Exclusive Survey ResultsLocal Leaders Share Business Outlook Amid Pandemic |

|

| Recently, GBQ celebrated its 67th birthday. We have seen numerous ups and downs over that time. Our firm was founded amid a short recession that resulted from demobilization following the Korean War, during which peak unemployment reached 6.1% in September 1954. Several of our recently retired partners started their careers in the mid-1970’s, experiencing the impact of the OPEC oil embargo and wage controls that drove five quarters of negative GDP growth and a 9% unemployment rate. More recently, most of us remember the Great Recession, triggered by the subprime mortgage crisis and the resulting bank credit crisis, which officially lasted 19 months, but had a long tail. The unemployment rate peaked at 10%.

This economic downturn is different in many ways. Beyond the obvious factor that a virus is the root cause, it is notably different given the sudden impact of shutdowns and the disproportionate impact on various types of businesses. GBQ’s clients are diverse in size and employment base, and represent many sectors: manufacturing, construction, real estate, healthcare, restaurants, professional services, credit unions, technology, transportation, logistics, nonprofits and more. Even within any given sector, the impacts have varied widely. For example, at the outset, manufacturers classified as “non-essential” had no choice but to do significant layoffs, while those businesses deemed “essential” made immediate plans to keep their employees safe while trying to continue business as usual. Perhaps most visible to all Americans are the shutdowns and social distancing requirements in the restaurant sector, which have impacted bars, fine dining and fast food very differently. Throughout the last six months, GBQ has been tracking business statistics and surveys from many different sources in an effort to understand the key issues and to apply this knowledge in serving our clients. In mid-September, we launched a survey to our clients to gather and comprehend the perspectives of business owners that we know personally. We shared that data in an all-associate webinar for our team on September 24, and have summarized the information below. Fortune surveyed the CEOs of the Fortune 500 in April and published those results. We borrowed a sampling of questions from that survey and have compared those responses to our clients’ responses. A synopsis from the Fortune article is below: |

| “CEOs of the Fortune 500, surveyed in the last two weeks of April, believe it will be years before the effects of COVID-19 are purged from the U.S. economy. Only 27% expect their workers to fully return to their usual workplaces this year. A majority believe it will be the first quarter of 2022 before overall economic activity returns to levels reached before the pandemic, and another 27% don’t expect that until the first quarter of 2023. Most say business travel at their company will never return to levels reached before the crisis. Despite the economic impact, three-fourths believe the crisis will force their companies to accelerate their technological transformation.” | ||

A link to the pdf Fortune 500 Survey is here |

|||

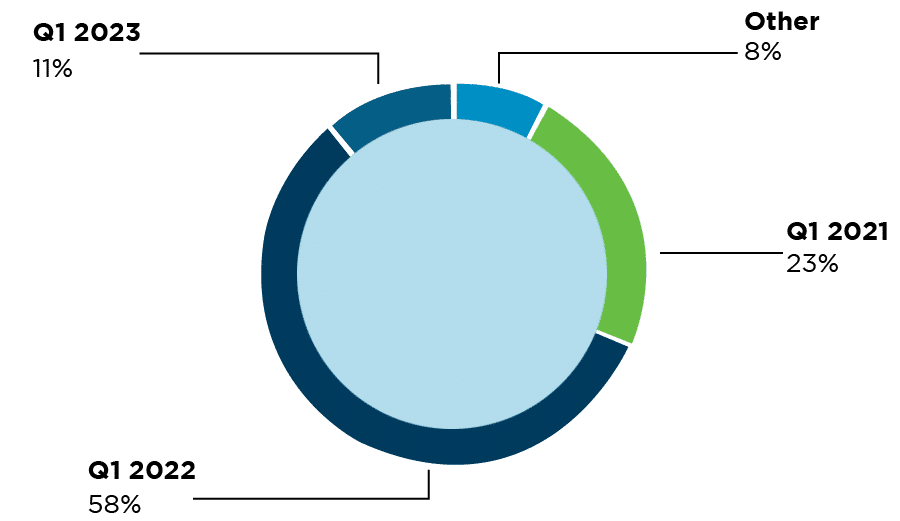

When will economic activity return to the level it was before the pandemic? |

|||

| In April, 52% of the Fortune 500 CEO’s said Q1 of 2022. In September, 58% of the GBQ clients surveyed agreed with that timing. We share that perspective. As COVID continues to impact the country, economic indicators – exacerbated by a divisive political climate and many unknowns – seem to suggest a cautious and conservative approach to managing cash flow in the remainder of this year and through 2021.

