option is granted and more than one year after the date the option shares are purchased. Former employees can exercise an ISO within three months after termination of employment (or within one year after termination due to disability). If these rules are not met, a portion of the gains from ISOs are treated as ordinary income.

However, there is a hidden cost to obtaining long-term capital gain treatment from an ISO. The “spread” (the difference between the fair market value of the shares on the exercise date and the option price paid for the shares) must be added into the taxpayer’s AMT calculation for the year the options are exercised. Any AMT attributable to the ISO spread generally is allowed as an AMT credit carryforward to offset regular taxes owed in future years. Thus, any AMT attributable to the ISO is effectively a prepayment of tax, not additional tax.

Planning Suggestion: If you are planning to exercise ISOs before December 31, 2019, that trigger AMT, consider deferring the exercise until early in 2020. Any AMT on such exercise would likely not be due until April 15, 2021, after the required one-year holding period for the stock has been met. At that time the option shares can be sold at long-term capital gains rates, with a portion of the proceeds used to pay the 2020 AMT liability.

Additional Planning: Consider a plan to exercise options each year up to the level that generates AMT. Tax reform increased the amount of preference items you can have before owing AMT tax.

If you have exercised an ISO in 2019 and the value of the stock has decreased, consider a sale before the end of 2019. This action should reduce the AMT effect. The sale must be made to a non-family member (or to an entity not considered to be related to the taxpayer under applicable rules) and the stock cannot be repurchased (even through an exercise of a different option or new compensatory award) for at least 30 days.

Nonqualified Stock Options

When a taxpayer exercises a non-qualified stock option (NQSO) that does not have a readily ascertainable fair market value at the time of issuance (generally the case where the option or the option stock is not publicly traded), the spread (the difference between the stock’s fair market value and option price) is taxed as compensation income. When the taxpayer sells the NQSO stock, any subsequent appreciation is taxed as long- or short-term capital gain, depending upon the stock’s holding period. The spread is taxed as ordinary income.

Planning Suggestion: If a taxpayer expects to be subject to AMT for 2019 and no AMT credit carryforward is expected, the taxpayer should consider increased ordinary taxable income to at least the AMT level by exercising NQSOs. The accelerated ordinary income from the NQSO is effectively taxed at the AMT marginal rate as opposed to the ordinary income rate. In addition, all future appreciation is capital gain. When making this decision, the potential tax savings should be compared with the opportunity cost of accelerating the income, taking into account the time value of money.

Nanny Tax Reporting

During 2019, if you paid $2,100 or more to a person 18 or over for household services, you are required to report his or her social security and federal unemployment taxes on your personal tax return. These amounts are reported on Schedule H.

These employment taxes must be paid by the due date of the return, April 15, 2020, without extensions. Inasmuch as these taxes are part of your tax liability, your estimated taxes or withholding must be sufficient to cover them.

Planning Suggestion: As the $2,100 amount applies to each household employee, if possible, try to keep payments to each person below $2,100 per year. In 2019, you can also give your household employee up to $265 per month for expenses to commute by public transportation without this amount counting toward the $2,100 threshold or being included in the employee’s gross income.

Caution: Payments to household employees may also be subject to state unemployment and other state taxes.

Estate and Gift Taxes

Tax reform increased the applicable estate and gift exemption for individual taxpayers and doubled the generation-skipping transfer tax exemption amounts for taxable years beginning after December 31, 2017, and before January 1, 2026. These amounts will be adjusted for inflation each year. Further, inflation will be measured using the Chained-Consumer Price Index, a lower rate of inflation. The Chained-Consumer Price Index is estimated once in February and is finalized the following February. For 2019, the gift exemption and generation-skipping transfer tax exemption increased to $11,400,000 ($22,800,000 for married couples).

Planning Suggestion: Affluent families should consider developing a lifetime gifting strategy to use some or all of their increased exemptions prior to December 31, 2025. The spousal limited access trust is an oft-used, time tested strategy that can help such taxpayers to do so.

