The tax on unearned revenue by a minor commonly known as the “Kiddie Tax” underwent a major overhaul with the Tax Reform.

The previous law stated that if a child had unearned income above $2,100, that income was to be taxed at the higher of the parents’ marginal tax rate or the child’s marginal tax rate. This was a pretty simple calculation.

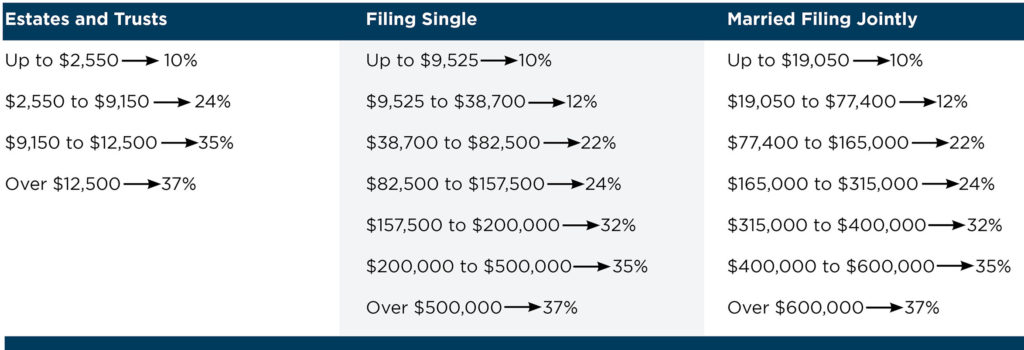

Under the new law, the “Kiddie Tax” is no longer tied to their parents’ tax bracket, now any unearned income in excess of $2,100 will be taxed on the same bracket used for trusts and estates. The 2018 rates are as follows:

As shown above, a child would reach the highest tax bracket with only having $14,600 of unearned income! To contrast just how drastic that change is, in 2017 the “Kiddie Tax” wouldn’t have reached the highest tax bracket until their parents income had surpassed $418,400 filing single, or $470,700 married filing joint.

Taxpayers from any bracket should evaluate their children under 18 years old with assets producing income in excess of $2,100, to see if moving those assets back to their parents’ custody would result in a slimmer tax bill at the end of the year.

If you have questions about if this affects your family or want more information on how strategies to avoid the “Kiddie Tax”, please contact your GBQ tax advisor.