|

|

||

| . | |||

| . | . | ||

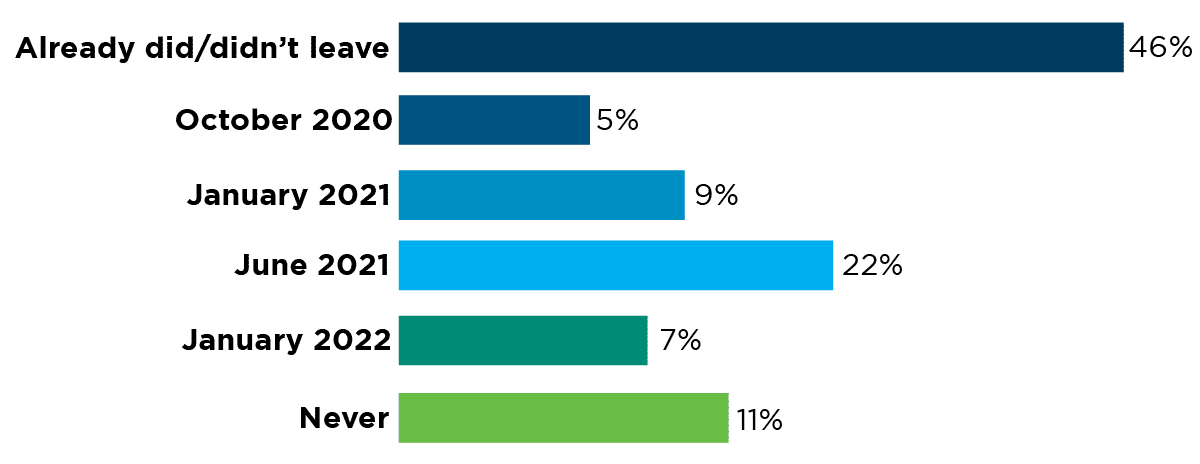

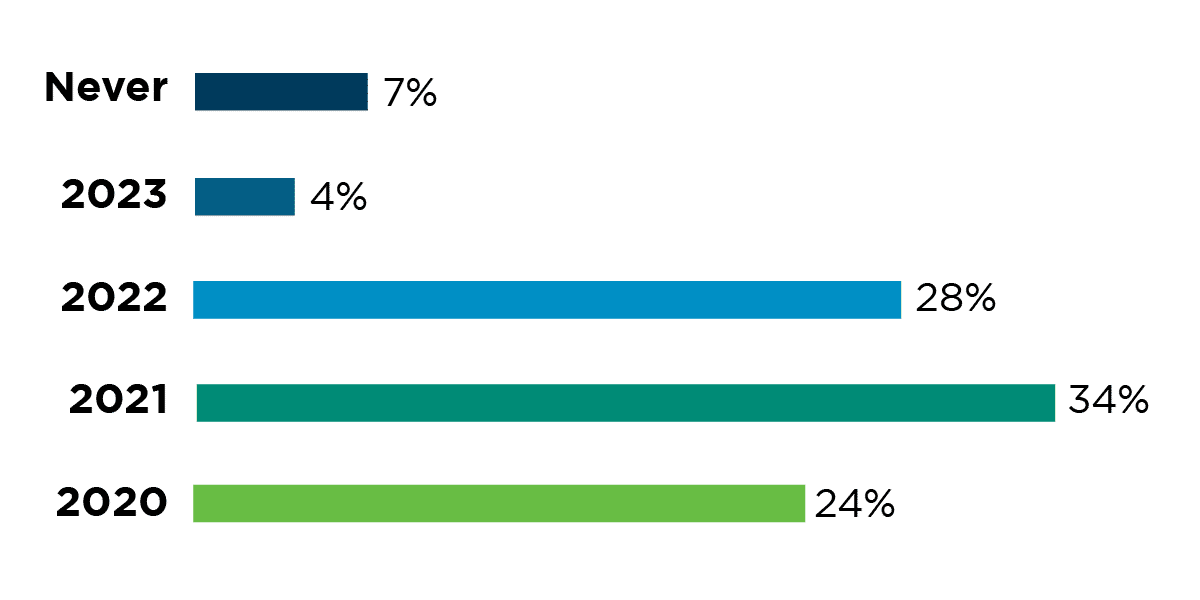

When will at least 90% of your workforce have returned to their usual workplace? |

