It took less than three months of accelerated vaccinations to elevate the supply chain disruptions from potentially problematic to problematic. As the spring ended, shortages of key materials and inputs were causing a slowdown in many industries, some of which were driving economic recovery. Against the backdrop of the highest growth in gross domestic product (GDP) in 70 years, it has become clear that demand could be fueling even higher growth if supply were not constrained.

None of the supply chain disruptions are particularly surprising. In certain sectors – residential construction and steel manufacturing, for example – the imbalance between the supply and demand have been pushing prices higher and lead times longer since before the approvals of vaccines in late 2020. For other sectors, like automotive, overlooked disruptions in small but critical components – semiconductors for the automotive industry – have shut down expansion as sales were growing. In the service industries, pent-up demand is running headlong into a shortage of skilled workers. The net effect of this global supply problem is that some major sectors of the economy will experience a delayed recovery. On the plus side, businesses are responding to supply bottlenecks by boosting investment in equipment and intellectual property.

The supply problem is most obvious in the manufacturing sector. The Institute for Supply Management manufacturing index jumped half a point in May to 61.2, after slowing to 60.7 in April. Within the sub-component indexes, however, the production index reflected the supplier disruption, falling four points from April and nearly 10 points from March. New orders increased, pushing the backlog index to 70.6 percent. Backlogs have hit all-time highs for three consecutive months.

Depending on how quickly the supply chain can recover, the late winter/early spring decline in manufacturing may prove to be a short-lived bump in the road. If semiconductors, for example, can recover to meet demand in the third quarter, auto manufacturing can escalate. Summer shutdowns can be deferred to increase production, which will also boost the disposable incomes of workers in an industry that makes up 7.5 percent of all industrial output. Even if supply can escalate, however, rapid increase in workforce participation will be needed to beat the clock in 2021. The more likely scenario is that some significant share of recovery-driven demand for services and goods will be pushed into 2022.

That scenario is not all bad for a forward-looking industry like construction. Project owners will have a longer runway to when full occupancy is required for offices, hospitality, and retail properties. Pent-up demand for construction will drive volume further into 2022 than if supply capacity utilization was much lower today. The other side of that forecast is that construction volume in 2021 will be lower than it might otherwise be.

Residential construction is already seeing the impact on volume. The May 18 report on housing construction saw a 9.5 percent decline in starts in April as builders felt the impact of record price increases in lumber and shortages of many materials and equipment. Single-family home starts fell by 13.4 percent, with permits for new single-family homes off 3.8 percent to 1.15 million units. The June 17 report on May’s starts revised the April starts lower by 52,000 units and showed a smaller-than-expected increase in May of 3.6 percent to 1.572 million units.

Some of the pullback in construction volume will doubtless be caused by the inflation in prices for many construction materials. The heightened inflation is another product of the disrupted supply chain, which is inadequate to meet the burst of new demand that followed the rapid re-opening of the economy in spring. The headline increases in consumer and producer prices were exaggerate by the comparison to spring of 2020, when economic demand was suppressed by COVID-19 mitigation; however, the increases in basic materials like steel, lumber, copper, asphalt, and fuel have been significant in comparison to January 2020 also.

