As predicted, the Federal Reserve Chairman, Jerome Powell, dropped U.S. borrowing rates by another quarter of a percent, with the lower limit dropping from 1.75% down to 1.50%. This is the third rate decrease the Federal Reserve has made since July after starting the year at 2.25%. Many economic experts believe this sudden and substantial rate drop points to an economic slowdown. Although not near the 2008 crisis levels, the rate reduction has experts concerned, and business owners should pay close attention to the trends at play.

Federal Reserve Rate – The Basics

As the central bank of the United States, the Federal Reserve controls the standard cost of short-term borrowing across the nation. Together with Congress, the Federal Reserve uses interest rate adjustments to influence the availability of credit in hopes of fostering economic stability. The Federal Funds benchmark rate (“Fed rate”) is the interest rate banks charge one another for overnight loans.

Historical Borrowing Rates for Federal Funds

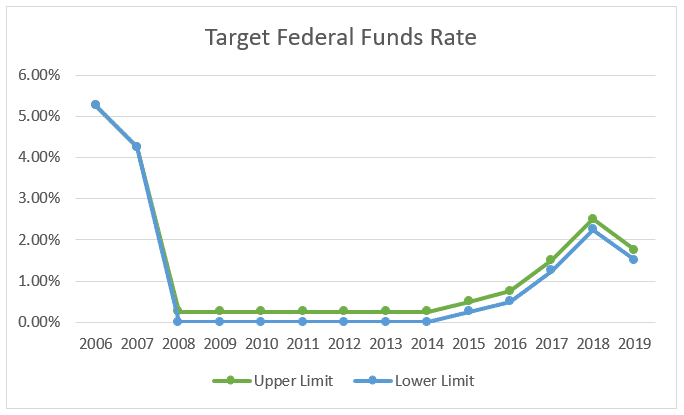

The Fed rate is a reliable marker for economic health, and the rate history is proof of this point. In the 2008 economic crisis, the Fed rate dropped from 4.75% down to 0% and stayed at less than 1% for eight more years. This rate decrease made borrowing more attractive to manufacturing companies and encouraged important investments in systems, people, and new production equipment. In 2017, the rate began to recover as the economy grew stronger, but this year’s rate reductions could point to trouble ahead.

2020 Economic Outlook

2019 started off strong, and even today, many metrics point to growth and stability. Unemployment is the lowest it’s been in 50 years, currently sitting at 3.6%, according to the U.S. Bureau of Labor Statistics; hiring is outperforming economists’ predictions, wages are rising; and although consumer spending is not growing as steadily as it was pre-recession, it is up from prior years. Unfortunately, other categorical data hints at a different conclusion.

- Trade agreements with China are still up in the air. U.S. tariffs on Chinese imports and China’s retaliatory tariffs on U.S. goods are still unsettled, and as two of the world’s largest economies battle it out, the stability of our economy sits in limbo.

- The United Kingdom was set to leave the European Union this month, but a recent Brexit extension gave the UK an additional three months to finalize the deal.

- The yield curve of Treasury bonds has inverted. In a healthy economy, the yield curve slopes upward indicating that short-term borrowing rates are lower than long-term borrowing rates. The current yield curve has inverted, with the curve sloping downward. This shift shows that long-term borrowing rates are stronger than the short-term. An inverted yield curve has historically preceded every major U.S. recession.

Reserve Chairman Jerome Powell has held that the 2019 rate reductions are not an indicator of an economic downturn, but rather insurance against one that may happen in the future.

Business Outlook

In an unstable economy, jobs are at risk, commodity prices soar, investment stagnates, consumers stay at home, and both domestic and international expansion are more perilous. There is no way to fully prepare for another recession, but there are a few best practices you can follow to help reduce its impact on your manufacturing company.

- Reevaluate your supply chain.

The Chinese tariffs are affecting a large percentage of goods and materials that U.S. manufacturers have historically sourced from China. Companies may need to allocate more money to material acquisitions as the tariffs go into effect.

- Adjust your budget.

The 2019 budget may have been based on first-quarter figures when the threats for an economic slump were not as pronounced.

- Take advantage of cheaper borrowing rates.

By utilizing the 100% bonus depreciation that is in effect for the next few years, you can pay off those loans on equipment and new machinery quickly and easily.

- Stay on top of hiring.

The labor market, especially the skilled labor market, is strained. This exacerbates the shortage of labor issue many Ohio manufacturers are currently facing, but serves as a good reminder of how a slowdown may impact the company.

The fate of the economy is still up in the air. Although most of the news out there is conjecture about what will happen in the first quarter of 2020, it’s important to carefully consider what the trends are revealing. The Fed rate drop is almost never indicative of a stagnant economy. For Ohio manufacturers, this is a good time to review operations and ensure the company’s financial vitality would not be significantly impacted by a slowdown. If you have questions about the economic data or need assistance with a manufacturing tax or financial reporting issue, GBQ can help. For additional information call us at (614) 221-1120 or click here to contact us.