Estate planning for high-net-worth individuals often involves a family business. Since a high percentage of many business owners’ wealth is comprised of ownership in the business, transferring interests in the family business is often a key estate planning strategy. With the passage of the Tax Cuts and Jobs Act (“TCJA”) in December 2017, the lifetime gift and estate tax exemption was expanded dramatically, making it possible to transfer unprecedented levels of wealth, including interests in family businesses, without triggering estate or gift tax.

A Temporary Window of Opportunity

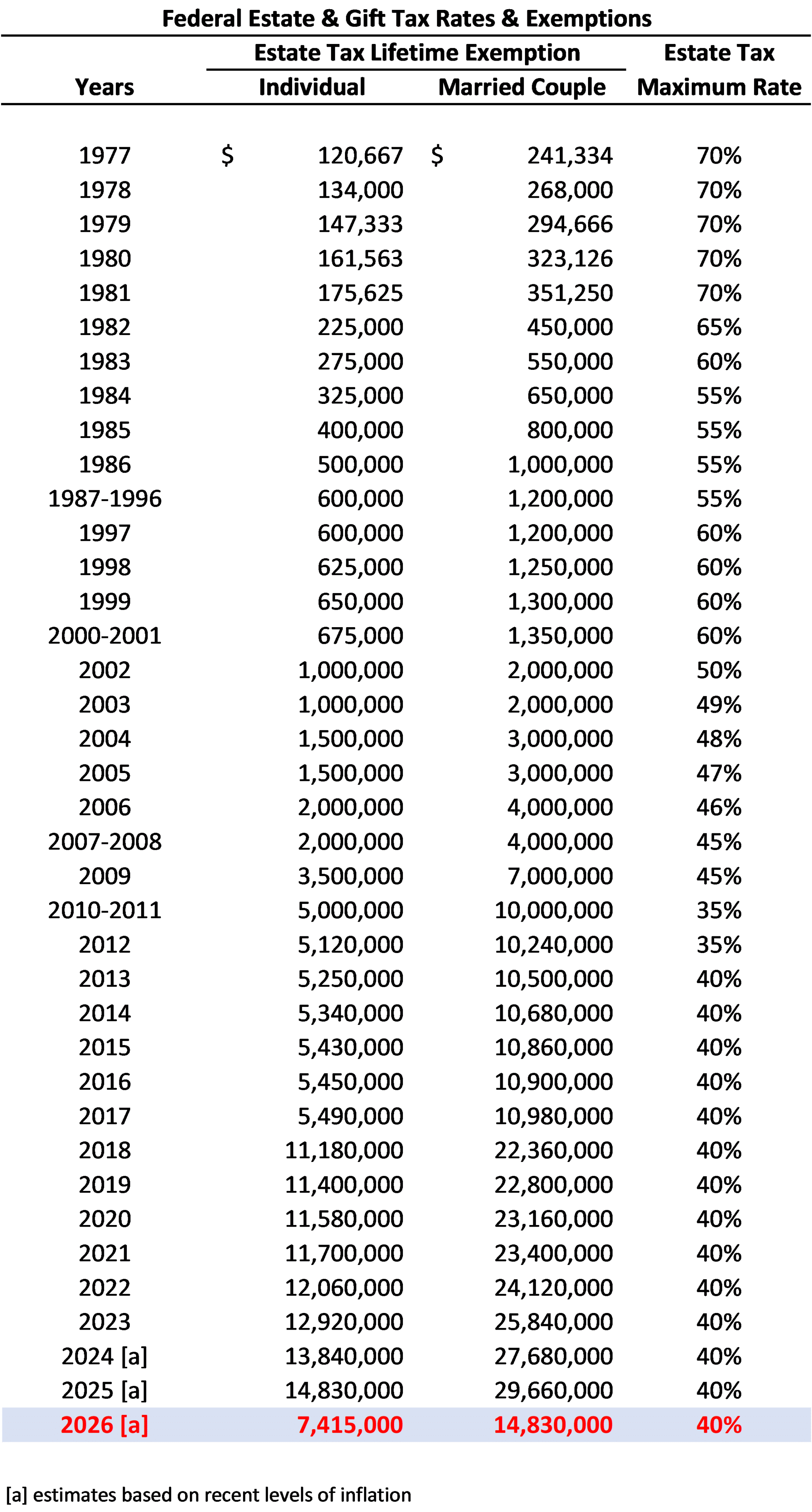

Under current tax law, a taxpayer can transfer up to $12.92 million ($25.84 million for a married couple) tax-free during their lifetime or at death. But there is a major catch: this elevated estate tax exemption amount is temporary. Without changes to the law, this lifetime exemption is scheduled to be cut in half after 2025. This means that the exemption will revert back to the pre-TCJA limit (i.e., $5.49 million), adjusted for inflation, on January 1, 2026. As such, based on inflation trends and estimates, taxpayers who pass away or transfer ownership after January 1, 2026, will have up to approximately $7-8 million of additional wealth ($14-15 million for a married couple) subject to estate tax, which could result in additional tax of approximately $3 million ($6 million for a married couple).

To avoid this costly mistake, many savvy business owners have locked in (or are planning to lock in) the current exemption limits by making lifetime transfers of ownership in their family business now. Owners of middle-market businesses worth $5 to $25 million can make transfers now and avoid this tax altogether, and owners of larger businesses can transfer substantial portions of their business and dramatically reduce the size of their taxable estate. There are many strategies to execute these transfers, including gifts, sales to trusts, and various other techniques.

Valuation Requirements

Implementing a gifting strategy often requires planning from attorneys, accountants, and other advisors, and one of the key requirements is to document the fair market value of the shares to be transferred. This is most often accomplished by hiring an independent valuation expert who develops a valuation opinion and documents that opinion in a comprehensive valuation report. It is critical to not short-cut this process, as taxpayers must satisfy the IRS’ “adequate disclosure” requirements, which, in essence, requires that the taxpayer “adequately disclose” the valuation methodology and assumptions that were used in determining the fair market value of gifted stock. The requirements under these disclosure rules are extensive, and the safe harbor is to obtain an independent valuation report that meets these requirements. And here’s the catch…if the fair market value of a gift is deemed by the IRS not to be “adequately disclosed,” the statute of limitations on the gift (which is typically three years) never starts. Thus, this gift can be subject to audit and scrutiny forever, even potentially leaving heirs with a skeleton-in-the-closet at the time of death if the estate tax return is audited.

