Surety guarantors – the insurance companies that bond the performance and payment of contractors – will tell you that they get almost as uncomfortable about the top of a boom as they do the bottom of a recession. In both cases, defaults and business failures tend to follow a couple of years later. While 2022 may not qualify as the top of a construction boom, there are conditions characterizing the market that are signaling caution to the surety companies.

“The market is ripe for too much work in light of the labor shortage, COVID vaccines, rising price of materials, and the supply chain complicating things,” says Jay Black, principal, and vice president of surety at Seubert & Associates. “I spent a week talking to the top folks at the eight largest shorties and they are sensing that 2022 is going to provide ample opportunities for companies to over-grow. With all that said, the sureties are still looking forward to this year as another good one. I’m feeling bullish about this coming year.”

“The potential backlog in terms of projects in Western Pennsylvania is phenomenal,” notes Zach Mendelson, principal at EPIC Insurance Brokers and Consultants, and third vice president for the National Association of Surety Bond Producers. “From the surety’s point of concern, there is cautious optimism. No one is seeing large losses.”

Performance and payment bonds are written by insurance companies that indemnify risk across all facets of business and life. Those companies profit from construction bonding in the same way that they do from life insurance or property/casualty insurance: by taking in premiums that exceed the amounts paid in claims and operating expenses. For construction bonding, that means assessing the risk of default by a contractor, either by failing to complete the project or failing to pay the subcontractors. This process of underwriting considers the macroeconomic factors that could increase the risk of claims – like recession or pandemic – and the microeconomic factors – such as the financial performance of the insured contractor or the projected profitability of the contractor’s backlog – to determine the rate that the contractor will pay and the bonding capacity the contractor will have. The latter often determines how much work the contractor can pursue.

Insurers characterize market conditions as either soft, meaning rates are lower and capacity is available, or hard, meaning bonding capacity is more precious and expensive. In ideal circumstances, surety bonding would shift to a hard market about a year or so ahead of rougher economic times. In practice, insurers often tighten underwriting in response to the poorer economic conditions.