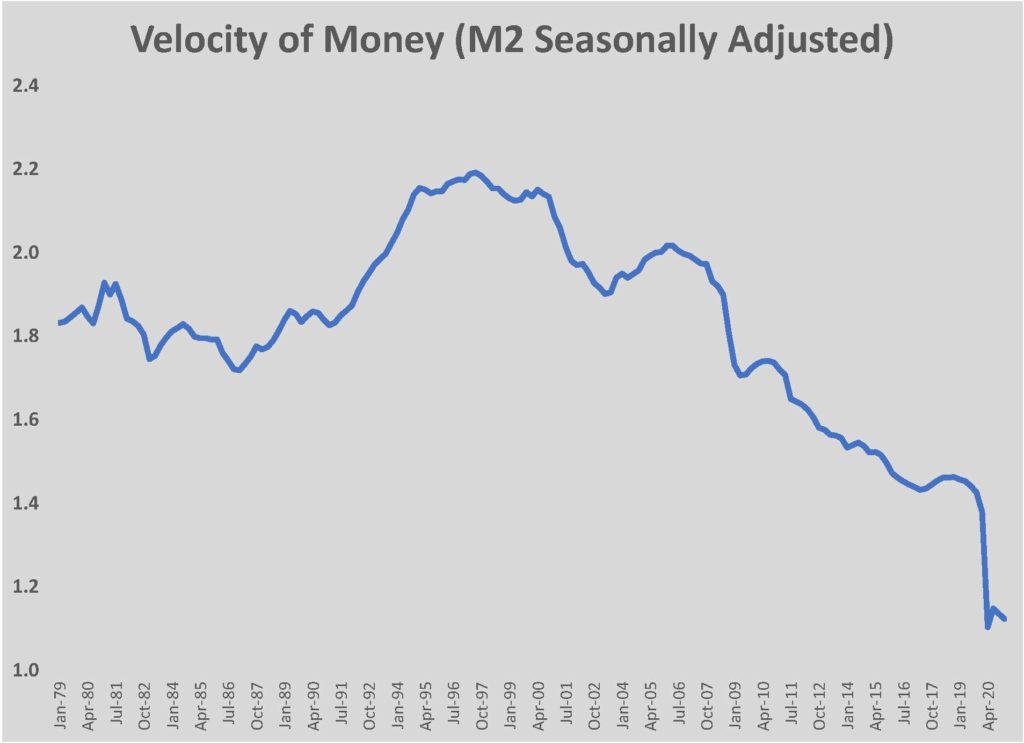

The outlook for inflation is calmer once the imbalances in supply and demand are remedied throughout the rest of 2021. Manufacturing capacity for steel and refining capacity for fuel, for example, remain much higher than global demand (although timbering capacity appears to be in a secular decline). Concerns about heightened money supply adding to inflation overlook the long-term trend in the velocity of money supply, which has been declining for 25 years. Put simply, the supply of money isn’t inflationary if it isn’t changing hands more rapidly.

Velocity of money – the frequency a dollar is used to purchase goods or services – has declined steeply as the supply of money has increased.

Source: Federal Reserve Bank of St. Louis.

There is strong evidence that the increase in money put directly in consumers’ hands has given a jolt to the economy. During the first quarter, for example, personal consumption grew by seven percent on an annual basis. That increase was more than the overall growth in GDP for the quarter. The strong increase in personal consumption during the first quarter bodes well for the recovery and expansion during the next few years. Compared to the peak-to-peak spending during the past four economic cycles, consumption during the first quarter of 2021 represents only a fraction of the potential. Spending on durable goods from January through March was about 30 percent of the average of the peak-to-peak durable goods consumption of the past four cycles. Personal consumption, non-durable goods consumption, and spending on services were all below 10 percent of the previous cycles’ totals, with services still negative through the first quarter. The comparison suggests that spending will continue to accelerate, particularly for services, throughout the rest of 2021 and 2022.

An acceleration of demand for services, assuming that it does not lead to a retracing of the progress in suppressing the spread of COVID-19, will be good news for hiring in a number of the industries that are lagging. The rebuilding of the supply chain, particularly in the durable goods category, will boost manufacturing. To return to pre-pandemic levels of employment, and to draw those who left the workforce back, there will need to be a recovery in service sector employment. Activity in the early summer should be supportive of that recovery, especially as pent-up demand for hospitality and recreation is unleashed. A summer void of major virus surges would boost the service sector and push unemployment below five percent by 2022.

One drag on GDP, inventories, is expected to turn positive during the balance of 2021. As expected, uncertainty about the economy made manufacturers unwilling to make commitments to re-stock inventories for more than immediate needs for most of the year following March 2020. Producers fared poorly at forecasting the turnaround, leading to supply issues that will limit the contributions of residential and business investment in structures during 2021. Unfilled orders for capital goods grew during the first quarter to almost 10 percent. The growing backlog should boost equipment spending starting in the second quarter and inventory re-stocking should take until early 2022 to peak. Those will be slight drags on GDP in 2021.