|||

| 27.4% of the Fortune CEO’s said that workers would be back by September of this year, but also noted that 26.2% would never come back, whereas GBQ clients indicated that 46% had already returned to the workplace – or never left at all, and only 11% would never return. The timing of the two surveys in April and September likely impacted the perspective on this one, as many large companies have since deferred their return-to-work dates, some as far out as July 2021. As a professional service business with the tools and abilities to send all of our associates home to work at the outset of this crisis, the realization that almost half of our clients did not have that opportunity is eye-opening for our team and provides perspective for us as we navigate our phased-in return to the office this fall. |  |

||

| . | . | ||

| . | |||

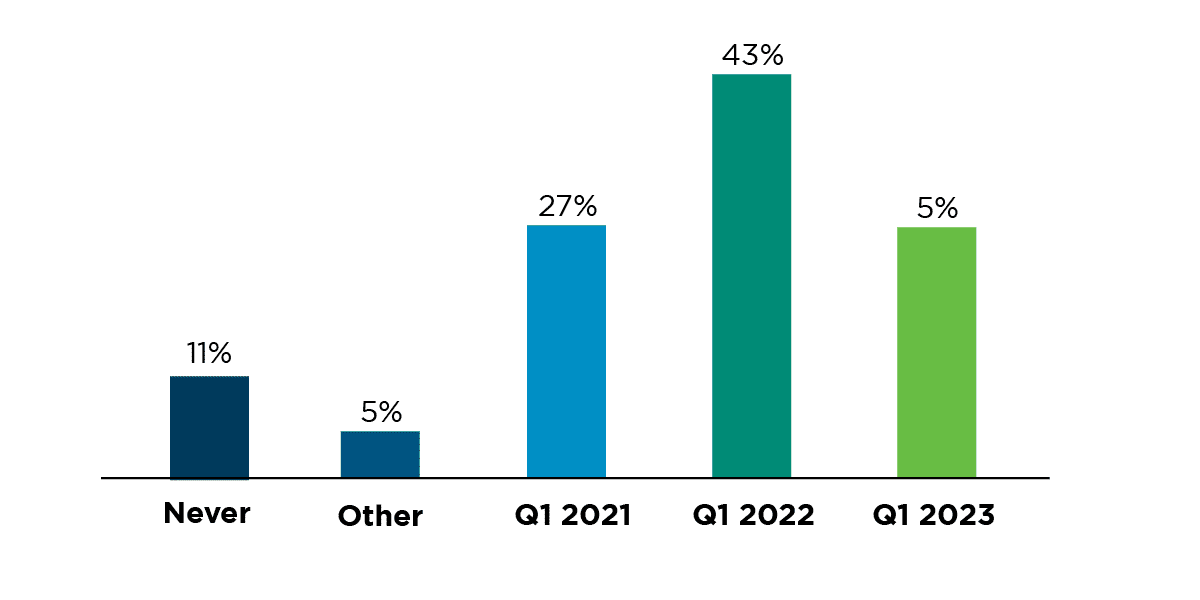

When will business travel at your company return to the levels it was before the pandemic? |

|||

| This question revealed a starker difference between the two surveys than most. More than 51% of the Fortune 500 respondents said business travel would never return to pre-pandemic levels, whereas 43% of GBQ respondents said it would return the first quarter of 2022. It is certainly true that we have all found ways to navigate virtual meetings, conferences and events, which is likely to change the outlook – and budget – for business travel indefinitely. Our assumption here is that air travel likely comprises a larger portion of the travel budget in very large companies, which may account for the differing response.

