The leading economic story of spring 2022 is the Federal Reserve Bank’s tightening of its two major monetary policies to rein in inflation that has lasted longer and spiked higher than was expected.

Since the earliest months of the re-opening of the economy in spring 2020, the Fed’s policies have focused on providing a bridge to the other side of the public health crisis. The central bank dropped its overnight lending rate to near zero and initiated another round of bond purchases, also referred to as quantitative easing, to ensure that credit would be available to businesses and consumers. Coupled with fiscal policy moves by the Trump and Biden administrations that put cash in the hands of consumers and businesses, the Fed’s accommodative monetary policy made the rapid recovery that followed the rollout of vaccines possible. It also helped fuel the inflation that resulted from that overheated economy.

One year later, fiscal stimulus has dissipated. What remains is the excess of liquidity and demand that exceeds supply. To respond to these conditions, the Federal Reserve hiked its Fed Funds rate in March and May, and has strongly signaled that additional hikes are likely. At the same time, the Fed began reducing its balance sheet, allowing maturing bonds to expire and selling off other bonds. That action will put further upward pressure on interest rates and force the private sector to re-assume its role in purchasing bonds, including mortgage-backed securities. The pressure on rates and reduction of liquidity is intended to cool demand and let the markets respond.

In the first 30 days after the Fed hiked rates, the core inflation rate responded. Inflation, stripped of volatile energy and food prices, was 6.5 percent year-over-year in March and rose 0.3 percent from February, less than the 0.5 percent that was expected. The problem with the focus on this so-called “core inflation” in spring 2022 is that the Russian-Ukrainian war is most directly impacting energy and food prices. For the Federal Reserve Bank, that means successes in cooling off the economy through monetary policy changes could be offset by shortages in oil, gas, and wheat. Those shortages will drive prices higher at the gas pump and grocery store, regardless of Fed actions.

Other factors are also cooling off demand. The impact of higher inflation on fuel, food, and other basics is reducing consumer spending. The expiration of stimulus measures that occurred in 2021 is also causing belt-tightening. For consumers and businesses still planning to invest in construction, the jammed-up supply chain is causing delays and deferrals. Inflation is snarling a growing share of projects as well. As the factors slowing expansion pile up, it is easy to envision the economy tipping into recession by 2023.

Should the Fed get its tightening right – and history shows that is a very difficult task – the cascading impact of the reduced spending, lingering inflation, and slower supply chain response could facilitate the kind of soft landing that will cool the economy temporarily. That scenario resets the economy for growth that avoids inflation above the long-term trend again.

Such a soft landing has proven elusive in the past. A recession has followed eight of the last nine periods of Fed rate hikes. In terms of stifling inflation, a recession triggered by tighter policy will have the desired effect, but the medicine will be difficult to take.

Based upon some of the leading indicators of the economy, it appears that few professionals have confidence that a slowdown – if not an outright technical recession – can be avoided. A Bank of America survey of global fund managers found that more than 75 percent expected the global economy to be weaker in April 2022. Bond prices have begun readjusting to the reality of higher rates. While that has reversed the short-lived yield curve inversion that occurred in late March, the steady increase in the 10-year Treasury bond has been accompanied by higher borrowing rates for commercial and residential buyers.

The outlook for the long-term inflation trend is little changed. The 5-year Breakeven Inflation Rate – a measure of inflation expectations derived from the 5-year Treasury Constant Maturity Securities that implies what market participants expect inflation to be – has become elevated twice since the end of 2021; however, that rate had fallen below 3.3 percent as April ended.

Thus far, the impact of the Fed tightening and geopolitical uncertainty has done little to dampen demand for development or construction. The U.S. economy has returned to pre-pandemic trendlines for nearly all metrics. While the Fed action, inflation, and the Ukraine war are likely to pare back some economic activity, forecasts for gross domestic product (GDP) growth in 2022 are still at or above three percent. Compared to other parts of the world, the U.S. has generally returned to pre-pandemic daily activity, putting U.S. companies in a better position to respond to demand than their competitors in China, India, and other emerging markets. Demand for housing is still significantly higher than the available supply of existing or new homes.

What will dial back demand for space will be the incremental increases in borrowing costs, as the Fed Funds rate ticks upward towards 2.75 percent in 2022, and in construction costs. While it is too early to measure how much the increases will reduce the amount of construction in 2022, there are signals that work is slowing.