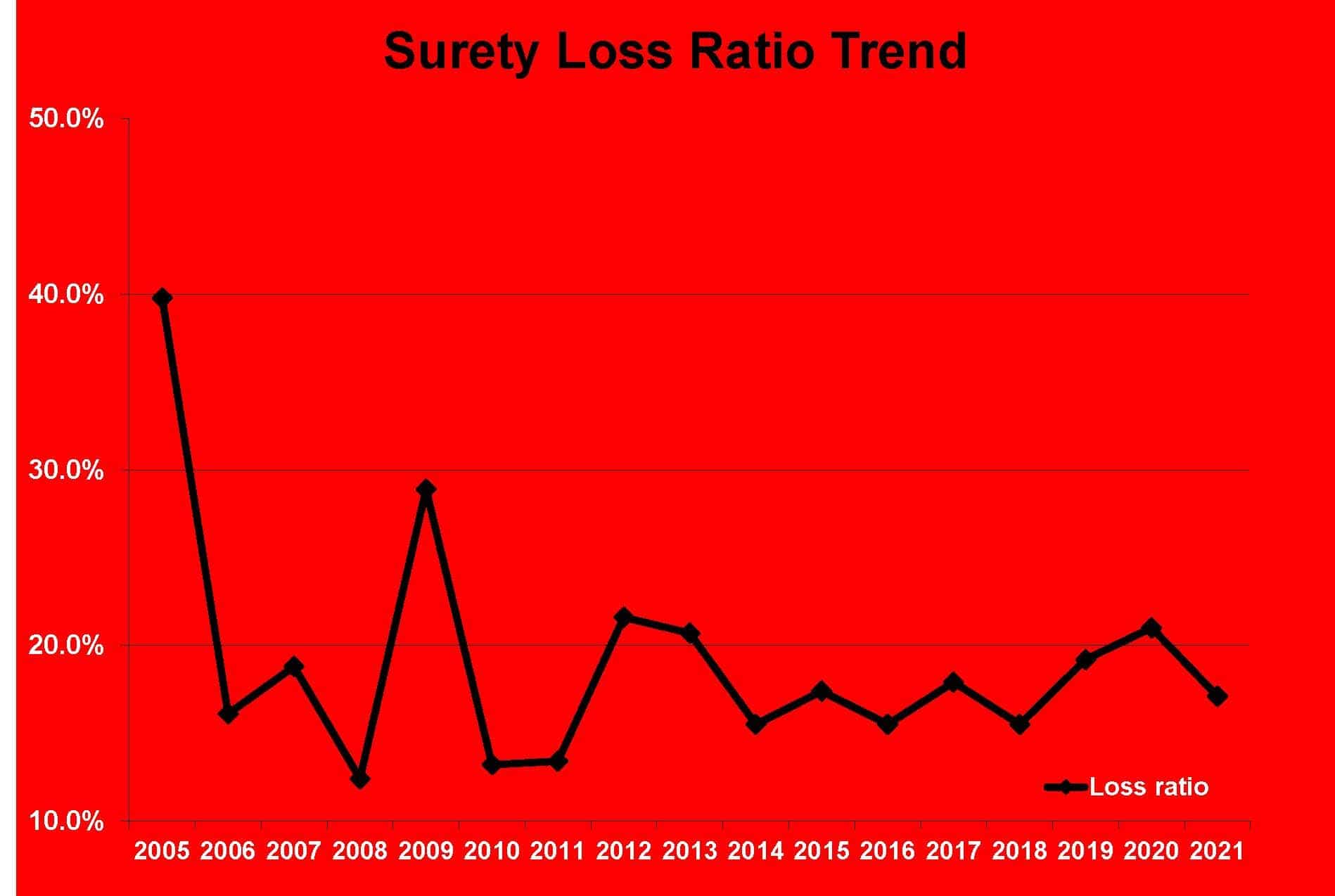

It was an overextension of soft surety market conditions at the end of the 20th century that resulted in a period of steep losses when construction defaults surged coincidental to several costly natural disasters and the 9/11 terrorist attacks. Following an unusually hard market in 2003 and 2004, surety loss ratios plummeted, remaining mostly below 20 percent through the 2010s. As a result, surety bonding capacity has been readily available for most contractors for more than a decade. Coming into 2022, however, this extended period of surety market strength is being challenged by three uncertainties: volatile inflation, a severely disrupted supply chain, and a growing labor shortage.

Long-term observers of the construction industry expect that the unusual conditions present in today’s market will lead to contractor losses and defaults at some point but are not concerned about that occurring in 2022.

“What will eventually happen is that there will be defaults with subcontractors and smaller contractors,” predicts Jim Bly, managing director for subcontractor default insurance and surety analysis for Alliant Insurance Services. “That will impact the reinsurance market and a lot of the sureties that are feeding business to reinsurers will start to lose capacity. But we’re a long way away from that happening.”

On the contrary, conditions in the construction surety market have attracted new players in recent years. By maintaining underwriting discipline since the 2004 losses, surety companies have kept losses well below levels that would threaten profitability, which has made construction more attractive to insurers. Bly reports that in 2022, Markel Insurance Company and Crum & Foster Insurance are ramping up surety bonding, offering programs up to $500 million. Those are only the latest insurers returning to construction surety, which has become reliably profitable for the industry’s largest players, like Travelers Bond, Zurich, CNA, Chubb, and Liberty.

“Capacity and underwriting terms will remain favorable for the next 12 months,” predicts Bly. “There is plenty of capacity in the market. The new players who entered the market in recent years have done well and the large insurers all had very strong years in 2021. The mood with sureties overall is good.”

Virtually everyone associated with the surety market is clear about the reasons why the overall mood is good. A strong economic recovery, leading to solid backlogs, has been helpful, but the surety market would look decidedly different without the Paycheck Protection Plan (PPP) that was included in the CARES Act of 2020.

“I was watching It’s a Wonderful Life as I do every year, and I couldn’t help think of Paycheck Protection,” chuckles Black. “The premise of the movie is what the world be like if Jimmy Stewart’s character wasn’t born. What would the world look like today if we didn’t have two rounds of PPP? Cash from PPP is still on the balance sheet. I think companies have been disciplined and managed there their extra cash well. It has companies in pretty good shape.”

“The conditions in 2020 had the potential to wreck financial statements but coming into this year we haven’t seen that come to fruition because of PPP,” agrees Mendelson.

“We are starting to see some increased losses from operations among subcontractors. They are having to deal with material cost escalations, and labor shortages, and challenging projects. There is enough capital now to absorb that,” notes Bly, whose company maintains a credit database of over 2,500 specialty contractors nationwide. “Results for subs from operations overall did deteriorate slightly in 2021 but net income did not deteriorate because of PPP forgiveness, which provided a 20 or 30 percent lift to bottom line profits.”

