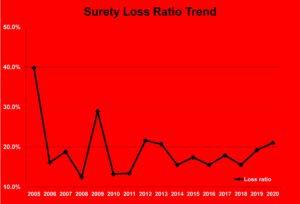

Since the surety business righted its ship in 2005, the industry has been profitable and relatively calm, despite the cyclical nature of construction. Losses never exceeded 30 percent at the bottom of the Great Recession (losses need to remain below 40 percent for insurers to make a profit) and the annual loss ratio has been between 15 and 18 percent since 2014. Alas, a combination of events – most unrelated to construction – has made surety bonding less certain coming into 2021.

Construction surety is a small portion of the insurance business. The total of all premiums written for surety is roughly $5.5 billion, a fraction of the $633 billion revenues from all commercial insurance products. Following the consolidation of the industry in the mid-2000s, surety bonding has been dominated by five major insurers, which earned 49.5 percent of the premiums thus far in 2020, with 100 or so remaining players in the market.

The financial stability of construction surety began to attract new insurers over the past few years, which helped keep capacity high and rates low. During that time, however, the insurance industry suffered losses from natural disasters at some of the highest rates ever in 2017 and 2018. The impact of those rising non-construction losses hadn’t affected surety yet when another outlying event – the COVID-19 pandemic – hit in March 2020.

The ramifications of COVID-19 on the construction insurance industry could have (and may still be) incredibly costly. If no other impact from the pandemic were felt, the shutdown of businesses and dramatic drop-off in construction volume could have created a big drop in premium revenues. Beyond the direct loss of premiums, COVID-19 was unique in its potential for huge unknown risks to an industry that rises or falls based upon its ability to understand and mitigate risks. As the year unfolded, COVID-19 did not have the disastrous effect that was feared.

“The market had momentum certainly coming into 2020 and then COVID hit. I don’t think it’s been as brutal as it could have been, especially with Paycheck Protection Program [PPP] helping along away and with the vaccines on the horizon,” says Jay Black, principal and vice president of surety for Seubert & Associates, Inc. “It’s not a hard market. There are really no changes to capacity. Underwriting isn’t getting any tougher that I’ve picked up on. Sureties are asking more questions regarding COVID and how contractors are dealing with it. It’s all about funding and forgiveness going forward.”

“Hard market” is the industry’s jargon for tightening in the insurance business cycle. Hard markets follow increases in losses and tough economic conditions. For surety customers, hard markets mean lower bonding limits, higher premiums, closer financial oversight, and more skin in the game for business owners. In the insurance business cycle, hard markets often follow periods of overly soft conditions for insurance, which lead to greater risk and oversize losses. The latter is not an accurate description of market conditions coming into 2020.

“I think it’s safe to say that, for the most part, 2020 should be a decent year for the surety companies,” notes Rick Gasiorowski, surety agent for Travelers Bond. “The year began on a very positive note and was strong through the end of March. Once the government reestablished construction as an essential industry, it was pretty solid through the rest of the year.”

“One of the benchmarks I look for is how many of the top 20 sureties have a loss ratio over 40 percent. Expense ratios for the sureties run in the 60 percent range, so if the losses are over 40 percent the company might be in an overall loss position for the line of business,” explains Jim Bly, managing director for subcontractor default insurance and surety analysis for Alliant Insurance Services. “Through the second quarter, there were only two underwriters with a 40 percent loss ratio. Four of the top five had loss ratios under 20 percent. There were very few big headline losses in 2020.”

Surety losses remained just above 20 percent through the second quarter of 2020. Source: Surety and Fidelity Association of America.

The latter points are goods signs for the bonding market. The dominance of the five insurers means that changes in market response by those companies will shift the market. Feedback from the other four top insurers, excluding Travelers, confirms that capacity is not an issue, especially for contractors with good financials and strong performance over the past few years. While none would characterize the market as hardening, there was consensus that customers could expect to report more regularly and rates would not be going lower. There was also the expectation that more business owners would be expected to indemnify the insurers personally.

The relatively small number of losses or defaults over $100 million helps to keep those five large insurers steady. In Western PA, the largest defaults have been well under $5 million. Tracking defaults, particularly among subcontractors, helps track the direction of the surety market.

Alliant Insurance’s Contractor Credit Model (C2M) looks at the financial and performance data of specialty contractors across the U.S. to evaluate their credit status for surety purposes. The C2M analysis is used by Facebook, and major engineering-procurement-construction firms like Fluor and Bechtel, along with regional construction managers like Mascaro Construction, Rycon Construction, and Massaro Corporation. Bly’s quick take from the incomplete 2020 results is that the COVID-19 recession is having an impact, but so is the Paycheck Protection Program (PPP).

“We analyze about 2,500 subs here across our footprint. That gives us a pretty good view of the health of the subcontractors across the US. The PPP money has had a significant impact on improving financial scores,” says Bly. “In Pennsylvania, even though some jobs were shut down, most subcontractors’ balance sheets have improved this year if they were able to get PPP money. That is a band-aid on a problem. We are seeing a higher volume of net losses in the subcontractor portfolio, but the balance sheet erosion has not occurred because of PPP money. There are some problems bubbling up, but nothing could wander into the range of a major insolvency.”