Estimated Taxes

Generally, all individuals must make quarterly estimated tax payments if they have income that is not subject to withholding. This includes individuals who are self-employed or retired or who have investment income, such as interest, dividends, and capital gains. It also includes partners and S corporation shareholders.

The law provides several safe harbors for determining the minimum estimated tax that must be paid to avoid penalties. In 2019, the prior-year safe harbor percentage was 100 percent of the 2018 tax for individuals with 2018 AGI under $150,000 ($75,000 for married filing separately), but increased to 110 percent of the 2018 tax liability for individuals with 2018 AGI over those amounts. Where an individual expects 2020 income to be lower than 2019 income, the individual can similarly avoid underpayment of estimated tax penalties by paying estimated taxes for 2020 in an amount equal to at least 90 percent of projected 2020 tax liability.

Planning Suggestion: Deferring a large gain from December 2019 to January 2020 may postpone all or a portion of the federal tax payment on that gain to April 15, 2021. While the gain deferral may postpone the timing of tax payment, the tax rates for 2019 should also be considered when making such decisions. Unless you are subject to AMT or the SALT deduction cap, it may be beneficial to pay estimated state income taxes on a 2019 gain prior to the end of 2019 to obtain an itemized deduction on your federal 2019 return.

Two other safe harbor exceptions are available to eliminate penalties for insufficient payments of estimated taxes. No penalty will be imposed for underpayment of estimated taxes if the unpaid tax liability for the year (after taking into account any withholding) is less than $1,000. In addition, if your income varies throughout the year, you may use an annualized installment method to reduce or eliminate potential penalties.

The same rules apply to certain estates and trusts.

Planning Suggestion: If you have underpaid an installment of 2019 estimated taxes, increasing a later installment will not completely eliminate the underpayment penalty. However, increased withholding on year-end salary or bonus payments may be used to make up the underpayment. That is because withholding on compensation is deemed paid evenly over all quarters of the year.

Note: Voluntary withholding of income taxes from social security payments and certain other federal payments is permitted. This withholding may eliminate the need to file quarterly estimated payments for certain retired persons.

Year-end and Other Gifts; Portability

The end of the year is the traditional time for making gifts. For 2019, you may give up to $15,000 to a person without incurring any federal gift tax liability. The $15,000 annual limit applies to each donee. Thus, you may make $15,000 gifts to as many people as you like. If you are married, you and your spouse can give a combined $30,000 to each donee, if your spouse consents to splitting the gift or if you give community property. To qualify for this annual exclusion, the property must be given outright to the donee or put into a trust that meets certain conditions.

In addition to the annual exclusion, the lifetime exemption (made available in the form of a credit against tax based on an exemption-equivalent amount) allows each person to transfer $11,400,000 for 2019 by gift without incurring any gift tax liability (reduced by the amount of any lifetime exemption that may have been used in a prior year). Using this credit now will keep future appreciation on the transferred property out of your estate. However, using the lifetime credit against 2019 gifts reduces the credit available for future years.

A widow or widower may have an increased lifetime exemption if the deceased spouse died after 2010 with an unused exemption amount and an estate tax return was filed. Please note that an estate tax return must be filed on a timely basis for the surviving spouse to obtain the increased exemption. This is true even if an estate tax return was otherwise not required to be filed because the value of the gross estate was less than the threshold required for filing an estate tax return. A full discussion of the portability of the lifetime exemption between spouses is beyond the scope of this letter. Please consult with your client service professional for a more complete explanation of the portability rules.

In addition to gifts subject to the annual exclusion and the lifetime credit, direct payments of tuition made on another person’s behalf to a university or other qualified educational organization are also excluded from gift tax, as are direct payments of medical expenses to a medical care provider.

Planning Suggestion: You should consider using appreciated property in making gifts. If the recipients are in lower income tax brackets than you, income from the transferred property, including any gain on sale, will be taxed at lower rates.

Additional Suggestion: It is generally unwise to give property that has declined in value. Rather, you should consider selling the property and realize the tax benefits of the loss.

