Much uncertainty remains about the outlook for construction pricing for the balance of 2021. As the economic recovery gains pace, however, it is certain that inflation for basic materials will be higher, and materials will be in shorter supply than prior to the pandemic. Experts in most of the industries experiencing volatile pricing expect things to normalize by the fourth quarter of 2021 but normalization of pricing will depend upon the normalization of the supply chain.

The outbreak of COVID-19 resulted immediately in a spike in inventories, as consumption stopped in March and April 2020. In the months following the strictest mitigation measures, manufacturers and distributors allowed inventories to burn off, creating the largest decline in inventory-to-sales ratios since the government began tracking that data in January 1992. The March 2021 ratio of 1.23:1 is the lowest recorded. Forecasting of demand has severely lagged the reality of the recovery thus far, leaving an extraordinary imbalance between supply and demand.

Evidence of supply chain disruptions has increased, even as manufacturers have ramped up production. The Census Bureau Small Business Pulse Survey found 43.4 percent of small businesses experienced a delay of some sort due to supply disruption at the start of June. The bad news is that 65.2 percent of construction businesses experienced a disruption. The worse news is that 81.2 percent of PA construction businesses experienced a disruption. The good news is that the resultant higher prices have been a strong incentive to manufacturers to rebuild inventories.

Compounding the price hikes that have been driven by supply/demand imbalances is a tight labor supply. In the face of growing employment demand, reluctance to return to work has constrained job growth. Even with unemployment at nearly six percent, wage growth is at three percent. In May, wages for non-supervisory workers were $1,300 higher year-over-year.

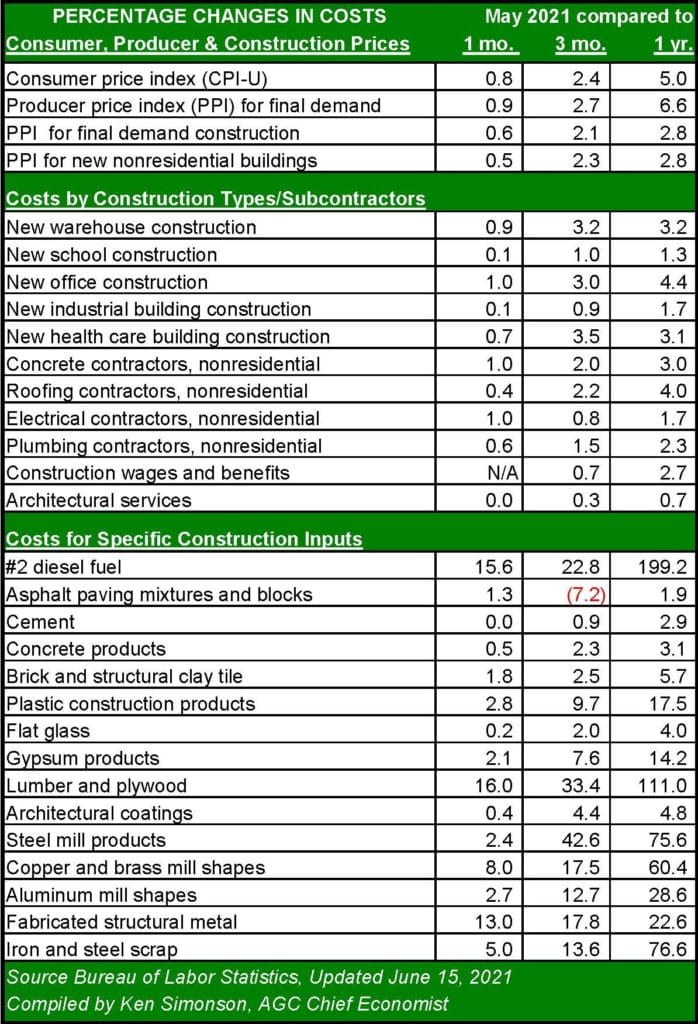

Producer price index for nonresidential building construction was 2.8 percent higher year-over-year in May 2021, a reflection of downward competitive pressures on profits rather than material inflation. Year-over-year inflation of all inputs to construction rose steeply by 24.3 percent. Materials that showed unusual inflation were again industrial metals (and their derivatives), #2 diesel fuel (and its derivatives), plastics, gypsum products, and lumber. The price of lumber has fallen significantly from its May 7 high of $1,710 per thousand board feet, although that is small consolation for those expecting to buy at sub-$500 prices that persisted through January 2021.

Taking the factors causing inflation into consideration, economists expect higher prices will be temporary but will persist through 2021, or until supply chain problems ease. Core inflation is forecasted for 3.2 percent to 4 percent in 2021, with construction inflation running slightly higher. Year-over-year comparisons through summer 2021 will be exaggerated by declines during the early phases of COVID-19 in 2020. With the Federal Reserve Bank seemingly committed to near-zero rates through 2022, inflation will turn upon the speed with which manufacturers and suppliers add capacity and inventory. Given higher prices as an incentive to expand capacity, expect calmer inflation before winter 2021-2022.