Alliant’s national analysis of specialty contractors found that PPP proceeds made up an even larger percentage of net income before taxes, which jumped from an average of 7.5 percent in 2020 to 12.8 percent in 2021, even though revenues fell by nearly six percent in 2021. Liquidity, measured by working capital as a share of backlog, increased from 10 percent to 11.7 percent from 2019 to 2021. Owner’s equity in the business remained steady at 15.5 percent. Alliant’s analysis of Pittsburgh-area specialty contractors found that their net income doubled from 2020 to 2021 on revenue growth of eight percent. One area of concern was the observation that profit margins shown on backlogs were lower than those on the income statements for 2021, suggesting that bids for work in 2022 may have been more aggressive.

Surety companies are buoyed by their clients’ cash reserves and a year that begins with big backlogs and growing demand. Not surprising, however, few surety professionals expect 2022 to be uneventful.

To begin with, changes in generally accepted accounting practices (GAAP) for recognizing revenue and accounts receivable (especially including retention) have created confusion for those, like surety providers, that must analyze the financial statements of contractors (see January/February BreakingGround page 52.) GAAP revisions have not been adopted by all contractors, and many sureties are untrained as to how the changes reflect the client’s finances.

“I am seeing a lot of confusion about the financial reporting. Sureties are getting financial reporting that is all over the map,” reports Michael Bronder, CPA, president of Bronder & Company. “It’s not done consistent with the way it’s been done in the past, so the sureties are having a terrible time analyzing the financial statements. Not all accountants are following the new standards. When sureties are confused, they tend to pull back a little bit.”

In the context of a soft market, pulling “back a little bit” is likely to translate to more questions being asked than in previous years. For now, at least, insurers are not going to reduce capacity. But the confusion in accounting is not the only cause for caution.

Inflation and supply chain disruption have gone hand-in-hand since early 2021. For surety companies, the concern is that those two factors present risks to the timely completion of projects, and ultimately to the financial health of contractors. Firms that won bids without properly accounting for price escalation – or worse, those that planned to buy projects out at lower prices after the bid – are unlikely to build the project for the promised price. In small doses, that is a recipe for reduced profits or small losses. On a large, complicated project, such an approach could lead to contractor default or business failure.

Likewise, failing to plan or account for the exaggerated delivery times with protective contract language will lead to consequences for contractors. Project delays have become commonplace. According to the Associated General Contractors’ 2022 Outlook Survey of its member general contractors, 72 percent of firms say projects are currently taking longer than expected, but only 44 percent say they are putting longer completion times in bids and contracts.

Labor has been in short supply for construction since the recovery from the Great Recession because of demographics and long-term trends in recruitment. Two years into the pandemic, construction is experiencing the same “great resignation” as other industries. With insufficient skilled labor and supervision, productivity has declined. That adds to the problems that inflation and supply breakdowns have caused project delivery.

“A fourth factor this year is lenders. We’re spending more time with lenders and investors than normal,” says Mendelson. “There has been more circling back by those entities financing private projects to the sureties to verify that the project is bonded.”

For contractors with established surety relationships, this heightened level of caution may not be recognizable in their reviews for 2021 and 2022; however, behind the scenes, surety providers are looking closer at leading indicators, as are the professionals serving the financial interests of the industry.

“The lawyers we work with say they have spent more time reviewing contracts in the last 18 months than they remember spending in the last 18 years,” says Mendelson. “Force majeure is something I remember learning 30 years ago starting out in the industry. It rarely came up in conversations until the last couple of years. Now, not a week goes by that we don’t talk about it in terms of schedule.”

It may seem like heightened caution is unfounded coming into a year with the promise of so much construction, but that is probably good for the industry. Surety companies play an important role in the construction industry, one that brings certainty about completion to owners and developers. Given the extreme uncertainty of the past two years, and the justifiable concerns about prices and schedules, a little extra caution may keep the industry from getting too far out over the tips of its skis. There is little or no evidence that the heightened caution is going to restrict capacity, so surety companies are seeking more assurance that the capacity will be utilized by contractors that are prepared for market conditions. And caution is not the same as pessimism.

“We saw increased bid activity in 2021. We wrote 6,500 bid bonds in 2021. The prior year it was 6,000,” says Black. “And this year is off to a good start. The work is out there.”