At GBQ, our travel has generally fallen into two categories: visiting our clients on-site for meetings and audit processes, and attending conferences – all of which have transitioned to virtual for now. We have learned how to navigate the audit function remotely, though in some cases, the time efficiencies gained by not traveling are totally offset by the inefficiencies of conducting remote processes. More importantly, the value of face-to-face interaction with our clients is greatly missed. Sitting in the same room with a controller, CFO, or owner and discussing the business and the critical issues, or working through the math together, is preferable. We are scheduling on-site fieldwork for the fall in situations where it is possible to keep both the client team and the GBQ team safe. |

|

||

| . | . | ||

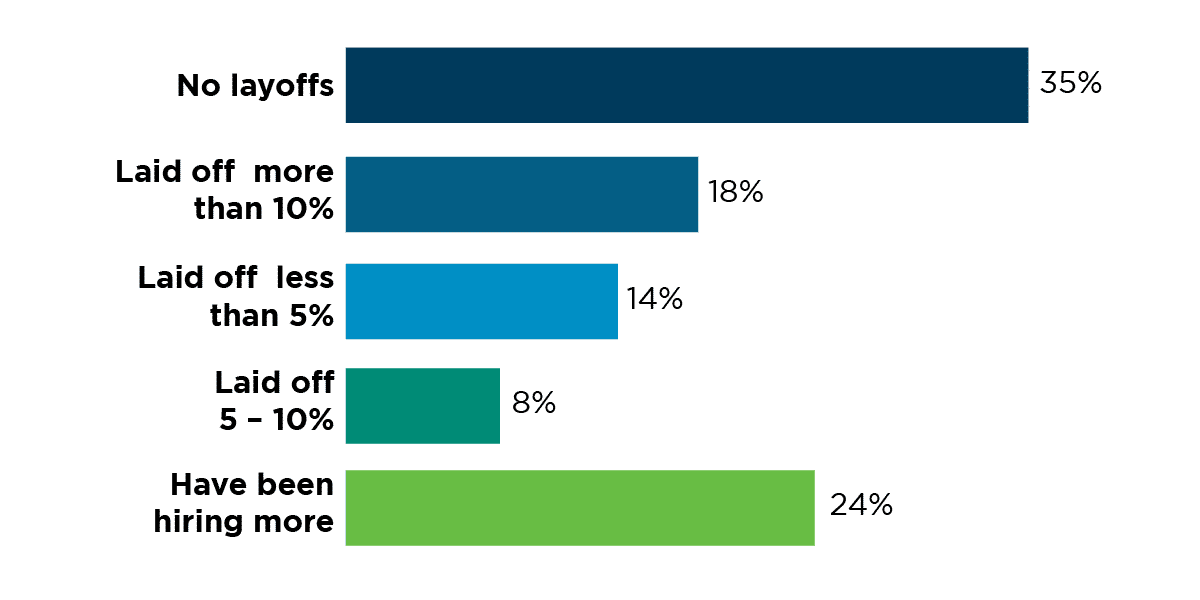

Have you laid off or furloughed workers in response to the crisis? |

|||

| In April, about half of the Fortune 500 had no layoffs. By September, 35% of GBQ respondents had conducted layoffs. Some of this reflects the mix of business segments represented in the Fortune 500 versus the middle market, but it also likely reflects the impact of the ongoing pandemic and economic shutdowns over the summer and early fall. In April, it was difficult to imagine that so many businesses would still be shuttered or operating at significantly diminished capacity in October.

On a positive note, 24% in the GBQ survey indicated that they are hiring more employees now. The question that we asked was not specific enough to determine if these are newly-created positions or if this reflects a return-to-work initiative for those positions previously furloughed or eliminated. |

