As the calendar turns to January, many business owners quickly shift their attention to the year ahead to finalize budgets, sales forecasts, and the all-important tax planning. During this period, one area of tax planning that is often overlooked is the management of real estate valuation and the associated property tax. Businesses often receive tax bills, accrue the tax and move on without giving a second thought as to the accuracy of the value or the underlying tax. However, taxpayers are afforded an opportunity to challenge the assessed value of their property, which can result in property tax savings. Property tax savings achieved through successful valuation appeals could be the difference in reaching profitability goals for the year.

Property tax in Ohio – and throughout the country – is often an overlooked area since there is not a formal return filed, and all valuation is performed by the county. Ohio law requires counties to reappraise all parcels on a six-year cycle and update the values in the third year of the cycle. Because the county essentially determines the value of all parcels with limited initial input from the property owners, Ohio has established an appeal process available for taxpayers who disagree with the value established by the county. Each three-year cycle opens a new appeal period for all property owners who disagree with the county-assessed value.

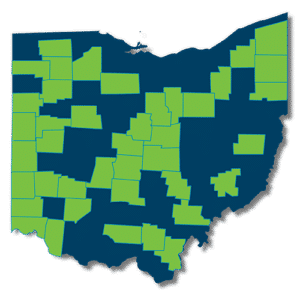

Forty-one counties throughout Ohio are undergoing revaluation as part of the three-year cycle in the tax year 2023 (payable 2024). This means that the value established for the tax year 2023 will remain in place for the next three years, absent significant changes to the property (such as an addition or demolition). Any valuation reduction achieved as a result of an appeal would have a direct impact on the property tax bill. The Ohio map shows the counties that will either be reappraised or updated for the tax year 2023. Click the map to see the county names.

Before deciding to pursue an appeal, taxpayers should evaluate their real estate holdings (including any leased properties where they carry the property tax burden) and estimate the value through any available data (which may include recent sales data, appraisals, and the valuation of similarly situated neighboring properties) to determine if the property is, in fact, overvalued. In addition, any potential tax savings should be considered along with the costs of pursuing an appeal and the potential risk of a valuation increase. In order to be successful in a real estate valuation appeal, taxpayers will need to provide the county with some type of evidence to prove that the value established by the county is incorrect. Items such as recent sales documentation or a professional appraisal of the subject property are items that may suffice as evidence in a valuation appeal.

The deadline to file an appeal to challenge a real estate valuation in Ohio is March 31, 2024. While this article focuses on Ohio appeals, it is important to note that most states have a similar process available to reduce value and property tax assessments.

If you think your property may be overvalued, please contact GBQ to discuss the appeal process in greater detail.

Article written by:

Jeffrey Monsman, JD

Director, State & Local Tax Services