In 2021, most companies benefited from favorable market trends, primarily a strong stock market and a historically low-interest rate environment. However, in 2022, the stock market exhibited double-digit declines, and interest rates increased significantly. As a result, as the year-end 2022 valuation season is in full swing, we are generally seeing lower company valuations unless improved company fundamentals can offset the negative market influences. The following explores the two biggest factors impacting the overall decline.

Negative External Factor #1 – Higher Interest Rates

One of the primary ways to value a company (whether Apple, a middle market company, or the corner deli) is to discount the business’ expected future cash flow to present value at a rate of return commensurate with the risk of realizing that cash flow. The discount rate most often used is the Weighted Average Cost of Capital (WACC), which requires certain inputs tied to interest rates. The most notable are the risk-free rate (typically calculated using the 20-year Treasury Bond rate) and the cost of debt. Given that both of these rates increased over the past year, it is not uncommon for middle-market companies to see a 15-25% increase in their discount rate, which will result in a material decrease in the present value of cash flows.

Negative External Factor #2 – Decline in the Stock Market

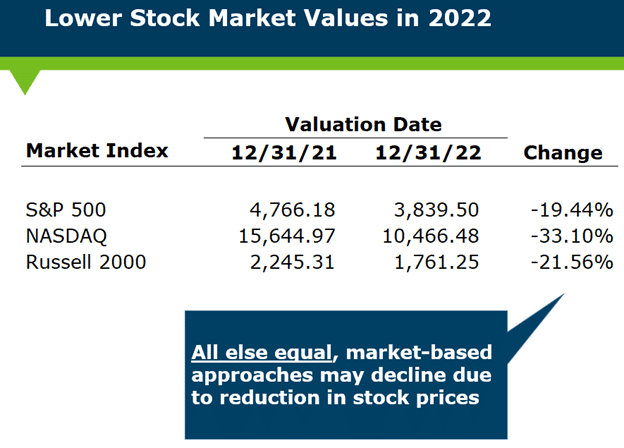

Relative valuation is also an important method used to value companies. The theory here, just like in real estate, is that two comparable assets should command similar prices. As such, one of the primary relative valuation methods involves using publicly-traded stock price multiples (with appropriate adjustments) to apply to a subject company. Most of the major indices were down 20% or more in 2022, which indicates that on a relative valuation basis, the value of the subject company will also be down, all else equal.

The Good News

The good news is that external factors such as interest rates and stock market performance are only a portion of the valuation process. Company-specific fundamentals play a critical role – specifically:

- Revenue growth

- New products/services/market share

- Profitability/cash flow

- Business plan/outlook

- Customer retention and growth

- Strength of balance sheet

To the extent that a company’s fundamentals improved in 2022 (and are expected to stay that way), there is a good chance that those factors may offset (partially or fully) the impact of negative market forces on the valuation.

How Can GBQ Help?

Unlike 2021 in which many companies experienced healthy increases in value from favorable market trends, valuations in the current environment are more than likely to be lower. However, valuations are complex and are affected by many factors, both internal and external, so working with experienced professionals like GBQ is key to obtaining an accurate valuation.

Article written by:

Kelly Noll, CFA

Director, GBQ Capital Advisors

Brian Bornino, CPA/ABV, CFA, CBA

Director of GBQ Capital Advisors

About GBQ’s Valuation & ESOP Advisory Practice

GBQ Capital Advisors has built a reputation throughout the country for its efforts in preserving companies’ legacies and employees’ loyalty through various transaction advisory services, including valuation and ESOP advisory services. Our team specializes in assisting clients ranging in size, from large publicly traded companies to small family-owned businesses, as they progress through the most important transactions and ownership transition events of their lives.