All outright gifts to a spouse (who is a United States citizen) are free of federal gift tax. However, for 2019, only the first $155,000 of gifts to a non-United States citizen spouse are excluded from the total amount of taxable gifts for the year. You should coordinate your year-end gift-giving with your overall estate planning. Your client service professional can assist you with these matters.

Opportunity Zone Program

The opportunity zone program was created under tax reform to promote investment in economically distressed communities. There are now over 8,700 certified QOZs in all 50 states, the District of Columbia, Puerto Rico and the Virgin Islands. Investors must invest in a qualified opportunity fund (QOF) within 180 days after the sale or exchange of a capital asset. If the capital gain is received through a Schedule K-1 and the pass-through entity has not elected to defer the gain, then the 180-day period with respect to the taxpayer’s eligible gain begins on the last day of the pass-through’s taxable year. The QOF is an investment vehicle that must hold at least 90 percent of its assets in qualified opportunity zone property, which includes qualified opportunity zone stock, qualified opportunity zone partnership interest, or qualified opportunity zone business property. Investment of capital gains in a QOF can result in beneficial tax incentives, including the following:

- Deferral of tax due on the capital gains invested in the QOF until December 31, 2026.

- Basis step-up of 10 percent on the capital gains invested if the investment is held for five years and 15 percent if the investment is held for seven years.

- Permanent exclusion from taxable income post-acquisition capital gains on investments in QOFs that are held at least 10 years.

Since 2017, Treasury and the IRS have issued two rounds of opportunity zone proposed regulations, first in October of 2018 and then in April of 2019. The October 2018 guidance focuses on provisions relating to real estate. The April 2019 proposed regulations provide guidance on the statutory requirements for qualified opportunity zone businesses. Final regulations are expected to be released in the fall of 2019 and will likely provide additional guidance.

Planning Suggestion: Taxpayers with recognized capital gain should consider making an investment in a QOF to obtain significant tax savings. As the end of 2019 quickly approaches, so does the deadline to obtain all of the tax benefits available in the Opportunity Zone program. Your client service professional can be consulted for further information and assistance.

Conclusion

Like an annual physical examination is important for maintaining good health, an annual financial examination that includes year-end tax planning can enhance your financial well-being. Your client service professional is available to help you achieve your tax and financial objectives.

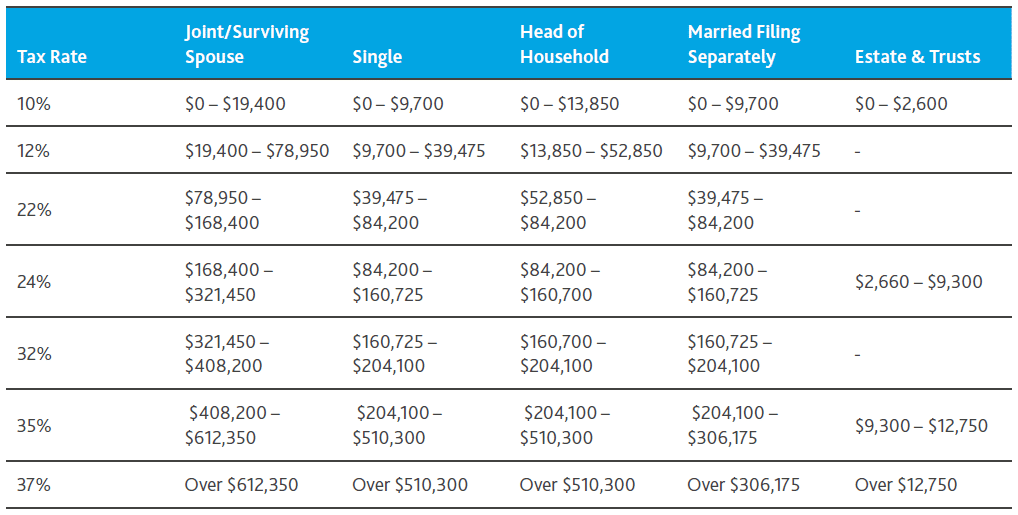

2019 Federal Income Tax Rates

Tax Tips for the Self-Employed

- Establish a Simplified Employee Pension (SEP) Plan by the due date of your 2019 return, including extensions. The contribution to the plan must be made by that due date. For 2019, the maximum allowable contribution to a SEP an employee can make independently of an employer is $6,000 ($7,000 if a catch-up contribution is included). However, the maximum combined deduction for an active participant’s elective deferrals and other SEP contributions is $56,000 for 2019.

