Despite the fact that most restaurant operators have fairly straightforward revenue recognition as a point-of-sale business, deferred revenues can often catch a restaurant operator and franchisors off guard. While Generally Accepted Accounting Principles (“GAAP”) can have long recognition periods for deferred revenue, income tax often has a very different revenue recognition policy. In the next two months, we will explore the two most common types of deferred revenues a restaurant operator may encounter: franchise fees and gift card revenue.

Basic Principles of Tax Revenue Recognition

Before reviewing the specifics of franchise fees and gift cards, it is important to understand the general principles of revenue recognition for tax. Unlike GAAP, tax will typically look to the economics of a transaction to determine revenue recognition. Therefore, revenue is typically recognized when cash is received unless there are restrictions to using cash or an exception applies. In our two cases of deferred revenue, statutory exceptions apply.

Franchise Fee Revenue Recognition – GAAP

Under a typical franchise fee agreement, a franchisor will receive an up-front payment from a franchisor to operate the franchise. In addition, the franchisor may receive fees for other services rendered. Under GAAP, revenue is recognized over the life of the franchise fee agreement starting when the store opens. In addition, if a distinct performance obligation is identified as part of the franchise fee (i.e., support services), GAAP may have a different revenue recognition method for that specific performance obligation under the practical expedient. The general concept is GAAP matches revenue recognition when the benefit is derived vs. when cash is received.

Franchise Fee Revenue Recognition – Tax

As mentioned above, tax will typically recognize revenue when cash is received unless a restriction to the use of the cash or a statutory exception applies. Regarding franchise fees, the IRS allows up to a one-year deferral of revenue recognition for the cash receipt in exchange for services (i.e., revenue will be recognized for tax in the year after receipt). Additionally, if the taxpayer has “applicable financial statements,” which include audited financials, tax revenue is recognized no later than when revenue is recognized for GAAP purposes. Therefore, if GAAP does not follow the one-year deferral, the tax will have the same revenue recognition for the books.

Example

Mama’s Pizza, Inc., a franchisor, signed a ten-year franchise agreement for $25,000 in January 2023. Operations of the franchised location begin the same year. Mama’s Pizza, Inc. has audited financial statements and complies with ASC 606.

GAAP Treatment

Under GAAP, the franchisor would recognize $2,500 of revenue in 2023 (1/10th of the franchise fee received). GAAP would continue to recognize $2,500 of revenue in each of the following nine years (2024 – 2032).

Tax Treatment

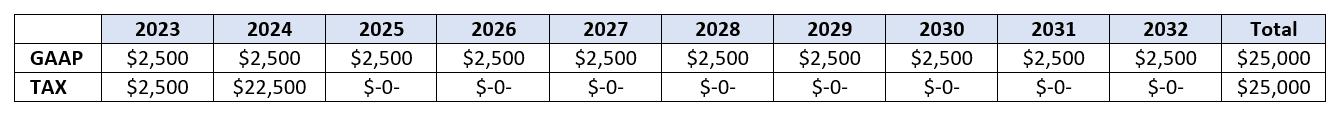

Under general tax law, Mama’s Pizza, Inc. would be eligible to defer revenue recognition of the $25,000 to the year subsequent to receipt (i.e., 2024). However, since GAAP recognized $2,500 of revenue in 2023, the tax must follow the same revenue recognition. Since tax only allows one year of deferral, the remaining $22,500 must be recognized in 2024. Following is a table outlining book and tax revenue recognition:

In total, GAAP and Tax recognize the same amount of revenue over the ten-year period, but the revenue recognition is accelerated for income tax. This is commonly referred to as a timing difference.

Impacts

Oftentimes, franchisors will utilize their internal or audited financial statements for purposes of forecasting and budgeting cash flow. However, careful attention should be paid to franchise fee revenue recognition for income tax as it could create taxable income while the company would have lower income or even a loss for financial statement purposes. The creation of taxable income will require tax payments to be remitted, which need to be budgeted for. Start-up franchisors should be particularly cognizant of this as the impact is magnified when franchise fees are received, and the stores do not open for a period of time.

If you have any franchise fee revenue recognition questions, please contact Dustin Minton, Ryan Kilpatrick or your GBQ advisor.