|

||

| . | . | ||

| . | |||

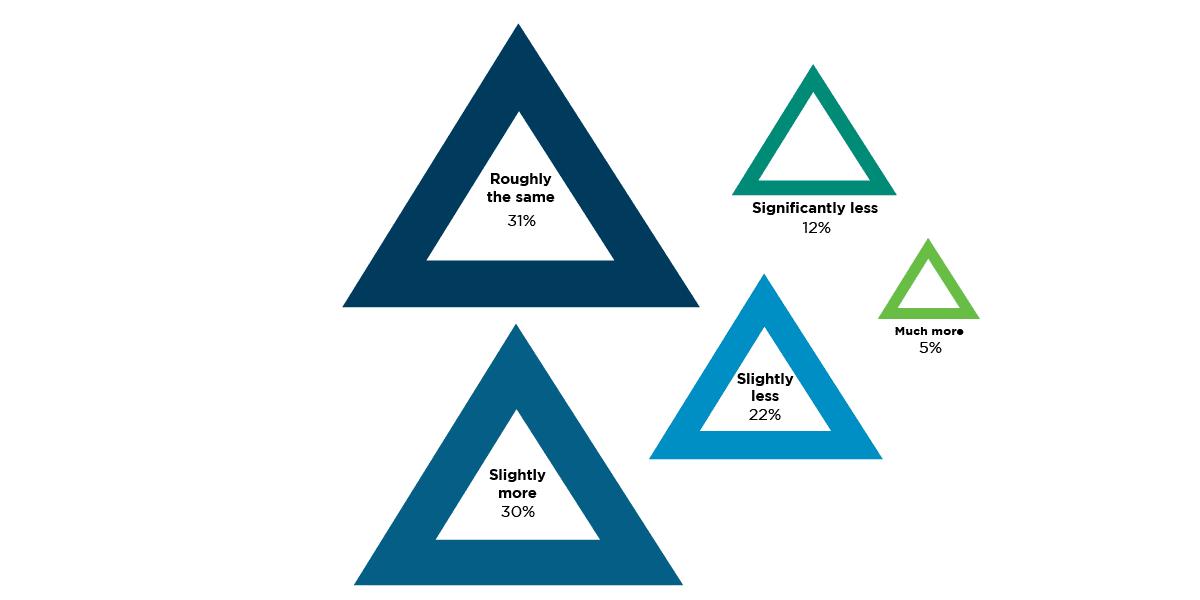

In January 2021, how do you expect your company’s total employment to compare to what it was in January 2020? |

|||

| 72.6% of Fortune 500 CEOs expected slightly or significantly less employment in January 2021 than 2020, and only 14.3% expected more. In comparison, only 34% of GBQ clients expected less, with 31% anticipating roughly the same employment in January 2021 as compared to the prior year. The lower percentages amongst the GBQ client base are likely influenced by the availability of federal Paycheck Protection Program loans to the middle market, which allowed many to maintain their workforce at a level that otherwise might not have been possible.

Across the country, the unemployment rate remains high. Recently released data showed the national unemployment rate at 7.9% in September, compared to 3.5% in February prior to the pandemic. The rate has steadily fallen from April’s high of 14.7%, but data shows that initial applications for unemployment benefits are still exceeding 870,000 people per week in September. As a whole, workers in the leisure and hospitality industry have suffered the highest unemployment rates, which remain at 19% in September. |

