Article written by:

Joseph Borowski, CFA

Director, Valuation & Financial Opinion Services

Thus far, 2020 has been a challenging year for many individuals who have seen their jobs eliminated, their retirement accounts reduced, and/or their health threatened. Several business owners have experienced the loss of customers, disrupted supply chains, and difficult decisions regarding their workforces. At the same time, challenges often create opportunities, and this environment has created a unique opportunity for these business owners to transition wealth to the next generation in a tax-efficient manner.

Lower Company Values

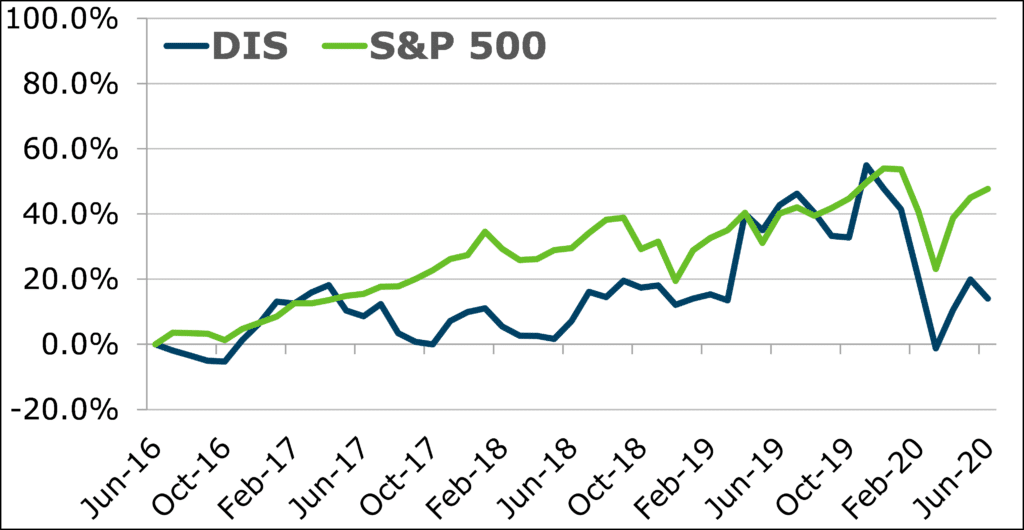

A company’s value is tied to its expected future cash flows, which provide a return to investors. Due to the pandemic and its impact on the economy, companies in most industries have seen expected cash flows fall, and the risks to those cash flows rise. Months of reported net losses may have weakened companies’ balance sheets, further reducing company values. Using the public markets to highlight this concept, Disney’s (NYSE: DIS) stock price fell 23% during the first six months of 2020, due to falling revenue/profit and uncertainty about when conditions will return to normal:

While lower company values may make business owners less interested in selling their businesses in the near-term, lower values are attractive to those who instead wish to gift equity in their businesses to family or others (either permanently, or in advance of a future sale). That is because wealth transfers above a specific level, known as the estate tax lifetime exemption, are subject to estate taxes.

Favorable Exemption and Rates

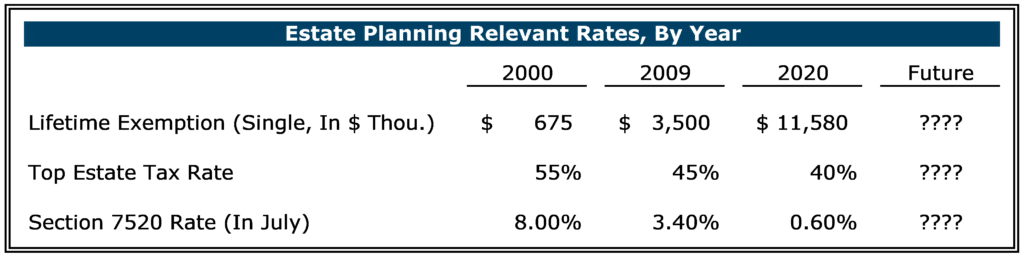

Below are common variables that impact estate taxes on wealth transfers:

- Estate Tax Exemption – The value of an estate that can be transferred to heirs before estate taxes become due.