Market Conditions Causing Relatively Low Valuations

In addition to the temporary estate tax limits, it is also a great time to transfer wealth because current valuations in many industries are relatively low. Higher interest rates, a relatively soft M&A market, and various uncertainties facing many businesses (e.g., labor cost and availability, inflation, supply chain issues, etc.) have resulted in a decline in many business values over the past year or so.

While some businesses continue to grow and achieve increases in value, many companies have experienced declines in value in the past year. Based on the many valuations that GBQ’s valuation practice performs, we have seen a higher-than-normal percentage of our clients experience declines in value. Although this is generally bad news, lower values are advantageous for estate and gift tax planning because (a) a greater amount of ownership can be transferred for the same value and (b) assuming the decline in value is temporary, more future appreciation will be removed from the business owner’s estate and rather realized by the recipient of the gift.

Summary

The decision to transfer ownership in your family business, particularly with today’s temporarily elevated lifetime exemption amounts and relatively low valuation levels, can be very rewarding and financially advantageous. But the clock is ticking. Taxpayers have about two years to execute these plans before tax laws are scheduled to become much less favorable.

An accurate, well-supported, and well-documented valuation is often the centerpiece of any transaction with potential tax implications. GBQ has extensive experience with valuations for estate and gift tax purposes, so please contact a member of GBQ’s Valuation Advisory team if you would like to discuss how a valuation can help your estate planning process.

Article written by:

Brian Bornino, CPA/ABV, CFA, CBA

Director of GBQ Capital Advisors

About GBQ’s Valuation Advisory Practice

GBQ is a nationally-recognized authority on valuations. Our professionals perform 300+ valuations annually and have completed thousands of valuations during our careers. GBQ’s valuations are designed to withstand regulatory scrutiny and we have a 20+ year track record of successful valuations on many high-profile transactions, estates, gifts, etc. GBQ specializes in valuations of all types, including ESOPs, estate & gift, stock-based compensation, shareholder transactions, mergers and acquisitions, financial reporting, and various other purposes. We are frequent speakers and authors on topics related to valuation and ESOPs.