|

||

| . | . | ||

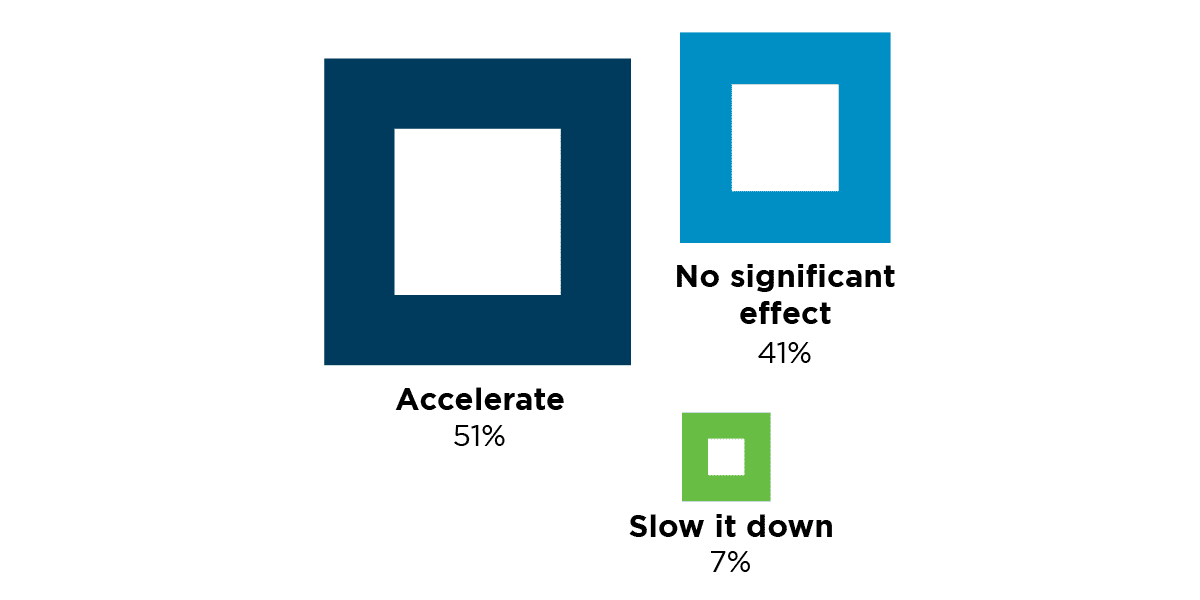

At my company, this crisis will have what effect on the pace of technological transformation? |

|||

| 75% of the Fortune 500 respondents indicated an acceleration in technology, whereas 51% of GBQ respondents agreed. A larger geographic dispersion of workers for the Fortune 500 requires a different level of investment to maintain connectivity, especially in a world without much business travel. A dizzying collection of technologies and an increasingly urgent rate of change present both opportunities and challenges for businesses of all sizes. Cloud, mobile, blockchain, artificial intelligence and machine learning, robots, autonomous vehicles, the internet of things…technology demands ever more attention – and more spending. Access to capital is a real barrier to many middle market companies, particularly those now impacted by COVID-related reductions in business activity. |  |

||

| . | . | ||

| . | |||

When do you expect capital spending at your company to exceed 2019 levels? |

|||

| 62 – 63% of the Fortune 500 CEOs and the GBQ clients indicated that capital spending would exceed 2019 levels in 2021 – 2022. Kiplinger reported last month that capital spending in the U.S. is currently on an uptick, rising 1.5% in August to return to pre-recession level and beyond. Computer and communications equipment spending leads the way as companies continue to equip their workforces for remote work. Machinery spending and orders are strong as well, even though many uncertainties about the economy’s progress remain. As a professional services business, almost all of GBQ’s capital budget is comprised of IT equipment and software, so this is one of the only expenditure categories that we did not cut during the pandemic. Like thousands of other businesses, continued investment in technology facilitated our ability to work efficiently in a remote environment. |  |

