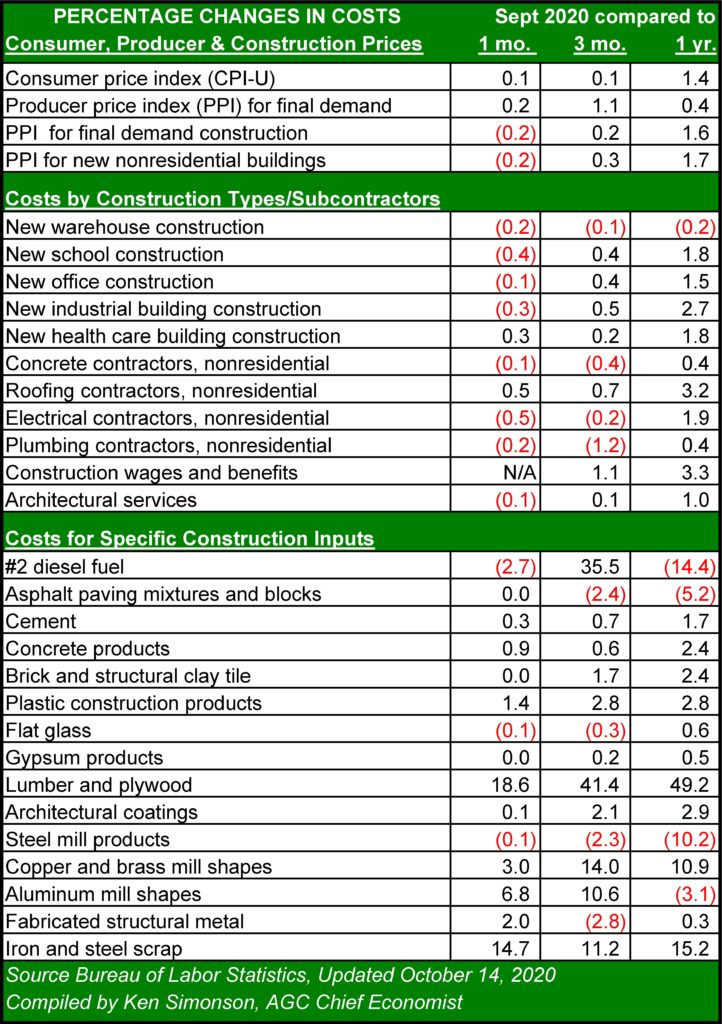

The erratic spread and nature of COVID-19 played out in erratic swings in prices as the third quarter wound down. While material prices overall have been pushed lower, the disruptions in the supply chain that resulted from pandemic-induced shutdowns in the spring resulted in sporadic shortages and prices that spiked upwards for brief periods. Overall, however, the steep decline in global demand for basic industrial commodities and consumer products has halved the rate of inflation since March 1.

Lumber and #2 diesel fuel are the best examples of how the chaos following the outbreak of COVID-19 roiled markets.

Lumber and plywood saw a decline in production during the spring shutdown. Sheltering at home produced a surprising increase in home improvements, pushing demand up as supply shrank. The result was month-to-month increases in prices in excess of 40 percent and year-over-year hikes of as much as 300 percent. By September, supply caught up and price increases compared to September 2019 were “only” 49.2 percent. Futures prices of lumber and plywood expect prices to return to pre-COVID levels in early 2021.

Diesel fuel similarly saw a decline in price as the virus smothered demand for oil and industrial users of diesel – like the construction industry – needed less of the fuel. In contrast to lumber prices, the price of #2 diesel has fallen 14.4 percent since September 2019; however, the re-opening of the U.S. economy and the pullback in production led to a recovery in oil and diesel prices. September’s diesel fuel prices were 35.5 percent higher than the prices in June, but 2.7 percent lower than the price in August.

Demand for construction materials and building products has leveled off or rebounded, and supply chains have begun to catch up. As a result, prices for most materials fluctuated less than one percent from August to September and are only slightly more volatile since June. The exceptions are industrial metals. Copper, aluminum, and especially iron and steel scrap, have seen aggressive price hikes since summer began. Copper is up 14 percent. Prices for aluminum mill shapes have jumped 10.6 percent since June, and scrap prices have risen 11.2 percent in the same time period. Prices for steel and fabricated steel have stabilized, with fabricate steel edging up two percent in September compared to one month earlier.

Construction wages have remained stable, even rising 1.1 percent from June to September. As the number of COVID-19 infections increase as November begins, prices of construction materials will remain relatively stable unless an unexpected increase in hospitalizations and deaths occurs. Assuming the fall flu season does not result in a surprise that leads to global halts in production and troughs in demand, the volatility of COVID-19 should not drive prices as it did in mid-2020.