Article written by:

Casey Grisez

Senior Financial Analyst

There are days that remind you of the uniqueness of the valuation business. One of those days was when we had to consider, “Do we include the private jet?”

One of the most important aspects of assessing the value of a company is fully understanding its historical financial performance. Unfortunately, financial performance can be distorted by non-recurring income and expenses, outdated asset values, and non-essential discretionary expenses. Having an understanding of potential normalization adjustments and, importantly, when and how to include them allows for a more accurate value.

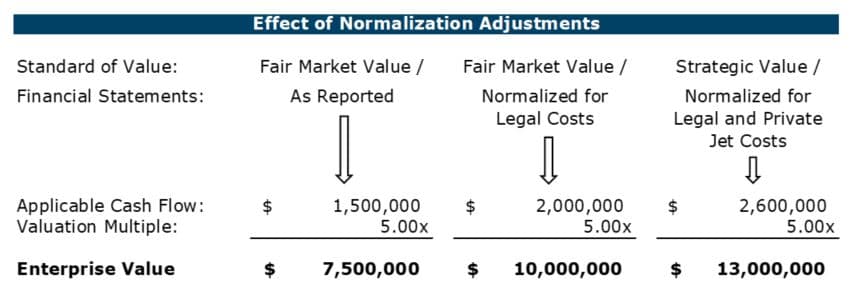

For example, suppose that a company’s reported profits of $1.5 million include $500,000 in various non-recurring expenses, such as legal costs related to large lawsuit. Let’s also suppose that the income statement includes $600,000 in discretionary expenses, such as private jet maintenance costs, that could be eliminated by new ownership without affecting ongoing business. As shown in the following simplified example, the concluded value of the company can vary widely:

Failing to properly account for normalization adjustments can lead to an inaccurate business valuation, potentially causing issues that range from paying excessive tax on a gift of overvalued shares, to receiving too little for your business in a transaction. The list of potential adjustments is extensive and varies based on your unique valuation, since factors such as minority interests can affect normalization adjustments. Please contact us today to see if various income or expenses may be distorting your company’s value. Who knows – maybe your company will be our next opportunity to discuss whether or not to include the private jet!