The housing market reacted to the prospect of rising rates during the first quarter. The average 30-year mortgage ticked above five percent in mid-April. Roughly 200 basis points higher than mid-November 2021. Major banks, such as Wells Fargo and CitiGroup, reported mortgage origination volumes off by 33 percent or more during the first quarter. The Mortgage Bankers Association forecasts a 35.5 percent decline in originations in 2022, with a 64 percent drop in refinancing. Homebuilders cited the move above five percent as the reason for declining sentiment in the April National Association of Homebuilders/Wells Fargo Housing Market Index. The reading of 77 was the fourth consecutive month of falling sentiment (although that reading was higher than any monthly reading between July 1999 and August 2020).

Housing starts edged slightly higher in March to 1.793 million units annually (seasonally adjusted), the highest level since June 2006. Starts were pushed higher by an increase of nearly five percent in multi-family units. Permits for new multi-family spiked 10.9 percent. While single-family starts and permits were lower in March, the backlog of homes not started was 280,000, a record high level. The high backlog was blamed on delays due to inflation, supply chain problems, and labor shortages.

Architectural billings moved sharply above the break-even 50 level in March. The American Institute of Architects’ Architectural Billings Index (ABI) was 58 in March, with the ABI for new inquiries rising again to 63.9. Always a good indicator for construction activity a year in the future, ABI may be particularly enlightening for the balance of 2022, as owners that expect inflation to trigger a recession are likely to put projects on hold. That would drop the index below 50. Should the ABI remain positive, that would be an indication that owners are continuing to pay for design services in anticipation of temporary cooling in demand.

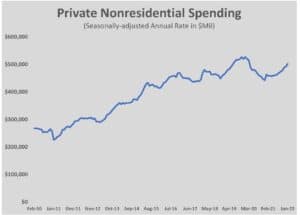

Inflation has pushed construction spending to all-time highs. Total spending in March 2020 topped $1.7 trillion. Private nonresidential investment in construction climbed to $503 million, the highest total since March 2020.

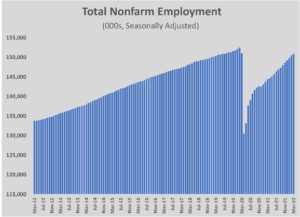

Labor markets remain puzzling. Employers added 1,285,000 jobs during the first quarter of 2022, bringing the unemployment rate down to 3.6 percent. The total number of unemployed fell to 6.0 million, nearly back to the February 2020 low. The number of persons unemployed for more than 26 weeks fell to 1.4 million, still 300,000 more than in February 2020 but 300,000 fewer than in March 2019. Total U.S. nonfarm employment increased to 158.5 million persons in March, roughly one million more than the number employed in March 2019; however, more than 11 million positions remained unfilled at the end of March. A gap of roughly 1.5 million workers exists between the civilian workforce in March 2022 and February 2020.

It is the gap in the civilian workforce and between the number of openings and the number of unemployed that is hardest to explain. Household survey data from the Census Bureau seems to corroborate the anecdotal evidence that the pace of retirements increased during the pandemic, with as many as three million more people retiring during the two-year period. If this pace continues – even if at less accelerated levels – it will be difficult for employers to staff the expansion plans that the record number of job openings suggests. Moreover, should the number of openings remain twice the number of job seekers for an extended period, the current upward pressure on wages (which are increasing at a five percent annual clip) will remain, regardless of GDP growth or decline.

In the near term, the surplus of six million job openings is a cushion that should keep unemployment from rising dramatically if the economy slows. The imbalance also suggests the current shift in bargaining strength enjoyed by workers will persist. If that is the case, higher wage rates will keep inflation higher than expected, eroding business profits. That trend, in turn, will also cool off hiring and bring labor markets back into balance.

No word describes the state of the U.S. economy better than imbalanced. Almost unprecedented imbalances exist between consumer demand and supply, business demand and supply, labor demand and workforce participation, and U.S. Treasury demand and Federal Reserve Bank balance sheet. The current levels of inflation are a result of some or all these imbalances. Restoring balance can be managed by interventions like those executed by the Federal Reserve Bank, but the marketplace will ultimately self-correct the remaining imbalances. The risk of recession increases to the degree that the market corrects the imbalances.