||

| . | . | ||

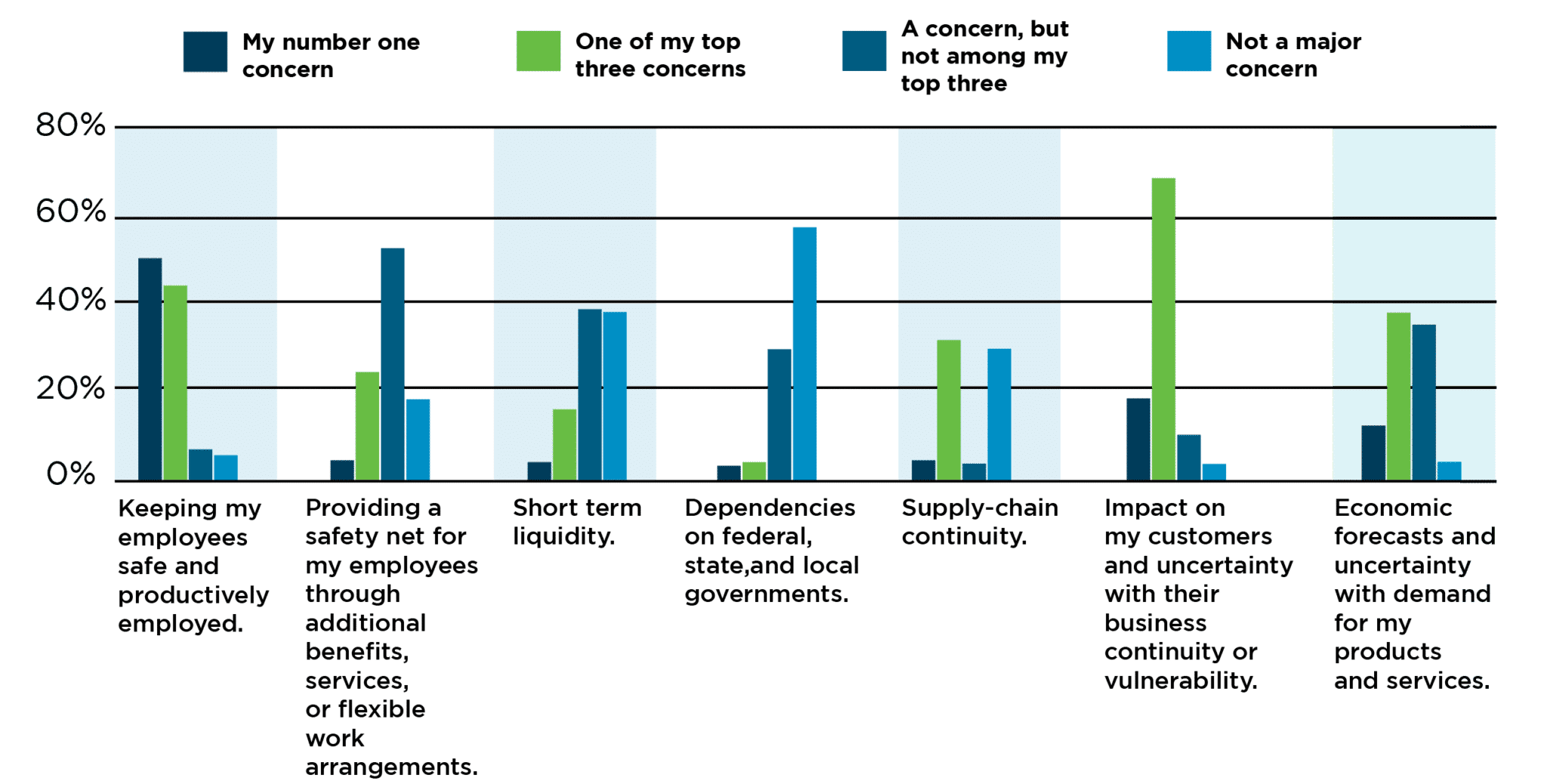

What are your top concerns with respect to business risk management in today’s current environment? |

|||

| Answers to these risk factors did not show much variation between the Fortune 500 and GBQ clients. Keeping employees safe and productively employed was the number one answer in both surveys. The second most frequent answer was concern about the impact on customers and uncertainly about business continuity and vulnerability. The seven risk factors in the survey are certainly not all-inclusive. There are several subcategories to these ideas, as well as industry-specific factors to consider.

It seems to be almost universal right now that we are all worried about uncertainty. With a team of mostly Type A planners and a business that functions around a very specific seasonal calendar of deadlines, this is the factor that is most challenging for the GBQ team. We know that some of you have built your business in fast-paced, undefined and ever-changing environments and that you thrive on that. We admire and applaud you. Here, we yearn for some process and certainty – final answers to PPP loan questions, definitive tax positions, and an idea of when the schedule will return to normal. As business owners, we are all accustomed to making plans for the future. We prefer playing offense as opposed to defense. Planning is very difficult in uncertain times, and working without a plan is stressful. At GBQ, we are trying to address the stress, but not dwell on it. |

|||

|

|||

| . | . | ||

| . | |||

The single most important thing the crisis taught me is… |

|||

As an open-ended question, GBQ received a variety of answers. Here is a sampling that reflects the common themes of communication, responsiveness, flexibility and caring for employees:

These surveys, our own experiences and the news every day remind all of us that we have not yet reached the end of the crisis. Even once COVID-19 is under control, there will still be lasting economic effects for our businesses. The GBQ team is working individually and collectively to make an intentional shift from “fighting through it” to “making the most of it.” Our goal is for your businesses – and ours – to emerge in a strong place. We will do that by staying focused on the basic concepts that have made us a strong team for decades: persistence, teamwork and empathy. We would love to spend time with you – virtually or in-person – to listen, understand and help. Take care of yourselves, your families, your team, and your customers. GBQ is here for you. |

|||

| . | . | ||