- Estate Tax Rate – The applicable tax rate for wealth transfers above the lifetime exemption.

- Section 7520 Rate – The applicable interest rate used in grantor retained annuity trusts (GRATs), a popular financial instrument in estate planning. A lower Section 7520 rate makes this instrument more attractive.

As shown in the table below, these variables are all currently at extremely favorable levels relative to prior years. At the same time, there is no guarantee that this will continue in the future, especially with an upcoming election later in 2020. History tells us that these rates can be changed quickly, including after a change in control of the U.S. Presidency and houses of Congress.

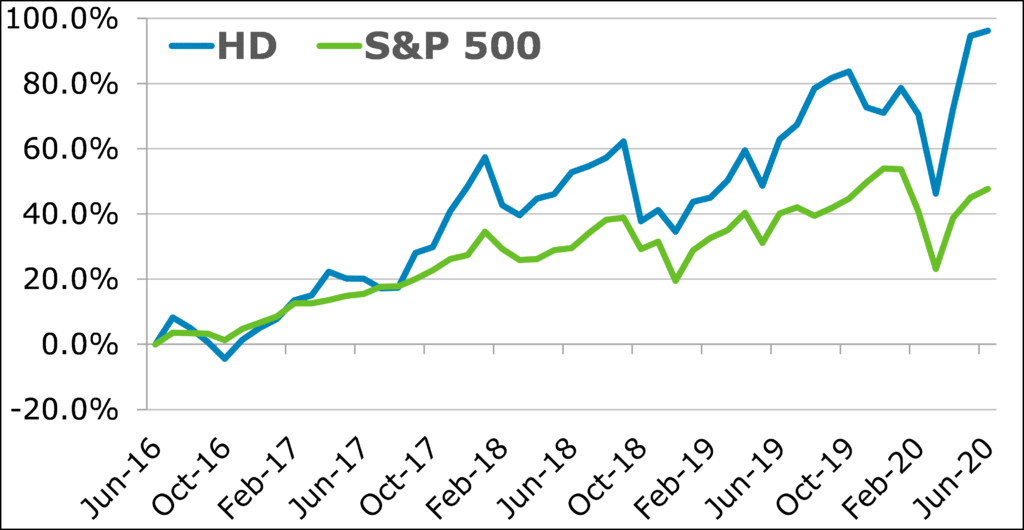

Company Values Can Improve Quickly

Not all companies have been adversely impacted by the pandemic, and some have been positively affected. Again, using the public markets for an example, Home Depot (NYSE: HD) has seen its equity value recover quickly (up 15% during the first six months of 2020) as cash flow and outlook has improved:

In this unusual environment, conditions can change quickly. Once a company’s outlook for the future improves, its value can increase rapidly. This creates urgency for business owners to act now, while values are still impaired.

Consult with Professionals

Before making any decision, remember to consult with your professional advisors – attorney, accountant, and valuation professional. There are several options and vehicles available to transition wealth, and these individuals can ensure your wealth transfer strategy meets your estate planning goals (and minimizes associated estate taxes). For example, when transferring equity in a privately held business, it is ideal to transfer non-controlling equity interests, since the value of these interests can be discounted from their pro-rata value.

Conclusion

Lower company values, combined with favorable estate tax exemption and rates, make this an ideal time for most business owners looking to transition wealth. At the same time, economic outlook and business values can change rapidly, which encourages action now.

For more information and insights, view our recent webinar on this topic – Exploring The M&A Environment During Uncertain Times.

We can help you discover whether the value of your business has decreased and if the timing is right to transition wealth to the next generation. To discuss this information in more detail, contact Joe Borowski or a member of our valuation team.