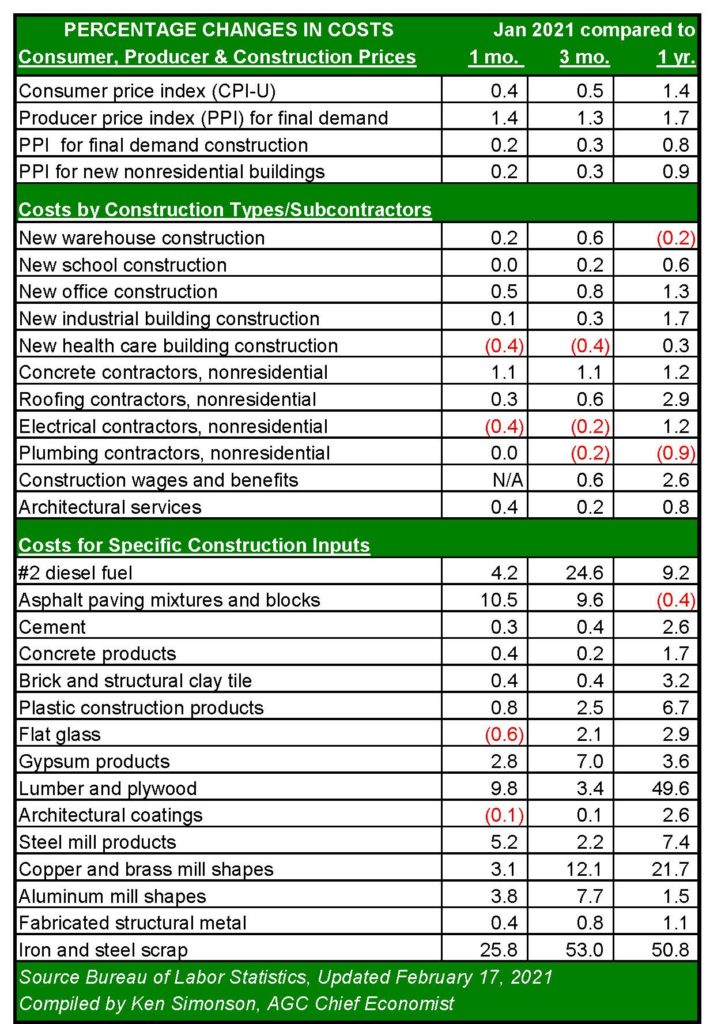

Conservative economists have been raising concerns about the potential for higher inflation as prices jumped in several key materials. Consumer inflation and the producer price index (PPI) remain below the two percent target, but overheating prices in several categories important to construction have contractors concerned. While the magnitude of some of the increases is alarming – lumber and steel scrap are both up 50 percent – the spikes aren’t unexpected as the global economy lurches back to more normal activity levels.

The steep decline in activity during the second quarter of 2020 depressed demand for materials that are involved in nonresidential construction throughout the year. Many of these products are still priced at or below the levels experienced last winter. With global politics and trade policy putting pressure on China, the world’s second-largest economy made policy decisions that turned Chinese production inward. With China exporting fewer commodities, global supply waned for the first time in years. That policy shift, along with punitive tariffs imposed by the U.S., helped push steel prices higher, despite the excess capacity worldwide.

A red-hot housing market has been the catalyst for rising inflation among materials, like plywood, gypsum board, and lumber, which are used in residential construction. Lumber, which sold for $260 on April 1, 2020, was quoted above $1,020 on February 22, 2021, and remains near that mark in mid-March. The commodity previously peaked at $831 on August 21, 2020, before falling below $480 at the end of September, when the decline in springtime demand and reopened supply chains were the dominant market forces.

Associated General Contractors’ chief economist, Kenneth Simonson, referred to the price changes in the lumber market as an “N turn.” In early December, the U.S. Commerce Department lowered the tariff on Canadian-imported lumber from 20 percent to 9 percent, which should impact pricing going forward. Increasing demand from the residential sector will continue to provide upward pressure, however, and a resurgent economy could create higher demand from nonresidential construction, among other sectors of the market.

These temporary imbalances resulting from early-stage recovery have been a boon to virtually all industrial commodities. Steel rose 5.2 percent in February, driven by a 25.8 percent jump in iron and steel scrap. Other industrial metals saw higher inflation, which is common at the beginning of an economic recovery. Aluminum rose five percent; tin was up 15 percent; and copper was eight percent higher. Crude oil was up 23 percent, natural gas fourteen percent, and gasoline was nearly 20 percent higher.

Local contractors have received notice of price increases from suppliers across a broad spectrum of materials and products since January 1. Many of these are market tests. Proposed hikes in drywall, for example, will require a more robust recovery than forecasted for nonresidential construction. High single-digit or double-digit increases were attempted during the early 2010s as the economy struggled to regain its footing. Each time, market conditions forced prices back down. It’s likely that the slow start to 2021 will have that same effect on current price increases. Increases based upon global supply and demand imbalances, like lumber, oil, and steel, will be more durable, although the current overheating should cool off by the third quarter of 2021.