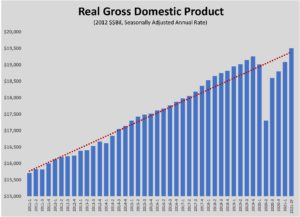

Even with the drag from the supply chain, the forecasts for GDP growth in the U.S. continue to move higher. The Blue Chip Economic Indicators, a monthly survey of leading economists by Havers Analytics, recently upped its forecast of second quarter growth to 9.2 percent, roughly half again as much as the first quarter growth. The consensus forecast of total GDP for the second quarter was $19.5 trillion, which would be above the output from first quarter of 2020 and above the long-term trend line.

Forecasts for the second quarter of 2021 bring GDP above the previous 2020 highs and the long-term trendline for GDP.

Source: Blue Chip Economic Indicators, Bureau of Economic Analysis.

Such elevated economic activity suggests that hiring should be occurring at a pace that would result in a million new jobs monthly; however, the reality has been less robust. Following April’s surprising slowdown in job creation, new hiring in May increased, but hardly at the rate the economic growth would suggest. May’s hiring saw 559,000 jobs added, bringing unemployment down to 5.8 percent. Based upon several indicators, however, employers have a significantly higher number of openings than there are job seekers. May’s Employment Situation Summary, in fact, found that workforce participation increased only slightly to 61.6 percent. That is almost two points lower than February 2020.

Several million workers remain out of the workforce, likely the source of the restrained hiring numbers. Claims for unemployment have been falling steadily throughout the spring, dropping below 400,000 by mid-June. With layoffs receding, hiring has been slowed not by employer demand but labor supply. While evidence doesn’t support the theory that the supplemental unemployment benefits is keeping workers on the sidelines, there is data that the lowest wage earners are not seeking employment while the extended benefits are in place. Moreover, the disproportionate number of women who have left the workforce suggests that lack of childcare – both closed day care centers and remote schooling – has forced mothers to stay home but not work. The vastly improved public health situation should help with both of these factors in September, as schools are expected to reopen normally, and enhanced unemployment is unlikely to be extended again.

Assuming that workforce participation recovers close to the 63.3 percent level of February 2020 by the end of the third quarter of 2021, job creation should maintain a pace at or above 500,000 monthly into the first quarter of 2022. That would be an organic boost to demand for goods and services that will drive construction.

Construction spending remains solidly in the $1.5 trillion range, even with a cooling of residential investment. Recovery of office-occupying jobs is not expected to move the needle on construction of facilities in 2021 and the impact of higher prices has slowed the recovery of spending on institutional and public construction.

The strongest growth category for the balance of 2021 should be commercial construction. Setting aside the uncertainty about the future of office occupancy, there are categories of commercial construction – industrial and multi-family – that will continue to receive a boost from the habits acquired during the pandemic; and categories that were severely impacted by the pandemic – hospitality and retail – should see increased construction as renewed interest in travel and entertainment spurs a recovery in occupancy and rents. Underlying the recovery in commercial real estate is an abundance of capital reserves and an interest rate environment that supports borrowing.

Recovering from the economic shock that followed the COVID-19 outbreak will follow a different trajectory than recovering from a recession caused by imbalances. While most economists and business owners expected a recession by 2021, the pandemic overwhelmed the long-term secular factors that were trending towards recession in 2020. The factors fueling recovery – high levels of consumer savings, record high reserves of business capital, strong stock markets globally, cheap capital cost, and booming demand for goods and services – are aligned to kick start the economy. Hurdles do exist, however. The likely trajectory for recovery will not be a straight line, but rather one with ups and downs as imbalances in supply and demand are worked out over the next six months. Vaccination levels must continue to climb, allowing infections to continue falling even as restrictions are eased. Accomplishing that will require solving the shortage of vaccines in Asia and Africa. Bringing the coronavirus under control throughout the globe will allow the economic forces to bring recovery to all markets.