- Alternatively, establish a Keogh Plan in 2019, before December 31. The full contribution to the plan need not be made until the due date of your 2019 federal income tax return, including extensions.

- Consider placing business assets in service in 2019. If qualified, Section 179 expense allows you to deduct the full cost of

- depreciable assets in the taxable year they are placed in service subject to an expense level of $1,020,000 and the phaseout threshold amount commences at $2,550,000 for 2019.

- For taxable year 2019, a taxpayer can deduct startup expenditures up to $5,000 with the phaseout threshold at $50,000.

- A self-employed individual generally may deduct the employer-equivalent portion of his or her self-employment tax in figuring adjusted gross income. This deduction only affects the taxpayer’s income tax. It does not affect net earnings from self-employment or self-employment tax.

- 100 percent of medical and long-term care insurance premiums, subject to the limitations on long term insurance premiums paid by a self-employed person, are deductible from gross income to arrive at AGI.

- Effective for payments made on or after March 30, 2010, the Affordable Care Act allows the self-employed health insurance deduction to include premiums paid to cover an adult child who has not attained the age of 27 before the end of the taxpayer’s taxable year.

* See our 2019 Year-End Tax Planning Considerations for Businesses Including Year-End Ideas for further information.

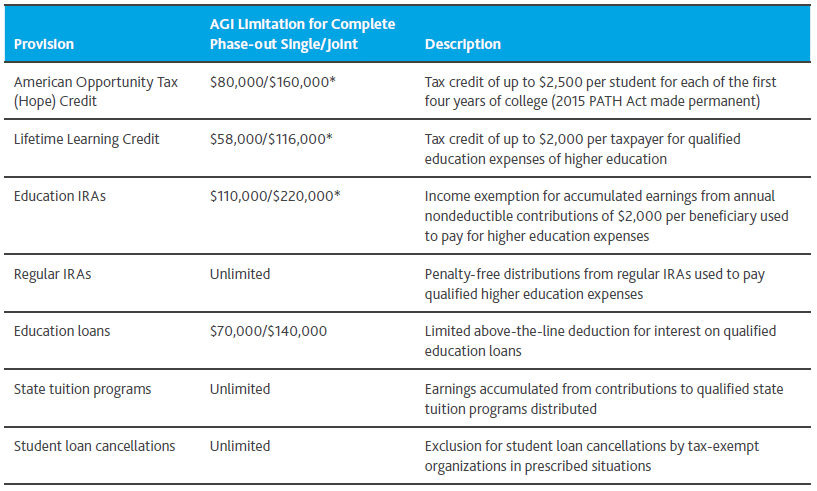

Tax Provisions Relating to Higher Education Costs/2019

The American Taxpayer Relief Act of 2012 extended the effective date of some of certain provisions in the federal tax law that were made to help moderate-income individuals and families save and pay for higher education costs. The Protecting Americans from Tax Hikes Act of 2015 again extended or made permanent some of these provisions. These provisions are as follows:

State tuition programs, also known as 529 plans, are popular education funding plans because there are no income level limits to funding such plans. There is no federal deduction for funding such plans, but the income within the funds grows income tax-free. Some states do permit an income tax deduction for state income tax purposes. Although the funding of such plans is a taxable gift by the donor, the annual exclusion is available. Furthermore, an election can be made on a gift tax return to fund the 529 plan upfront with an amount equal to five times the annual exclusion amount and have such lump-sum gift attributed over a five-year period. Since the 2019 annual exclusion is $15,000, a taxpayer could fund up to $75,000 into a 529 plan and have no taxable gifts with the proper election.

*Limitation is on MAGI