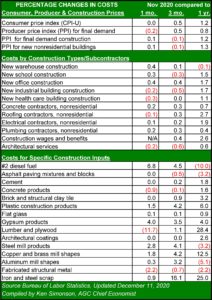

As expected, producer price inflation was slowed in November by increases in unemployment claims and decreases in economic activity brought on by the resurgent COVID-19 coronavirus. The December 11 report by the Bureau of Labor Statistics found the producer price index (PPI) for goods rose 0.4 percent from October to November, while PPI for services remained unchanged. Year-over-year, PPI for final demand – change in prices received by domestic producers for goods, services, and construction sold for personal consumption, capital investment, government, and export – rose 0.8 percent. That is well below the two percent inflation goal set by the Federal Reserve Bank.

Producer prices saw higher inflation than consumers in November, as the pandemic chilled demand for dining, travel, entertainment, and gasoline. The consumer price index edged up only 0.2 percent compared to October.

For the construction industry, the pace of inflation remained on the slowing trend line that has been in place since summer. PPI for final demand construction was up 0.1 percent in November compared to October and rose only 1.2 percent year-over-year. The increase in prices for new nonresidential construction was 1.3 percent compared to November 2019.

Supply chain disruptions, which caused spikes in certain building materials, have mostly been rectified or offset by slowing demand. Most materials and building products are seeing changes in pricing that are within a narrow range of one or two percent. Of those outliers, the spike in lumber prices continued to retreat in November. PPI for lumber was still 28.4 percent higher year-over-year, but the 90-day and 30-day increases shrank to 1.1 percent and -11.7 percent respectively. Likewise, the year-over-year decline in diesel fuel has slowly reversed as the production war between Russia and OPEC states has been derailed by plunging global demand. With nation-states cutting production to cut losses, the glut in supply has stabilized. Diesel prices were 6.8 percent higher in November than October, although still 10.0 percent lower year-over-year. With the U.S. no longer a net importer of oil and gas, the rebound in diesel prices – and related materials like asphalt – will be limited.

An emerging trend worth following is the increase in steel and metal scrap prices, because of the predominance of metals in construction products. Global demand for steel is unlikely to drive prices dramatically higher in 2021 but, with China turning its steel manufacturing inward, the level of excess global capacity will decline.