While PPP loans provided a needed bridge to help small businesses get past the COVID-19 downturn, there is some uncertainty clouding the picture about 2020. Passed in a hurry as part of the CARES Act, Paycheck Protection Program had unanswered questions about how the loan would be treated by the Internal Revenue Service (IRS) if it was later forgiven. As of this writing, expense deduction rules are just coming out of the IRS and still require further clarification for the overwhelming majority of businesses that took the PPP loans and met the conditions for loan forgiveness. It’s that loan forgiveness that Black sees as one of the keys to the market.

“When the money was dispersed the impression was that it was without strings, except for maintaining employment. How that is going to be treated is a big question these days,” Black says. “It is a significant number and it was a significant help to many companies, but it is a fluid situation in terms of the regulations. The government hasn’t decided how much is going to be taxable. If you took the money, you kept people working. But, if you thought there would be tax consequences you may not have pursued the loan, or you might not have taken as much. It’s really an unfair situation that hasn’t been ironed out yet.”

Surety companies thus far assumed that loans would be forgiven but few, if any, have factored that into their balance sheet analysis. If the IRS rules that expenses covered by PPP aren’t deductible, profits will be impacted. PPP loans are still counting as debt rather than equity, which could have a significant impact on how the insured contractor is viewed in 2021. Higher debt to equity ratios can lead to requirements for the company’s ownership to reserve more profits for equity or to add equity to the business. With financial scrutiny increasing, the health of the insured’s balance sheet will gain in importance in 2021.

“I would say throughout the course of the year we’ve gotten more frequent inquiries for updates about the financial performance of the contractors,” observes Bly. “There are tighter requirements around quarterly reporting and more requests for periodic updates than usual, particularly if there’s a large project generating inquiries.”

Bly also notes that COVID-19 has had a severe impact on industries like, hotels, cruise lines, and entertainment, which also require commercial surety bonds. Bonds for license and permitting or financial guarantees have been triggered by the loss of business in those industries. That is likely to have a tightening effect on insurers in those lines that also write construction bonds.

The outlook for 2020 is, therefore, less certain than it has been in a decade. Bly sees conditions brewing that could tighten the market, particularly if the surety companies must recover from losses overall that resulted from the global pandemic. He suggests that contractors and owners prepare for that possibility.

“I would say contractors should start preparing for a harder market. Owners should certainly have a bond program in place and a tighter prequalification program in place,” Bly suggests. “Sureties are tightening their underwriting a bit. It’s a time for contractors to be vigilant, staying on top of how their sureties are performing. Contractors should have a Plan B in place in case there is a pullback that affects their surety. Our philosophy is that clients with $200 million or more in backlog should have a co-surety. There should be two sureties on every bond so that, if there’s a problem with one, the other can step in.”

Hard markets usually start with smaller insurers, typically ones that are more reliant upon riskier reinsurance for revenues. Insurers with losses will exit lines to reduce risk, even lines that haven’t been responsible for the losses. Contractors with no problems can lose bonding capacity because of the surety’s problems and a hard market is not a good time to be shopping for more capacity.

Most insurers and agents do not expect 2021 to become a hard market. In fact, few expect the coming year to mark the low point in the business cycle. The worst years for losses come after a recovery has begun when the increase in new business overwhelms unprofitable work in progress.

“It takes time for the problems to surface. After the banking crisis in 2008-2009, the surety losses didn’t start kicking in until 2011 and 2012. The subcontractor default insurance losses didn’t kick in until 2012 and 2013. When all that happened, everything tightened up. Requirements for subcontractor prequalification and reductions in capacity happened in 2012 and 2013, not in 2009. It’s after the dip, when people start building backup, that the defaults begin. Overeating is the number one cause of default in construction.”

“Is anything drastic happening in the marketplace right now? I would say no, but I would keep an eye on what transpires in 2021, and even 2022 and 2023,” agrees Gasiorowski.

For most construction businesses, concerns about 2021 are a higher priority than worries about three years down the road. The pipeline of construction projects was extremely full coming into 2020, which bodes well for recovery after the public health crisis passes. COVID-19 caused damage that will cancel some of those projects, but the fact that highly effective vaccines are already being distributed has lifted much of the uncertainty that has existed since March. There will be questions unanswered about certain sectors of the construction market throughout 2021, but demand for construction should increase steadily from the outset.

“I think the news on vaccines is creating a different scenario in terms of optimism looking forward. I think there’s optimism that 2021 can be good if there is funding for construction,” says Black. “The surety companies are making money and want to continue to make money. They want to continue to write business and aren’t shedding accounts. It’s an active marketplace but actual bid and bond activity is down slightly. The business needs to get that construction funding back in place.”

“I think there are challenges be heading into 2021. Most contractors had sufficient backlog heading into 2020. Now, with the PPP money exhausted, most contractors are looking to set the plate for 2021,” says Gasiorowski. “As we start looking toward next year, we’re seeing large numbers of bidders on small- to medium-sized projects. That begs the question, are contractors going to be much more aggressive with pricing. If you look at the recent PennDOT lettings, there are projects with upwards of 15 bidders. I think that is what we’re going to see more of that in 2021.”